PDF | ePub

Disclaimer

The information contained in this analysis is provided for general informational purposes only and is not intended to be, and should not be relied upon as, legal, financial, or professional advice. Steakhouse Financial assumes no liability or responsibility for any errors or omissions in the content of this assessment or for any actions taken based on the information provided herein.

This analysis is based on the information available at the time of its preparation and is subject to change without notice. The assessment is not a guarantee of future performance or results, and past performance is not necessarily indicative of future results.

You should seek professional advice from a qualified attorney or financial advisor before making any decisions or taking any actions based on the information contained in this assessment. Steakhouse Financial disclaims all liability and responsibility for any actions taken or not taken in reliance on the information contained in this analysis.

Executive Summary

Product Name

Hashnote International Short Duration Yield Fund Ltd (iSDYF)

Issuing Entity

A Cayman Islands Exempted Company Incorporated With Limited Liability

Underlying Assets

Debt securities out to 6 months maturity, repurchase and reverse repurchase transactions

Tokens

USYC, ERC-20 Tokens on Ethereum

Permissions

Primary and Secondary trading limited to whitelisted investors passing a KYC/AML onboarding process

Yield Distribution

Yield accrues to Fund NAV

Oracle

Reports current price daily, adheres to the Chainlink aggregator interface

Liquidity Facility

Smart-contract managed PYUSD

Fees

10% of the daily increase in the net account value of the Fund’s Prime Brokerage Account

Tokenized Fund Shares

USYC is an ERC-20 token on the Ethereum network that serves as a digital counterpart to the Shares. The Fund will create ("mint") USYC tokens in quantities matching the number of Shares currently issued in the Fund. Consequently, the supply of USYC tokens will always be equivalent to the outstanding Shares of the Fund.

Low-Risk Underlying Assets

The Fund primarily invests in short-term U.S. Treasury Bills and performs reverse repo activity.

Income Accrual

Income generated by the Fund will be accumulated and reinvested by the Fund. There are not expected to be any distributions or dividends to the shareholders or token holders.

KYC/AML Compliance and Whitelist

The Fund and USYC tokens are available to "whitelisted" investors who have passed checks for suitability, anti-money laundering, or "know your client" verification. Only the whitelisted users can subscribe for or acquire tokens on the secondary market. Generally, transfers of shares between these accounts are permitted without prior authorization.

PYUSD Liquidity Facility

In order to enhance the immediately available liquidity of USYC tokens, Hashnote, in connection with Paxos, has established a smart-contract controlled pool of PYUSD that is exchangeable for USYC tokens 24/7, creating atomic liquidity for the Fund.

Structural Analysis

The information herein is sourced primarily from the HASHNOTE INTERNATIONAL SHORT DURATION YIELD FUND Ltd Offering Memorandum and supplementary materials. For a complete description of the Fund, including its risks, please refer to the Offering Memorandum and governing documents directly.

Key Term

The Fund

Hashnote International Short Duration Yield Fund Ltd (iSDYF), an exempted company incorporated in the Cayman Islands on 17 March 2023

The Investment Manager

Hashnote Management LLC

Directors

Leo Mizuhara and David S. Shapiro

The Shares

The Fund has an authorized capital of US$50,000 comprising 100 Management Shares and 4,990,000,000 Class A Shares.

Class B Shares

Issued at US$1 per Share, to Hashnote International Management LLC to provide liquidity for Class A shares

Performance Fee

10% of the daily increase in the net account value of the Fund’s Prime Brokerage Account

Redemption

Shares may generally be redeemed on any Business Day (each, a "Redemption Date")

Compulsory Redemption

The Directors have the right to compulsorily redeem any or all of a Shareholder’s Shares at any time for any reason or for no reason without notice to such Shareholder

Administrator

NAV Fund Services (Cayman) Ltd. has been appointed as administrator, registrar and transfer agent and Net Asset Value calculation agent to the Fund.

Prime Brokerage

Marex Capital Markets, Inc.

Custodian

BNY Mellon

Auditors

Cohen & Co International (Cayman)

Investment Program

The Fund aims to generate yield by buying and selling short-term U.S. government and agency debt, typically less than 30 days, but may extend up to 6 months based on market conditions. It also engages in repurchase and reverse repurchase transactions to boost yield and manage liquidity. Additionally, the Fund may hold stablecoins and engage with stablecoin issuers for liquidity and yield purposes.

The Investment Manager intends to pursue this investment program and will generally follow the outlined investment strategies as long as they align with the Fund's objectives. However, the agreements governing the fund allow the Investment Manager to formulate and implement new approaches to carry out the investment objective of the Fund without the prior consent of Shareholders.

PYUSD Liquidity Facility

In order to enhance the immediately available liquidity of USYC tokens, Hashnote, in connection with Paxos, has established a smart-contract controlled pool of PYUSD that is exchangeable for USYC tokens 24/7, creating atomic liquidity for the Fund. Users may access this PYUSD pool via the Hashnote UI or directly with the smart contract.

Income Accrual

Income generated by the Fund will be accumulated and reinvested by the Fund. There is not expected to be any distributions or dividends to the shareholders or token holders.

Oracle

The USYC Oracle reports the current price of USYC. The price is updated once per day and occurs after the prior day's activity has been reported by the Prime Brokerage. Once all subscriptions, redemptions, and accrued interest are reconciled off-chain, the price is calculated and placed on-chain. The USYC Oracle adheres to the Chainlink aggregator interface.

Fees

The Fund incurs a 10% performance allocation on daily net account value increases, accrued and payable daily to the Investment Manager. There may also be certain subscription fees that may vary based on the method of subscription. There is currently a 0.10% fee for subscriptions made in USDC and USDT. The Fund is also permitted to pay Administrator Fees and certain other expenses from the Investment Manager.

Feeder Funds

Hashnote manages a series of funds: the iSDYF; the Hashnote Master Fund LP; the Hashnote Feeder Fund LP (“US Feeder”); and the Hashnote International Feeder Fund LP (“Offshore Feeder”). The US and Offshore Feeders are the sole participants in the Master Fund. Investors in the US and Offshore Feeders may allocate some or all of their investment to iSDYF exposure; any shares of iSDYF and the corresponding USYC tokens would be held in the name of the Master Fund.

Legal Overview

The Fund is registered with the Cayman Islands Monetary Authority (“CIMA”) as a mutual fund under the Mutual Funds Act. Registration under the Mutual Funds Act entails the filing of prescribed details and audited accounts annually with CIMA. However, the Fund is not subject to supervision in respect of its investment activities or the constitution of its portfolio by CIMA or any other governmental authority in the Cayman Islands. Nevertheless, CIMA has the power to investigate the activities of the Fund in certain circumstances.

The Fund has an authorized share capital of US$50,000 consisting of 100 Management Shares and 4,990,000,000 Shares. All of the Management Shares are held by the Investment Manager and are non-redeemable and non-participating. They do not confer a holder any right to participate in the income or profits of the Fund.

Instead, Management Shares give the holder the exclusive right to vote on all matters, including, the appointment and removal of Directors, the winding up of the Fund, and amendments or modifications to the Articles.

Alternatively, the non-Management Shares (i.e. the remaining 4,990,000,000 “Shares”), may be offered in one or more classes and/or series, as determined by the Directors in their sole discretion from time to time. Each Share confers on its holder the right to participate in any dividend declared or paid on the class and/or series to which it belongs and the right on a winding up of the Fund to participate in any surplus assets of the Fund. A Share does not entitle its holder to receive notice, attend, speak or vote at any general meeting of the Fund but does entitle its holder to vote at any applicable class meeting of holders of Shares.

Record of Ownership

Shares will be registered in the name of the Shareholder and held in book form. USYC is an ERC-20 token on the Ethereum network that serves as a digital counterpart to the Shares. The Fund will mint USYC tokens in quantities matching the number of Shares currently issued in the Fund. Consequently, the supply of USYC tokens will always be equivalent to the outstanding Shares of the Fund.

Key Parties

The Fund

The Fund is an exempted company incorporated in the Cayman Islands on 17 March 2023 in order to operate as an investment fund. The Fund's investment strategy may be conducted through one or more subsidiaries and, where the context permits, references to the "Fund" should be read as including these entities. At present (May 2024), no such subsidiaries exist nor are any such subsidiaries planned.

The Directors

The Directors have overall authority over, and responsibility for, the operations and management of the Fund. The Directors have, however, delegated the day-to-day investment management of the Fund and its investments to the Investment Manager and the day-to-day administration of the Fund to the Administrator. Each of the Directors is registered with CIMA pursuant to the Directors Licensing Act. The current Directors of the Fund are Leo Mizuhara and David S. Shapiro.

Investment Manager

Pursuant to the Investment Management Agreement, Hashnote Management LLC (“Hashnote Management”) will act as Investment Manager of the Fund. The Investment Manager has full discretion to invest the Fund’s assets, subject to the Directors' oversight, in line with the Investment Program outlined in Section 1.2 above.

Formed on October 19, 2022, Hashnote Management is the general partner of the Hashnote Master Fund LP and Hashnote International Feeder Fund LP, both Cayman Islands mutual funds registered with CIMA, and the Hashnote Feeder Fund LP (Delaware). Additionally, Hashnote provides specialized investment and trading advice, particularly in options strategies, to institutional clients through separately managed accounts.

Calculation Agent & Administrator

Pursuant to the NAV Calculation Agreement, NAV Consulting, Inc. has been appointed as the Fund’s NAV Calculation Agent for the Fund. The NAV Calculation Agent's responsibilities include calculating the Fund’s net asset value and providing various accounting, back-office, data processing, and related professional services as outlined in the agreement.

Pursuant to the Administration Agreement, NAV Fund Services (Cayman) Ltd. serves as the Fund’s Administrator. The Administrator's duties include maintaining the shareholder register, processing the issuance and transfer of Shares, disseminating financial information to shareholders, handling redemption requests, keeping the Fund’s books and records, and performing additional administrative services as detailed in the agreement. The blockchain serves as the official source of truth for shareholders, and the share register must follow the blockchain. Collectively, the NAV Calculation Agreement and Administration Agreement are referred to as the “NAV Agreements.”

Auditors

Cohen & Co International (Cayman) have been appointed as the independent auditors to the Fund on their usual terms and conditions and will charge a customary fee for such services.

Custodians

The Investment Manager may change or add custodians or broker-dealers as deemed in the Fund's best interests. The Investment Manager is authorized to open accounts and establish arrangements with additional custodians and broker-dealers. This allows the Fund to hold securities in its name with relevant market securities depositories on terms determined at the Manager's sole discretion.

Currently, the Fund has a Prime Brokerage Account with Marex Capital Markets, Inc. (“Marex”) and has entered into a reverse repurchase agreement with Marex, covering Treasuries and other debt securities in the Fund’s prime brokerage account.

Brokers

The Fund may engage brokers and pay them commissions, whether they are clearing brokers, introducing brokers, or otherwise. This includes brokers affiliated with the Investment Manager or its principals. Brokerage commissions are variable and can fluctuate based on factors such as the currency being traded and changes in exchange rates.

USYC Transfer Restrictions

Upon subscription, the Fund will transfer USYC tokens equal to the number of Shares purchased to the investor’s Hashnote client wallet or a whitelisted external blockchain address per the Fund’s KYC policies. For redemptions, the Fund will remove USYC tokens corresponding to the number of Shares being redeemed from the investor’s Hashnote client wallet. If an investor holds USYC tokens in a whitelisted address, redemptions must be initiated by transferring the equivalent USYC tokens to a designated Fund redemption wallet.

Transfers of USYC tokens between Hashnote client wallets and/or whitelisted addresses (whitelisted transfers) will be treated as Share transfers between the respective investors and recorded by the Administrator. The Investment Manager allows whitelisted transfers without prior authorization but may annul transfers violating regulatory obligations.

The Investment Manager may declare non-whitelisted transfers ineffective, annulling them by burning the transferred USYC tokens and minting new tokens to the sender's wallet. Investors may pledge, transfer, or encumber USYC tokens as they can with their Shares.

Redemptions

Regular Redemptions

Shares can generally be redeemed on any Business Day ("Redemption Date") at the Net Asset Value per Share for that day, minus applicable fees and charges. Redemption requests must be received by 5:00 pm Eastern Time on the Business Day before the Redemption Date ("Redemption Deadline"). Late requests may be carried forward to the next Redemption Date, and affected Shareholders will be notified.

To redeem Shares, Shareholders must provide the Investment Manager with their method of transmitting redemption requests, authorized individuals for requests, and a digital wallet if proceeds are in Digital Assets.

Redemptions in U.S. Dollars are processed within three Business Days following the Redemption Date while redemptions in Digital Assets are generally processed by the next Business Day. Payment of redemption proceeds can be delayed if identity verification information is not provided promptly. Proceeds are paid to the original subscription account, either in cash, in kind, or Digital Assets. Digital Assets are returned to the original wallet unless otherwise agreed.

The Fund may establish reserves, gates, lock-ups, or holdbacks for accrued expenses and contingencies, which could reduce redemption distributions. The Directors can waive notice or fees, permit special redemptions, charge redemption-related costs, and set minimum redemption amounts. Redemptions must not reduce an investment below the minimum initial subscription without Director consent.

Compulsory Redemptions

The Directors reserve the right to compulsorily redeem a Shareholder’s Shares at any time, for any reason or no reason, without prior notice. Unless otherwise decided by the Directors, the proceeds from such compulsory redemption will be distributed in a manner similar to regular redemptions. Additionally, compulsory redemptions may be executed to cover the Performance Allocation, with such amounts retained by the Fund to pay the Investment Manager. Typically, the Directors expect to use compulsory redemption primarily if: (i) any representations made by a Shareholder in the Subscription Agreement were false or have become false; or (ii) continued ownership of Shares by a Shareholder would result in legal, regulatory, tax, financial, or significant administrative disadvantages for the Fund or the Shareholder.

Suspension

Suspension refers to the suspension or postponement of certain activities, which may be independently suspended or postponed for any class and/or series of Shares. These activities include the allotment and issuance of Shares, the redemption of Shares at the option of the Shareholder, the calculation of the Net Asset Value (NAV) and/or the NAV per Share, and the payment of redemption proceeds.

The Directors may declare a Suspension at any time, for any reason or none at all. This Suspension will remain in effect until the Directors decide to lift it. Affected Shareholders will be notified of both the initiation and the lifting of the Suspension. The Directors expect that a Suspension will typically be necessary only under specific conditions: when unusual market conditions affect the Fund’s liquidity or valuation, during periods when the Fund’s investments are restricted, in emergencies where disposing of investments is impractical or harmful to Shareholders, when communication breakdowns hinder the accurate determination of asset or liability values, or when fund transfers for investment transactions cannot be executed at normal exchange rates.

Winding Up

After paying creditors and returning the par value of Management Shares to their holders, any remaining assets of the Fund will be distributed among the Shareholders. This distribution will be proportional to the value of the internal accounts linked to the participating shares held at the start of the winding-up process.

During the winding up of the Fund, the liquidator has the authority to (i) decide how to distribute the assets among shareholders or different classes of shareholders; (ii) value the assets to be distributed as they see fit; and(iii) vest the whole or any part of any assets in such trustees and on such trusts for the benefit of the shareholders entitled to the distribution of those assets as the liquidator sees fit, but so that no shareholder shall be obliged to accept any assets in respect of which there is any liability.

Financial Analysis

The Fund is composed of cash, US Treasury bills, notes, and other securities guaranteed by the US Treasury, along with repurchase agreements backed by these obligations or cash. As such, this section will provide a comprehensive review of the overall U.S. Treasury market.

Overview of the Treasury Market

The Treasury market refers to the global market for trading U.S. government debt securities, commonly known as Treasuries. These securities are issued by the U.S. Department of the Treasury to fund the federal government's operations and finance its budget deficits. The Treasury market is considered one of the largest and most liquid financial markets in the world, with investors ranging from individual retail investors to central banks, financial institutions, and large institutional investors.

There are four main types of Treasury securities:

Treasury Bills (T-Bills): Short-term debt securities with maturities that span from a few days up to 52 weeks. These are issued at a discount to their face value and do not distribute interest in the form of coupon payments. Rather, investors are compensated by the difference between the original issue price and the full face value delivered upon maturity.

Treasury Notes (T-Notes): Medium-term debt securities offered in maturities of 2, 3, 5, 7, and 10 years. T-Notes provide semi-annual interest, often referred to as coupon payments, and refund the face value upon maturity.

Treasury Bonds: Long-term debt securities that come with maturities of 20 or 30 years. Analogous to T-Notes, Treasury bonds also disburse semi-annual interest and repay the face value upon reaching maturity.

Treasury Inflation-Protected Securities (TIPS): Inflation-indexed debt securities, available in 5, 10, and 30-year maturities. These securities are engineered to safeguard investors from inflation by adjusting both the principal value and interest payments according to fluctuations in the Consumer Price Index for All Urban Consumers (CPI-U). However, for the purposes of this analysis, this category will be omitted.

The Treasury market plays a critical role in the global financial system, as Treasury securities are often considered safe-haven assets due to the perceived low credit risk of the U.S. government. The prices and yields of Treasury securities serve as key benchmarks for interest rates in other markets, and their performance can influence the overall economy, monetary policy, and investor sentiment.

The U.S. Government is perceived to be the strongest (and lowest-risk) USD creditor as a result of the country’s full control over both fiscal and monetary policy. While the Federal Reserve is designed to be independent from the U.S. Treasury, aligned interests in economic stability suggest (and have historically shown) that the Federal Reserve would support the U.S. Treasury market with new base money before any traditional defaults occur. In the current structure, the most likely route to default would be a result of internal U.S. Government dysfunction (e.g. failure to increase the debt ceiling). This issue came to the fore in 2023, when the debt ceiling was hit on January 19th, but the effects were delayed through extraordinary measures until at least June 5th, and then later extended for several more years. There was no dramatic market reaction as this issue has periodically occurred in recent decades.

Treasury securities are issued via regular auctions conducted by the U.S. Department of the Treasury. T-Bills are issued weekly in volumes exceeding $250 billion, while T-Notes see a monthly issuance around $200 billion. Investors have the option to directly partake in these auctions, or alternatively, they can transact Treasury securities in the secondary market through a variety of avenues including brokers, dealers, and trading platforms. Notably, Treasuries are highly liquid, with daily trading volumes usually surpassing $50 billion for Treasuries that have less than a 2-year maturity.

Typically, the market categorizes Treasuries into two groups. On-the-run Treasuries, which represent the most recent U.S. Treasury issues for each respective maturity, serve as benchmarks for pricing and trading fixed-income securities due to their high liquidity and substantial investor demand. Conversely, off-the-run Treasuries are older issues that have been superseded by newer on-the-run issues. As a result, they tend to have lower trading volumes and less liquidity compared to their on-the-run counterparts.

The implications of this categorization are the following:

On-the-run Treasuries, due to their higher liquidity, typically command higher prices and yield lower returns.

Off-the-run Treasuries are less liquid and generally trade at a discount, offering higher yields to compensate investors for their reduced liquidity.

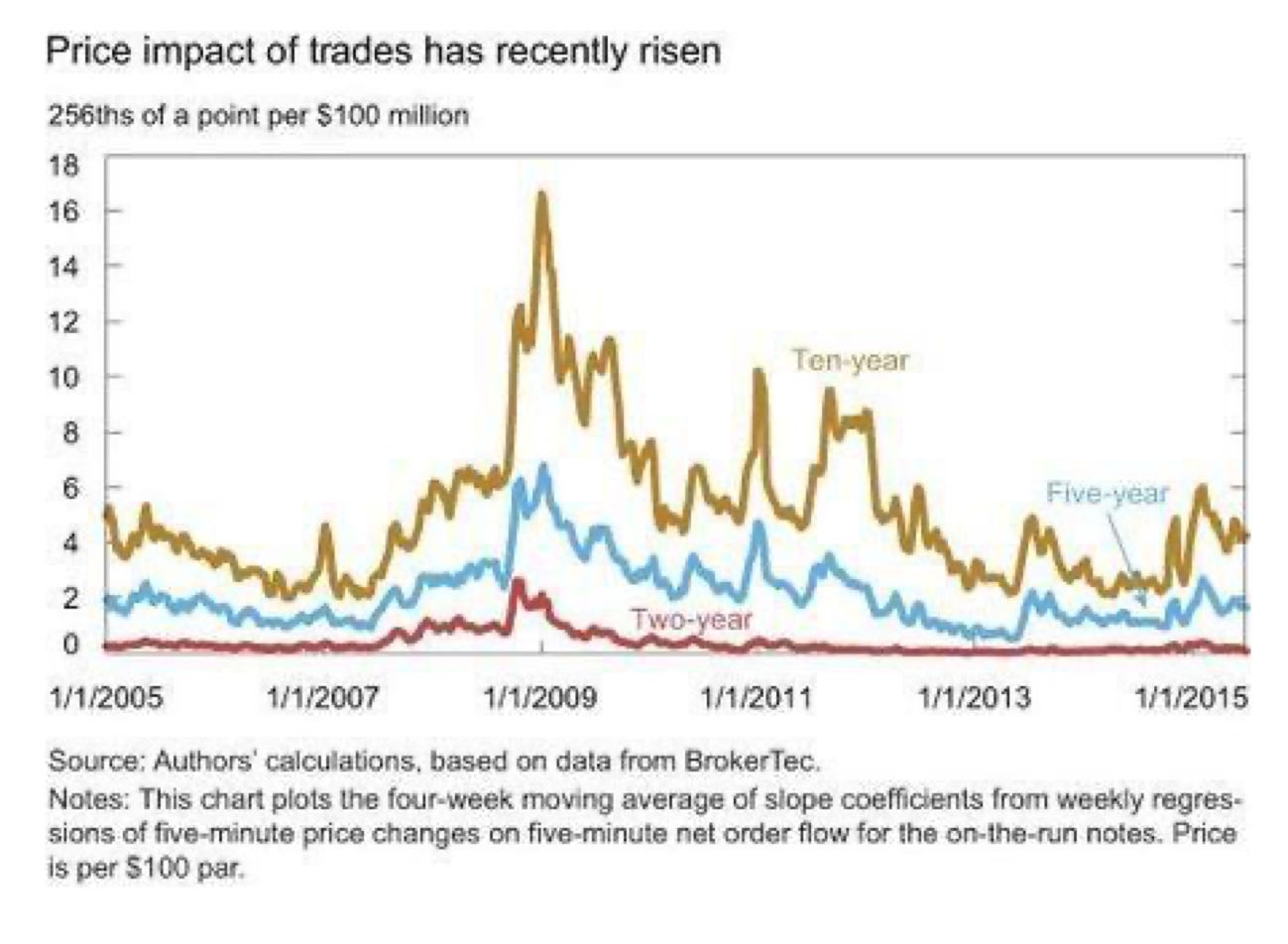

The difference in yield between on-the-run and off-the-run Treasuries, referred to as the "liquidity premium," functions as a barometer of market liquidity and investor sentiment. According to our research, this premium appears to be less significant for short-term Treasuries post-2000s, as demonstrated in the chart below (source).

Also shown below, trading impact on the shorter end of the curve is not material.

Overview of the Reverse Repo Market

In recent years, overnight reverse repurchase agreements have become an attractive alternative to T-bills for many asset managers. A reverse repurchase agreement, or reverse repo, is a short-term transaction where an entity lends money to a counterparty – the Federal Reserve in this case – in exchange for securities, often with the agreement to buy them back at a later date at a slightly higher price.

The surge in the use of reverse repos can be attributed to several factors. Firstly, regulatory changes post-2008 financial crisis, such as the Liquidity Coverage Ratio and Net Stable Funding Ratio under Basel III, have prompted banks to reduce their short-term wholesale funding and improve the quality of their liquid assets. This shift has led to an increased demand for high-quality liquid assets (HQLAs), such as government securities, which are often used in reverse repo transactions.

Secondly, the monetary policy of central banks, particularly the Federal Reserve, has played a significant role. The Fed's use of its reverse repo facility has allowed it to set a floor on short-term interest rates and manage the abundant reserves in the banking system when the supply of similar assets (T-bills) is not sufficient to meet demand. For asset managers, participating in these transactions provides a safe haven for excess cash, while earning a small but predictable return.

Duration Risk

Although less material compared to longer dated treasury bonds, the primary financial risk associated with T-bills is their duration risk. Duration risk is a specific type of financial risk that stems from the sensitivity of the price of a fixed-income investment to fluctuations in interest rates. The duration of a fixed-income investment measures the average length of time until the investor receives the present value of all the investment's future cash flows, including both coupon payments and the principal amount at maturity. For short-term and low coupon products, the duration is very close to the maturity.

When interest rates change, the present value of the future cash flows of a fixed-income investment changes as well. Duration risk is, therefore, the risk that the price of the fixed-income investment will vary in reaction to changes in interest rates. Generally, the longer the duration of a fixed-income investment, the more sensitive its price is to changes in interest rates.

With a duration of 0.25 (~90 days), an unexpected 1 percentage point interest rate rise (which would be a material outlier) would decrease the NAV of the portfolio by 0.25%. As currently the yield to maturity of short-term government securities is above 5%, it would take roughly 15 days to be compensated for the mark to market loss by the yield to maturity (of 6% after the 1% increase). It's also worth noting that the 0.25% decrease should be considered in conjunction with transaction fees.

Given that iSDYF’s portfolio is very short duration (limited to assets that mature six months or less from the date of purchase), the duration risk would be considered very low and not significant for the average USYC investor.

Competitive landscape

In this section we review and compare USYC with other similar products that are already live. This isn’t intended as a complete review of these products, for additional information on similar products providing a yield from T-bills, please see Steakhouse’s 2023 Tokenized T-Bill Memo.

Comparison of Tokenized Treasury Products

Fees

Fees are displayed but shouldn’t be relied upon as a proxy for performance.

Market Growth

In early 2023, various providers began introducing an array of treasury bill offerings to the market. The 2022-2023 bear market in crypto led to a unique split in interest rates, with off-chain yields consistently surpassing those from on-chain DeFi protocols. This discrepancy spurred a demand for transferring these higher off-chain yields onto the blockchain. T-bills, known for their low risk and high liquidity, emerged as the prime candidates for this transition.

By Q1 2024, the total market value of these offerings had reached approximately $500 million, with Ondo, Matrixdock, and Mountain Protocol leading in market share. March 2024 then saw the launch of BlackRock’s BUIDL token, aimed at institutions with an innovative USDC liquidity solution, which quickly grew to be the market leader and spurred growth in the overall market capitalization of tokenized securities. As of June 2024, the total circulating supply of tokenized treasury products sits at roughly $1BN, with BUIDL representing ~$450M of the market.

Permissions

The market for tokenized T-bill products has adopted diverse strategies to navigate regulatory concerns, including permissions and Know Your Customer (KYC)/Anti-Money Laundering (AML) procedures. Despite cryptocurrency's vision for a more open and trustless financial ecosystem, each product must contend with the regulatory realities shaped by the jurisdiction of its launch and its specific use case. This has led to varied interpretations and approaches among these products.

All T-bill products to date mandate some level of KYC and AML checks for their primary customers—those with the ability to directly mint and redeem tokens. However, approaches to secondary trading vary significantly. For instance, Backed’s bIB01, originating from Switzerland, permits permissionless secondary trading, which simplifies its integrations with Automated Market Makers and lending pools, removing the need for special user or smart contract whitelisting. Conversely, most products, including Hashnote’s USYC, require a whitelisting process for secondary trading.

Some issuers have innovated to bypass these constraints without directly making secondary market trading permissionless. For example, Ondo launched Flux, a lending marketplace that channels a portion of T-bill yields to non-permissioned users via collateralized lending. In this model, permissionless users can offer stablecoins for loans, with whitelisted borrowers providing OUSG as collateral. This system leverages market forces to ultimately provide lending rates slightly below the standard risk-free rate.

As the tokenized T-bill sector is still nascent, the optimal strategy for success is yet to be determined. Users and issuers around the world will continue to face different regulatory considerations depending on the jurisdictions from which they operate, and as a result, we expect a multitude of strategies will find product market fit in the years ahead.