Objective-based liquidity design for stETH and directions for further research

Steakhouse evaluated the suitability of this Lido's liquidity spending for stETH by looking at whether the DAO improve its governance by paying incentives in LDO, whether paying incentives helps susta

Conclusion

LDO should not be used to pay for liquidity incentives

The DAO should not be paying to create a significant buffer of liquidity over trading volume

It does not meaningfully change the exchange rate

The DAO should not be bearing the cost of risk for looped staking

It may make sense to incentivize early pools on L2 to start liquidity but the approach needs real-world testing to validate

Introduction and aims: Bootstrap the emergence of an organic mechanism for stETH to trade close to its fundamental value

At length, the network effects associated with increasing usage of stETH in DeFi should create positive feedback loops of greater liquidity and greater attractiveness to use stETH as a tool to secure the Ethereum network. The implied aim of the reWARDS program is to serve as a scaffold during a period of fragile growth until this state can be reached. During this period, the aim of the program is ostensibly to subsidize the emergence of liquidity pools that can facilitate exchange rate discovery of stETH against ETH and hopefully have it land as close to 1:1 as possible. This should also protect stETH holders from sudden and unexpected market movements in the price of stETH relative to ETH, while withdrawals to ETH are not yet ready.

However, this goal is not explicitly stated, and is often mixed in with various other considerations, including increasing the decentralization of the LDO token, attracting new governance participants and incentivizing the creation of large pools to absorb cascading liquidations during periods of market turbulence.

Broadly speaking, we propose to simplify the objective in the following way:

Bootstrap the emergence of an organic mechanism for stETH to trade close to its fundamental value

LPs should be paid in the most favorable currency for the DAO

Liquidity should be provided when it can actually help close an exchange rate gap in a small pool

Liquidity should not be incentivized when there are no marginal improvements for stETH users

To evaluate the suitability of this framework for stETH, we looked at three questions:

Does the DAO improve its governance or otherwise benefit by paying incentives in LDO?

Does paying incentives help sustain a closer exchange rate to 1:1?

Should we aim to sustain a large cushion of liquidity to protect looped staking?

Outcome 1: LDO should not be used to pay for liquidity incentives

The net effect of paying for anything in LDO is the equivalent of the DAO market-selling LDO for cash then using that cash for an expense. We should not be tempted to think the LDO in Aragon has any value until it starts circulating, and when it starts circulating the DAO needs to be confident it was employed in a way that maximizes stability for stETH and LDO users, however defined (e.g. return to governance could be an outcome).

Of the implied demand drivers, the easiest and most impactful to test is whether LPs in Curve hold on to the LDO that they receive as incentives. Between 2022-01-01 and 2023-02-23, almost 80m LDO has been churned in the Curve incentives pool, 98% of which has been claimed. Looking at the 80% largest holders of LDO following these transfers:

A staggering 85% was dumped immediately

A further 10% was dumped within 6mos

Only 5% is held

Only 80 addresses claimed more than 100k LDO, of which 4 participated on less than 3 Snapshot polls and only 1 participated more than 5 times. Distributing LDO as incentives not only disproves the implied framing but is demonstrably bad for the DAO along those same lines. The net effect of using LDO to pay for incentives is that wealth is transferred from existing LDO users to 80 whales on Curve.

55% of the LDO sold went to ETH and 35% went to USD, however, it may be a factor of the most liquid pairs with LDO and could eventually skew stronger towards USD or ETH respectively. A common strategy for liquidity provision is delta-neutral farming, wherein an LP borrows one asset against the other to remain neutral to price movements and only collects the fees from the pool (and in this case, also the rewards). It is very unlikely that delta-neutral LPs are weighing the ability to vote on governance proposals as a factor drawing them to the Curve pool.

→ To the extent that the DAO incentivizes any form of liquidity, it should be doing it in the token the protocol generates a surplus in, stETH

It is what Curve whales actually want

It is easier to frame the cost of the program

It incentivizes the circulation of stETH as a unit of account

Outcome 2: The DAO should not be paying to create a significant buffer of liquidity over trading volume

There is a substantial amount of liquidity on the Curve pool for stETH/ETH, often with the amount of liquidity on the pool being hundreds of times larger than the actual traded daily volume (Dune query 3).

We attribute this excess liquidity to the DAO’s continuous funding of incentives in the Curve pool over time, in particular during May 2022 when the amount of daily trading volume approached 1x the size of the Curve pool.

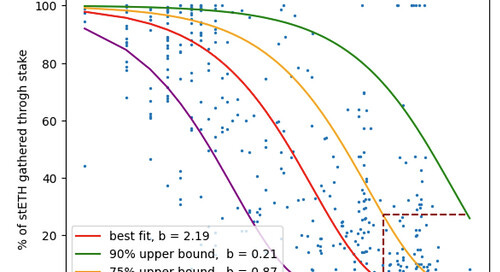

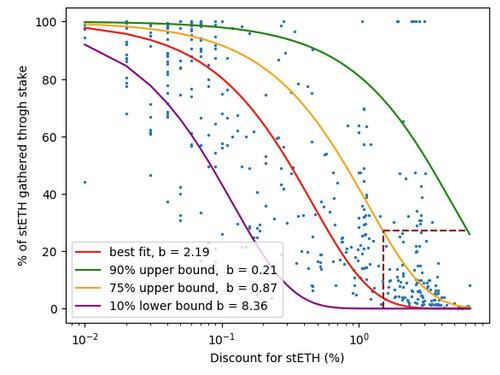

→ If the market discount exceeds 1.5% there is a 75% probability that less than 20% of stETH would come from new stake

There is a rough relationship between the discount on stETH relative to ETH and the amount of stake growth. This relationship is quantified in the below chart (Dune query 1):

The fall-off from a discount relative to ETH is very strong and clearly affects new stETH growth. We should therefore only expect new stETH growth from the market if the discount is less than 1.5%.

→ There is no hard evidence that incentive cuts to 0 would lead to a drop in daily average exchange rates rate of over 0.8% (with 99% confidence interval, based on daily rates)

Introducing a second pool of Curve incentives in May 2022 likely supported the exchange rate and may have prevented further liquidations, particularly on Aave, over the space of a few hours as Instadapp de-leveraged. However, similar TVL drop events repeated in November 2022 and on 2022-12-31 (likely due to tax loss harvesting) with no additional support from a second pool of incentives, which suggests an alternative hypothesis:

There is no ability to actually influence the outcome of market events beyond a timescale of a few hours

To test this idea, we need to formalize a simple model of market exchange rates to isolate the impact of our liquidity incentives. We propose the below model:

Where I(t) is the time series for converting incentive investments in the Curve pool (in ETH or USD) into an impact on the exchange rate, X(t) is an exogenous exchange rate term and ϵ is a random error term.

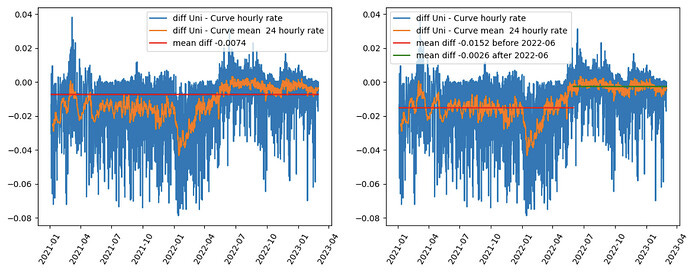

The Analytics team modeled the undisturbed rate on the Uniswap v2 pool with a few mitigating factors: it exists simultaneously to the Curve pool and it is considerably smaller and more volatile than the Curve pool.

There is a clear difference between the Uniswap v2 rates and the Curve rates that is persistent and volatile over time. However, there is also a time component to the difference which has a discontinuity that starts in July 2022.

Based on the data from the last 8mos, this suggests that the gap that incentives are closing is 0.26%. Although on an hourly basis, the 99% confidence interval includes drops of up to 2.5% (left-hand side) the daily rate 99% confidence interval stops out at less than 0.8% (right-hand side).

The measured difference between incentivized pools and unincentivized pools has been extremely small historically, and declined further since July 2022. Additionally, when the relative sizes of both pools balance out, the difference is compressed further.

The observed difference in rates can’t be projected exactly as a scenario estimate change in market rate, since we’re observing exchange rates on Uniswap while the Curve pool exists (it is responsible for most of the market and provides opportunity for arbitrage). When withdrawals become available, there will be another strong path to arbitrage (the rate is fixed but time cost of asset is implied).

The core outcome is that effect on exchange rate is, relatively, small compared to stability of rate - therefore, designing incentivization, we should consider what pool size is required to provide availability of X swap without price dropping more than Y% (given A 30). We should therefore model what amount of spending in USD or ETH is required to achieve that aim. However, we should also be mindful that the evidence suggests a very thin link between pool incentives and pool size.

For what it’s worth, in USD terms, the return to LPs in the Curve pool has been lower than just staking vanilla ETH in Lido directly for quite some time, and at least for the past 9-12mos. This suggests that LP participants have unknown constraints (for e.g. they may be forced to hold ETH, preventing them from staking it) and we are not addressing those directly.

One example of a rationale for depositing into Curve vs staking would be a delta neutral farming strategy. An LP holds ETH but doesn’t want to be exposed to the price of ETH or to stETH. Additionally, all the leveraged looping degens that supply stETH make it cheap to borrow. So an LP farmer could prefer to hold ETH, borrow stETH for low rates and farm Curve fees, no matter the level of incentives. For these participants, given their constraints, Curve fees alone should attract a large enough size to stay liquid even for large swaps.

→ Whether incentives attract pool size that could defend cascading liquidations or not, the DAO should not effectively hold the safety net for staking loops

Clearly, having larger pools makes it easier for large liquidation clips to be absorbed in the market. However, the consideration for whether the DAO should try to hold a safety net for staking loop users is not testable, it is normative. It is also independent of whether incentivization actually creates larger pools or not.

Problem: Staked ETH looping users constitute a large number of stETH users, but mostly benefit lending protocols who accept stETH as collateral. These vaults are constantly on a knife’s edge because stETH users degen into it to take advantage of a perceived (but illusory) ‘peg’ that creates an seemingly risk-free leveraged loop. As the price of stETH floats by design, this is not a correct perception. Therefore there is a large risk that in the event of a large market dislocation, cascading liquidations are triggered when large clips push the price of stETH temporarily lower.

Objective: Lower the risk of these cascading events

Solution:

Technical solution for lending protocols would be to implement hour-long delays on oracles or open the oracle set to new participants (e.g. Chronicle, Pyth, etc.) who have hour-long delays

This would significantly lower the risk of liquidations as it would provide people with an hour to cover with collateral

Solution for the Lido treasury is to simply stop trying to hold the net for looped staking users

Anyone with a leveraged position is incurring a risk and should be responsible for that risk

After withdrawals are open, a clear arbitrage path opens to redeeming stETH for 1 ETH exactly

Therefore cascading liquidations, if they occur, would not affect unleveraged users

→ We should protect these users rather than the leveraged users, who nobody is forcing to take on more risk

Finally, even in the event of significant discounts of stETH relative to ETH, the quality of the product, its robustness as a staking solution and the breadth of its acceptance and integration have created a highly desirable product at 1:1, and a market with a seemingly bottomless well of demand under 1:1, for what buyers perceive to be a huge bargain.

→ Market discounts of over 2% significantly cut into new deposit growth, but there is no hard evidence removing incentives would meaningfully change the exchange rate

The market for stETH is enormous at this stage of growth

Our financial resources are much smaller than the market

We cannot change the market

→ The DAO should not hold the bag for looped staking

It is the responsibility of leveraged users to manage their positions, not the DAO’s

Withdrawals will open a strong arbitrage loop for unleveraged stakers to redeem discounted stETH

There will always be a buyer under 1:1 as long as the product continues to be the best liquid staking product

Further research: How do we set a goals-based approach to building liquidity on new domains?

We have not tested the impact of liquidity seeding on smaller or new pools. It stands to reason that some amount of incentivization may be necessary. However the approach requires real-world testing to validate. What we are missing is a structured principle for setting early goals to scaffold liquidity growth on new L2s, and we hope to arrive at this framework in time through further research.

Further research: What is the best way to automate liquidity provisioning

Our team proposed the Steakhouse Skewer, a PID controller contract to regulate future liquidity incentives in an automated way. This controller contract would receive a budget for incentivizing liquidity and distribute it to the relevant pools that require support.

Given the above, the PID controller would likely end up being tuned to be highly sensitive in the derivative component (the Kd parameter), which reacts to sudden changes, and potentially a smaller Kp parameter set to a fixed level of TVL over trading volume in the 1-20x range. The integral parameter would essentially be zeroed out, i.e. no support in the event of a sustained drift in the exchange rate for a period of time. This controller would therefore be able to intervene whenever the amount of liquidity in Curve is less than some multiple of the total hourly trading volume, provided it got there suddenly.

This formulation furthermore also does not require an oracle, as the parameters can be read directly from the Curve contracts.

In the case of the Curve pool, hypothetical Kp and Kd triggers could intervene under the dotted line, adding stETH payments to LP providers in the event of TVL coming 1) under a threshold level of liquidity and 2) over a threshold for rate of change to get there.

Whether this is the most efficient way to provide liquidity, whether the approach works or whether there are more suitable approaches are all questions for further research and discussion.

Takeaways

LDO should not be used to pay for liquidity incentives

The DAO should not be paying to create a significant buffer of liquidity over trading volume

It does not meaningfully change the exchange rate

The DAO should not be bearing the cost of risk for looped staking

It may make sense to incentivize early pools on L2 to start liquidity but the approach needs real-world testing to validate

Financially, a first step in the right direction would be to start considering the liquidity budget in the context of overall operating expenses for the DAO. This will be introduced in the context of LIDO-2, an upcoming request for supporting external contract work.

Acknowledgements

Massive thanks to the Lido Analytics team, @pipistrella and @mol_eliza, for a huge analytics lift.