Icarus' Issuance Curve

The subtle economics of issuance curve changes and bank runs in proof-of-stake blockchains

There is an asymmetric downside to being wrong on issuance curve changes, particularly reductions. Increasing the staking rewards rate too high may overcome the propensity to use, rather than stake, ETH as a commodity for transaction fees. Conversely, too little issuance can cause a cascading withdrawal effect, or a ‘run’, undermining network security.

Further background on issuance curve debates:

A ‘run’ on a bank occurs when depositors rush to withdraw their balances. For a full-reserve bank, a run is ostensibly not a problem for depositors, as 100% of their deposits are invested in liquid cash or near-cash short-term securities, such as T-bills with <90d of maturity. For a fractional-reserve bank, a run presents a problem since the balance sheet is tilted towards longer maturities on the asset side relative to the liability side. In practice, for the depositors, it means that the bank must rush to liquidate investments and have less cash available. Depositors may be forced to wait for asset liquidations or face the prospect of a liquidation taking place at less than the original, par, value.

Proof-of-stake blockchains are exposed to various risks, notably the so-called ‘51% attack’. In this scenario, an attacker purchases more than 51% of the crypto collateral required to validate transactions and effectively comes to control the network. These attacks are mainly deterred by virtue of their unprofitability - namely, it becomes increasingly expensive to purchase more crypto collateral the more collateral is purchased. Furthermore, even if the attack is successful, it is much less likely to materialize in a financial profit for the attacker. This is because the financial value of a crypto commodity, such as ETH, declines precipitously if the risk of a 51% attack increases. In effect, the value of a crypto asset subject to a successful 51% attack is fully exposed to counterparty risk. Nobody wants to hold or use a crypto commodity where a single counterparty determines the validity of the next block. Therefore, the 51% attacker would likely face a significant capital loss when it comes to realizing their investment.

Researchers at the Office for Financial Research have published a thoughtful working paper (Does Lock-up Lead to Stability? Implications for Runs in the Proof-of-Stake Protocols)1 on stake stability in proof-of-stake security. This research provides a new insight into the effects of issuance reductions that is relevant in the context of current proposals like the Issuance Policy Endgame2. The most interesting contribution is the exploration of the staking mechanism for providing security to proof-of-stake blockchains and modeling it in the context of a ‘run’. While stakers commit their capital to securing a proof-of-stake network, there is always the possibility of many of them rushing to exit, either to use in transactions or to sell for other assets, such as fiat currencies. If there is a quick reduction in the number of stakers akin to a run, the risk of a 51% attack increases substantially and in a spiraling way. Namely, the faster stakers ‘rush’ for the exits, the more likely it is that the crypto collateral declines in value, both compounding the ease of executing a 51% attack by controlling enough validators and making it cheaper to attack.

The entrance of ETFs from traditional investors makes this possibility more, rather than less, likely. ETFs introduce a very sensitive source of capital into a blockchain, by aggregating preferences from a class of staker that moves in large, unified blocks, and is more likely to be indexed in fiat currency terms than a solo staker. A run could feasibly be triggered by a random exogenous factor, such as an unfavorable change in tax treatment of crypto ETFs in a country with many ETF investors.

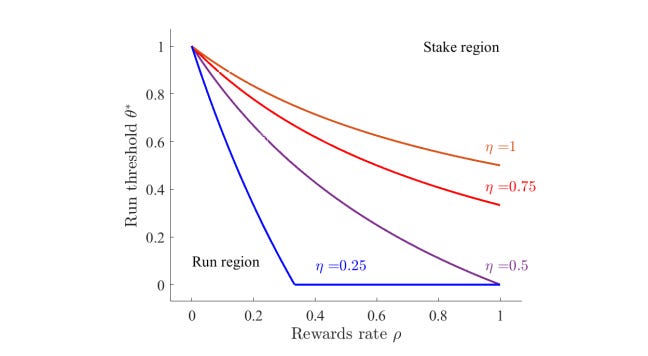

In the paper, Hempel, Phelan and Ruchti model the strategic game for independent stakers as making “a choice between exiting the pool, selling their stake, or remaining and receiving staking rewards. Security strength of the protocol declines as stakers leave the staking contract.”. The user’s choices will be determined both by the rewards rate (modeled as a probability p of receiving coin rewards) and the financial outcome of staking for an unsecured blockchain, if there is a run to the exits from other stakers. The output of these interactions sets the threshold for minimum security, under which a rational staker would choose to exit rather than continue operating validation software for an unsecure blockchain. One of the findings is that protocols are more robust with higher rewards rates, as it creates greater incentive to stick around and avoid a run below a threshold which might trigger a 51% attack.

In particular, 2nd order effects of issuance reduction on validator stability in light of their own financial incentives can compound negatively. Interestingly there is also the exploration of lockups and liquidity of validators which intuitively suggests there exists even more risk when such conditions exist. If there is an artificial friction on exit from validators, such as a withdrawal queue, the threshold for a run shifts towards a greater likelihood of being triggered.

The conclusion is not necessarily that higher rewards are necessarily always better. Saleh (2021)3 and John (2021)4 conclude that a network with sufficiently low rewards rates will filter out participants driven by financial motivations producing an altruistic set of validators who are more ethos-aligned, ultimately less likely to act opportunistically. The insight taken from this is that such a cohort could produce a more reliable, stable consensus preserving base.

So rather than either solving for maximum or minimum staking rate, the paper suggests that there is an optimal region of staking rewards to solve for, such that it motivates users to stay balanced between staking, using the network and exiting the system. “In other words, a robust protocol requires sufficiently high staking rewards. However, Saleh (2021) shows that for PoS to achieve consensus, where a single dominant branch exists for a coin, requires sufficiently small staking rewards. John et al. (2021) argue that maximizing the participation in a coin, a pre-condition for security, also requires staking rewards that are not so high as to preclude coin adoption by investors with greater trading needs.”

Current proposals5 by Anders, Ansgar, Casper, and others at the Ethereum Foundation that propose to reduce issuance and set an upper target on total stake, do so to reduce costs and improve the security positioning of the network. However, at sufficiently low levels of rewards, the impact of a run on the system is magnified. Security should not be designed around actors behaving correctly, which ironically over emphasizes a trust assumption.

The reality here is we should hope for the best, but plan for the worst. Building a system that accounts for rational, self-interested actors is ultimately more resilient. Hempel, Phelan and Ruchti argue a nuanced point here regarding “Run Risk” that has not been widely discussed in depth yet with regards to protocol security.

In essence there is an equilibrium above which validators are incentivized to accept the volatility and risk of loss, below which validators stop accepting this risk and collectively head for the door. And we can then draw a simple analogy to a bank run, where fear begets fear and ultimately leads to the outcome least desired. To put it more simply a loss of financial motivation, can lead to loss of validator stability (mass exits), can lead to loss of network credibility, crashing value of financial stake, rinse and repeat.

There are two key takeaways from this:

There is some value we can assign to the validator set having a healthy margin above that equilibrium which risks the entire network. While validators are fundamentally performing a service, there are also considerable financial assets at stake which bear the volatility of network success.

Some amount of illiquidity, whether contracted in protocol or via decentralized staking routers (LST) can reduce run risk, thereby increasing stability and security.

In light of recent reduction proposals, to set the network's economic issuance too close to this equilibrium seems akin to Icarus flying too close to the sun. While there is potential welfare to be gained in compressing this margin, there is also a potential catastrophic consequence if tripped, a binary outcome that seems irrational to risk. Further it undermines one stated goal of some proposals to eliminate LSTs.

We should continue to have discussions about welfare and finding the right economic policy, but we ought to do so knowing what is at stake. In pursuit of the staking end game, the issuance curve changes have many risks, some of them with catastrophic consequences.

We should all keep that in mind and tread carefully, insisting on rigorous research comparable with that which goes into any technical upgrade to the network. If we would not risk catastrophic consequences on a marginal improvement technically without deep research, why would we do so on a marginal economic change?