Steakhouse Tokenized T-Bills Review 2023

This memo discusses and compares the different T-bill-like products that have emerged in DeFi since the beginning of 2023. At their core, these products offer exposure to T-bills and provide access to

Summary

This review is a companion of the Tokenized Public Securities dashboard on Dune Analytics.

Disclaimer

This report is provided for informational purposes only, and does not constitute financial, investment, legal, regulatory, or tax advice. The authors cannot guarantee the accuracy of data and information contained in the report, which is provided strictly on a best efforts basis. References to assets are made for informational purposes, and are not a recommendation, offer to sell, or solicitation of an offer to buy any asset. Content, data, or assessments provided in this report are subject to change without notice.

This report includes certain forward looking statements; such statements face a high degree of uncertainty and are not a guarantee or promise of future performance or events. Authors are materially relying on waiver of liability as a condition of providing this report. By accessing the content herein, readers agree to indemnify and hold harmless authors against any and all claims. This presentation is provided as is and is still a work in progress and shouldn’t be relied on for anything.

Sébastien Derivaux serves as an independent director on the board of an Ondo related entity (for a product not launched yet). Some Steakhouse members received a de minimis amount (<$100) of bCSPX tokens from Backed in order to facilitate research. The tokens in this report are listed in the order they were studied.

General comments on tokenized t-bill products

Since January 2023, a proliferation of tokenized T-Bill products has emerged, offering investors access to the risk-free rates offered by Treasury Bills in traditional finance. In this report, we utilize the term "tokenized T-Bills" to encompass all on-chain products directly or indirectly backed by Treasuries with remaining maturities of less than one year, including repo arrangements against longer-dated Treasuries. These products can be achieved through direct asset holdings, indirect exposure via Money Market Funds (MMFs) or Exchange-Traded Funds (ETFs), or lending activities against such products.

Differentiations from Stablecoins

Tokenized T-Bill products offer distinct differentiations when compared to stablecoins. Firstly, they provide a yield, unlike stablecoins that typically lack yield options without added risks. Exceptions to this include Coinbase’s Rewards, which offers up to 4% on USDC holdings within their exchange, and the Dai Savings Rate (DSR) on MakerDAO's DAI stablecoin, offering a yield of 3.5% when using sDAI. Stablecoin products can also entail higher complexity and risk factors, as some blend T-Bills with significant bank deposits, which carries its own risks as evidenced by the USDC depegging incident following the collapse of Silicon Valley Bank. Moreover, certain products rely on riskier assets or employ complex smart contracts, as seen in DAI and USDT. In contrast to stablecoins, tokenized T-Bills are, by construction, securities, leaving little regulatory doubt. They often benefit from enhanced disclosure practices and are issued by Special Purpose Vehicles (SPVs) designed to mitigate risks through bankruptcy remoteness and security agreements, reducing potential default risks of the operating entity.

Liquidity and Duration Risk

Tokenized T-Bills currently exhibit lower liquidity compared to stablecoins, primarily due to their reduced reliance on bank deposits. Redeeming tokenized T-Bills necessitates asset sales, which typically require more time for execution. While some products allocate reserves of stablecoins to facilitate faster redemptions, these reserves remain relatively small in scale. It is important to note that tokenized T-Bills can adopt different pricing mechanisms. While some maintain a stable value of $1 through rebasing, others can experience price fluctuations linked to duration risk. In the event of unexpected interest rate increases, these products may experience temporary value losses. However, it is crucial to contextualize this risk. For instance, a product with a 0.3 duration (3-month maturity) would only be impacted by 30 basis points due to a 1% interest rate increase. With a 4% interest rate, this impact could be absorbed in less than one month.

Key Considerations for Investors

Before investing in tokenized T-Bills, careful evaluation of several factors is essential. This includes analyzing the regulatory framework governing their issuance, understanding the Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, assessing the safety of collateral backing the tokens, and the impact of associated fees.

In most cases, tokenized T-Bills are issued by SPVs to establish bankruptcy remoteness from the token operator. However, it is crucial to acknowledge that complete bankruptcy remoteness is never guaranteed, especially within the United States. While an SPV may be remote from the operator, it can still face bankruptcy risks, such as substantial fines imposed by local governments. The tokenizer is typically the operator, although caution should be exercised as token operators have the potential to engage in fraudulent activities. While mitigation measures can be implemented, they are not trustless by nature. Tokenized T-Bills are structurally centralized and rely on a certain level of trust.

Some tokenized T-Bills products provide a 1-to-1 equivalence to real-world products, often mirroring the IB01 ETF, while others offer interest within managed funds. Comparing the performances of different products remains challenging due to their relatively short history and varying underlying durations. Longer duration products have demonstrated slightly lower performance thus far.

Conclusion

Tokenized T-Bills have introduced a novel avenue for investors seeking access to risk-free yields within the DeFi landscape. Offering benefits such as yield provision, regulatory clarity, and enhanced disclosure practices, these products represent a significant departure from traditional stablecoins. While liquidity and duration risks exist, ongoing developments are expected to address these challenges. Diligent evaluation of regulatory compliance, collateral safety, fees, and issuer structures is crucial for investors seeking to engage with tokenized T-Bills.

In line with Steakhouse values, we encourage tokenized T-Bill operators to strive to improve transparency by providing audited financial statements. That being said, we recognize that tokenized T-Bills generally exhibit greater transparency than fiat-backed stablecoins.

Comparison

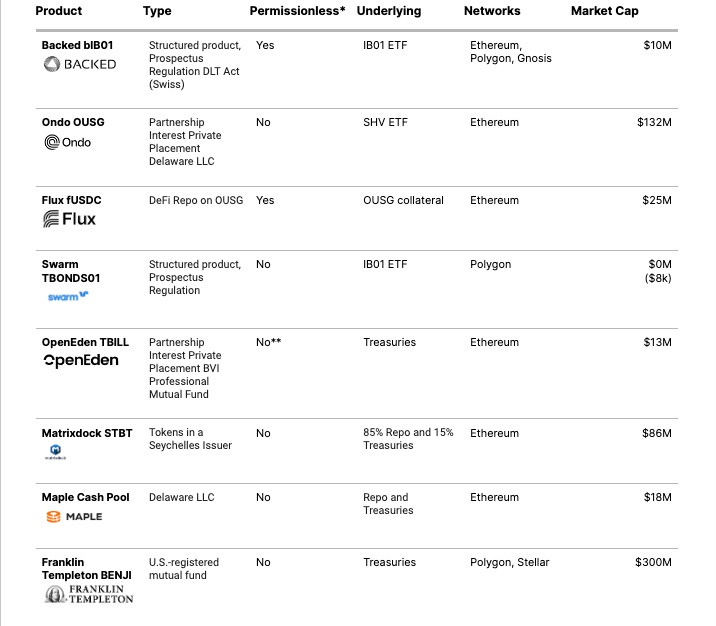

Structure

* Secondary transfers, only fUSDC is permissionless on minting/redemption

** Could be enabled for non US citizen

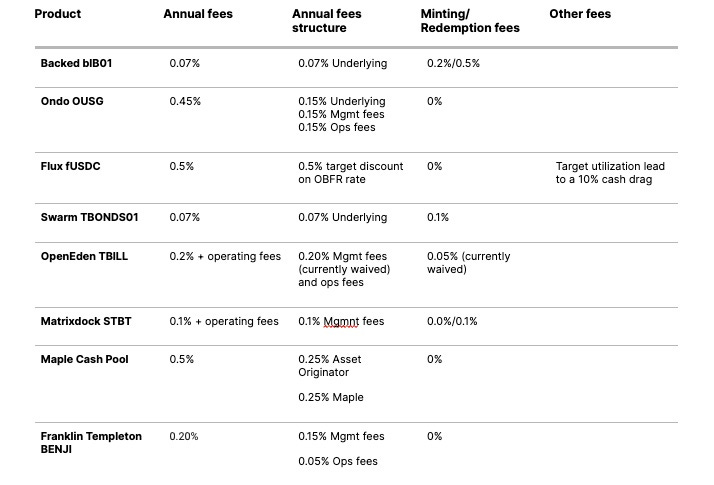

Fees

Fees are displayed but shouldn’t be relied upon as a proxy for performance.

Backed bIB01

Description

Backed bIB01 is a structured product issued under the Swiss DLT Act, designed to provide investors with a tokenized solution backed 1:1 against the IB01 ETF.

This product is exclusively available to non-US citizens, with a minimum ticket size of 5k CHF payable in USDC. It operates as a permissionless token. Its prospectus (EU prospectus regulation) was approved in Liechtenstein and Switzerland and is issued on Ethereum, Polygon and Gnosis Chain.

The Underlying

Each bIB01 token represents one share of the IB01 ETF, which is issued by Blackrock and invests in short-term Treasuries with maturities of less than 1 year. The ETF typically exhibits a duration below 0.4, introducing a potential duration risk resulting in temporary value fluctuations.

The IB01 ETF is an accumulating product, meaning it does not distribute dividends or income.

Collateral Security

A tri-party agreement is established between Backed Assets (the issuer), the custodian, and a security agent. It grants the security agent the authority to assume control and facilitate redemptions in the event of default or bankruptcy by Backed Assets.

DeFi integration

bIB01 integrates with various DeFi platforms, offering opportunities for investment and collateralization. It serves as an investment in the R-USDC product offered by Ribbon Finance and can be utilized as collateral on Angle Protocol for borrowing agEUR. Liquidity on decentralized exchanges is currently limited.

Fee structure

bIB01 primarily incurs the low annual fees associated with the IB01 ETF, amounting to 0.07%. Backed applies a minting fee of 0.20% (to be increased to 0.50% after reaching the first $100M) and a redemption fee of 0.50%.

Conclusion

bIB01 presents an attractive proposition for non-US citizens seeking exposure to structured yield opportunities. It is important to note that the product may not be suitable for short-term holdings due to associated fees. However, for investors with longer-term holding periods, the absence of additional management fees beyond the low IB01 fees enhances its attractiveness. The permissionless nature of bIB01 facilitates seamless management and aligns with evolving market demands.

Ondo OUSG

Description

Ondo OUSG represents a limited partnership interest in Ondo I LP, a Delaware-based investment

vehicle offered exclusively to accredited investors under a confidential private placement memorandum. This investment opportunity is issued on the Ethereum blockchain.

The Underlying

OUSG offers investors participation in a fund primarily focused on the SHV ETF. The SHV ETF, managed by Blackrock, mainly invests in short-term Treasuries with maturities of less than 1 year. While the duration of the ETF typically remains below 0.4, there exists a potential duration risk resulting in temporary fluctuations in the ETF's value. Ondo provides daily reports from a third party.

Collateral Security

The fund is located in the United States and benefits from custody services provided by ClearStreet.

DeFi integration

At time of writing, the Flux Finance lending platform is the only known integration for OUSG (see fUSDC).

Fee structure

On a recurring basis, OUSG entails three layers of fees. The SHV ETF charges 0.15% as its management fee. Ondo imposes a 0.15% management fee, and operational fees of up to 0.15%, which are expected to decrease with scale. This results in a combined fee structure of up to 0.45% for participants.

There are no minting/redemption fees.

Conclusion

OUSG is a hybrid approach in the sense that it is a fund that is mainly invested in an ETF. There is an emphasis on transparency. The lack of minting/redemption fees makes it strong for short-term cash management.

Flux fUSDC

Description

Flux fUSDC is a tokenized t-bill product offered by Flux Finance, providing users with access to the T-Bills rate through a repo arrangement against tokenized t-bill assets. In addition to USDC, Flux fUSDC supports DAI, FRAX, and USDT, offering users a range of options.

Issued on the Ethereum blockchain, Flux fUSDC operates on a permissionless model, enabling seamless minting and redemption processes. Only individuals whitelisted on OUSG have the authority to liquidate the collateral.

The Underlying

The underlying asset composition of Flux fUSDC is represented on-chain, with approximately 10% allocated to USDC and the remaining 90% tied to a variable rate loan backed by OUSG collateral. The loan's pricing is based on the OBFR (overnight bank funding rate) minus 50 basis points. Notably, the loan has no expiry date and operates on the principle that borrowers will be motivated to deleverage in the event of liquidity depletion, a process that may take a few days. Since the protocol's inception, the 90% collateral ratio has demonstrated notable stability.

Collateral Security

The collateral for Flux fUSDC consists of on-chain representations of OUSG and USDC tokens. Built on the foundations of Compound v2, Flux Protocol incorporates governance mechanisms that grant ONDO voters control over a wide range of parameters. While the utilization of whitelisted collateral mitigates certain risks, it's important to acknowledge that residual risks remain.

DeFi integration

UXD Protocol has integrated fUSDC into its treasury, currently holding approximately $10M worth of funds.

Fee structure

Flux Finance does not impose any direct fees on users. However, at a target utilization rate of 90%, a 10% cash drag impacts the performance of fUSDC due to the idle USDC component comprising 10% of the collateral. From the remaining 90%, the yield is calculated as OBFR minus 0.5%. It's worth noting that the utilization rate is subject to fluctuations and may occasionally exceed the risk-free rate. At a 5% OBFR rate, the implied fee would be slightly less than 1%. Over time, the fee structure has demonstrated relative stability despite fluctuations in utilization rate.

Conclusion

Flux Finance is a simple way to get exposure to the T-Bills rate but at the expense of a slightly lower yield. Minting is permissionless and intra-block. Redemption could be intra-block or can be delayed (probably up to a few days) if there is no more liquidity (in which case the yield will go to OBFR + 3%).f

Swarm TBONDS01

Description

Swarm introduces TBONDS01, a tokenized debt instrument under German laws. Each token is designed to be backed by one share of the IB01 ETF, providing investors with exposure to a diversified portfolio of Treasuries.

Issued on the Polygon network, TBONDS01 operates within a regulatory framework approved under EEA regulations. The product is expressly prohibited for US citizens, while there is no minimum investment requirement.

The Underlying

The underlying collateral for each TBONDS01 token is one share of the IB01 ETF, which is issued by Blackrock. The ETF focuses on investing in Treasuries with maturities of less than one year, typically exhibiting a duration below 0.4. It is worth noting that duration risk exists, as the value of the ETF may temporarily decline.

IB01 is an accumulating product, meaning it does not distribute dividends to investors.

Collateral Security

The collateral assets are held in a Special Purpose Vehicle (SPV) and safeguarded for investors. Additionally, investors have the option to request the delivery of the underlying asset directly instead of receiving a cash payment.

Swarm employs the services of a token trustee, Deloitte, to manage the TBONDS01 tokens.

DeFi integration

Swarm facilitates a decentralized over-the-counter (OTC) protocol that enables the issuance of sell and buy orders, providing users with seamless access to liquidity.

Fee structure

TBONDS01 carries an issuance and redemption fee of 0.1%. However, there are no annual fees associated with holding the tokens.

Conclusion

TBONDS01 presents an attractive low-cost alternative for investors seeking exposure to the IB01 ETF and looking to operate within the Polygon ecosystem.

OpenEden TBILL

Description

OpenEden TBILL is issued as a token under a private placement memorandum under BVI laws. This private fund is only open to professional investors (initial buy > $100k) and is issued on Ethereum.

The Underlying

The fund invests in Treasuries with a weighted average maturity of 0.33 at the time of writing. It also keeps a small liquidity buffer (USDC) on-chain. At the time of writing, the first maturity was 45 days. A daily composition is provided on the webapp, as well as a daily statement from Swissquote. There is a monthly attestation by a third party accounting firm.

Collateral Security

The BVI fund issues the token but investment activity takes place in a Cayman subsidiary. A panel of custodians is used, one of which is Swissquote Pte. Ltd (Singapore), a subsidiary of Swissquote Bank SA.

DeFi integration

No known DeFi integration at this stage.

Fee structure

Fees are currently waived until further notice, including operating fees that are subsidized. A possible fee structure could be 0.05% mint and redemption fees, and 0.2% annual management fees on top of the operating costs.

Conclusion

OpenEden TBILL provides a great deal of transparency. It is proposed that investing directly in the T-bill is more efficient than adding another ETF or MMF layer. This is certainly true as long as operating fees are subsidized.

Matrixdock STBT

Description

Matrixdock STBT offers investors a tokenized solution that provides exposure to Treasury bills (T-bills) and repurchase agreements (repo) while maintaining a stable value of $1 through a rebase mechanism and no negative rebase.

Matrixdock STBT has usage restrictions in several countries, including the United States and China. Additionally, the minimum investment requirement for the primary market is set at $100,000, and the token is issued on the Ethereum blockchain.

The legal structure is an orphaned Seychelles SPV (Prometheus Solutions Ltd token issuer) owning a Cayman entity (Epimetheus Technologies SPC) holding the assets.

The Underlying

The underlying at the issuer level (Prometheus Solutions, which is orphaned) is a note issued by an affiliate entity. This note is secured by US Treasuries (< 6 month maturity) and repo against treasuries.

On June 26th, the assets underneath were composed of 11% 3-month treasuries and 89% overnight treasuries repo.

Collateral Security

Prometheus Solutions / Epimetheus Technologies, possesses no significant liabilities other than STBT and holds no significant assets apart from the note. Although the exact condition of the note remains undisclosed, it is stated that the collateral of the note is segregated from other assets.

DeFi integration

STBT is present with significant liquidity on an incentivized Curve pool of ~$15M TVL.

Fee structure

MatrixDock has a redemption fee of 0.1%, no minting fees and an annual service fee of 0.1%.

Conclusion

Matrixdock STBT makes use of a rebase mechanism, which ensures a stable value of $1, potentially simplifying integration. Furthermore, the absence of negative rebases eliminates concerns of value erosion. The presence of an incentivized Curve pool enhances liquidity and facilitates efficient market participation. However, the token still requires the use of KYC/AML procedures.

Maple MPLcashUSDC

Description

Maple Cash (MPLcashUSDC) allows investors to participate in the repo and T-bills market through the Maple platform. It is available to accredited non-US individuals, with a minimum investment requirement of $100,000. MPLcashUSDC operates on the Ethereum blockchain.

The Underlying

MPLcashUSDC's underlying asset is a loan extended to the asset originator Special Purpose Vehicle (SPV) at the prevailing T-bills 4-week coupon equivalent rate.

The SPV's asset composition currently consists of 80% overnight repo agreements and 20% T-bills with maturities of less than 30 days.

Collateral Security

The SPV’s assets are purchased through StoneX (prime broker) and held with BNP Paribas (custodian). Maple Foundation, a third party Cayman domiciled entity, acts as Security Agent under the Master Loan and Security Agreement signed by the SPV.

DeFi integration

No known DeFi integration at this stage.

Fee structure

The product has annual fees of 0.50% divided equally between Maple and Room40, the asset manager. The asset originator’s fees are 0.25% (deducted from the rate). Maple’s 0.25% in fees are taken as management fees (expressed as % of the interest rate so when the rate is 5%, management fees are 5% to get 0.25%).

Conclusion

Maple MPLcashUSDC offers investors exposure to the 4-week T-bills market but without any fluctuating price (no duration risk, no downward price) as it is a loan and not the underlying directly.

Franklin Templeton BENJI

Description

Franklin Templeton BENJI is a regulated US government money market fund (GMMF) that aims to maintain a stable value of $1 per token. Interest is accrued and added as new tokens on a daily basis, ensuring capital preservation.

With a minimum investment requirement of $20, Franklin Templeton BENJI accepts fiat currency for participation. The token is issued on the Polygon and Stellar networks and is held in custody by Franklin Templeton.

The Underlying

Adhering to Rule 2a-7, which governs government money market funds, Franklin Templeton BENJI invests 99.5% of its total assets in government securities, cash, and repurchase agreements collateralized fully by government securities or cash. As of the end of May 2023, the fund's portfolio primarily consisted of Federal Home Loan Bank bonds, which are government-sponsored bank bonds.

The fund operates within regulatory limits that restrict the level of risk taken on the liquidity side. The weighted average maturity of its holdings is 24 days.

Collateral Security

For the purpose of this report, we presume that the history and reputation of sound investment practices by the issuer will excuse us from looking into the quality of the issuer in detail. However, as always, we urge all parties to not take trust for granted.

DeFi integration

No known DeFi integration at this stage.

Fee structure

Franklin Templeton BENJI has an anticipated annual fee structure of 0.2%, comprising 0.15% management fees and 0.05% operating fees. The prospectus discloses an estimated 8.61% prediction for operating expenses, with any variance being absorbed by Franklin Templeton until July 2023. Future fee adjustments beyond this period are not explicitly outlined. The fund does not impose any minting or redemption fees.

Conclusion

As an offering from a heavily regulated institution with a long standing track record, Franklin Templeton BENJI presents an attractive choice for investors seeking exposure to a US government money market fund.