Steakhouse Wrapped 2025

Morpho +600%, Launch on Solana, Beyond Vault Curation, More in 2026

Welcome to 🥩Steakhouse Wrapped 2025🥩

We want to thank everyone who used our vaults, integrated with our infrastructure, or worked with us throughout the year. We’re grateful for the trust and collaboration along the way, and we’re excited to keep building together in the years ahead!

Wishing everyone a happy New Year 🥂

Contents:

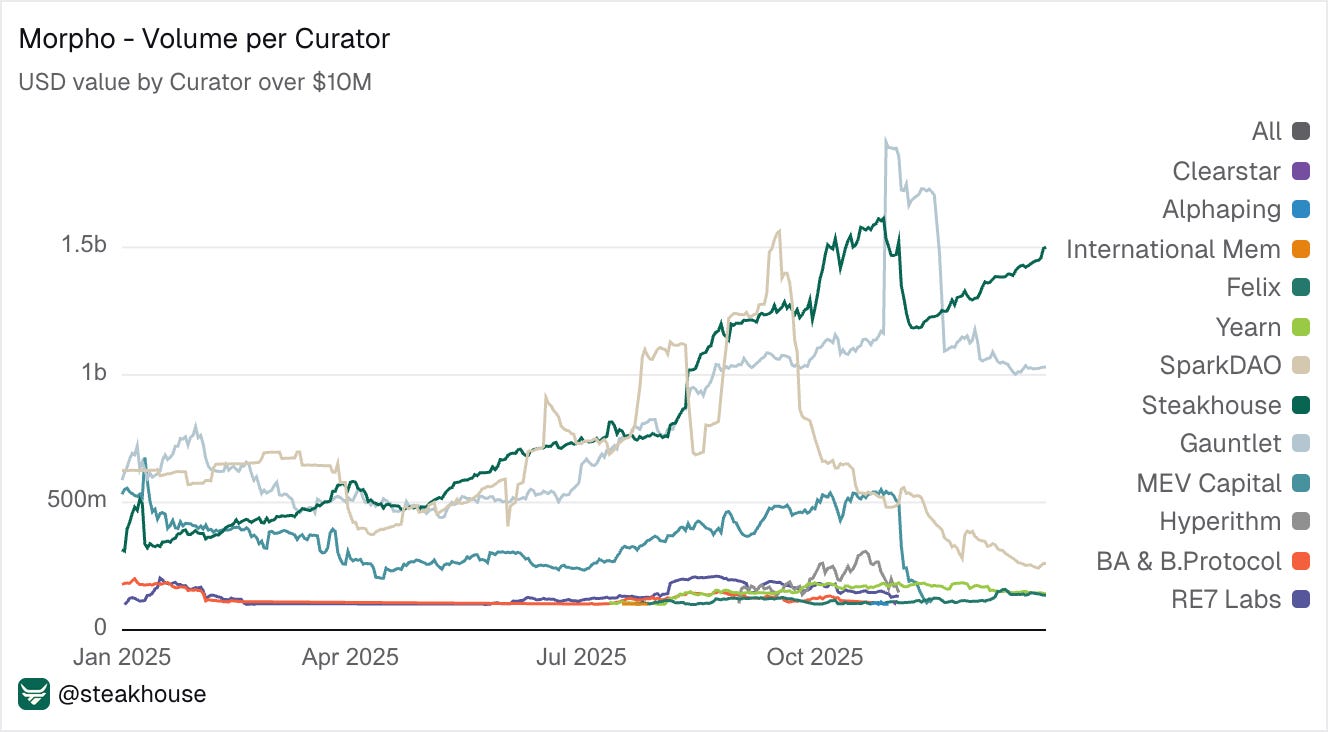

Leader on Morpho with $1.5bn, +600% in 2025

Launch on Solana with Kamino

Pushing DeFi forward beyond vaults

More of everything in 2026 👀

1. Leader on Morpho with $1.5bn, +600% in 2025

🏆 Steakhouse is the biggest onchain asset manager

Our vaults grew +600% from January to $1.5 billion by December.

🏆 We are the only major curator with no bad debt events

After the collapse of Stream Finance and Elixir, we were the only major curator left standing with no exposure across any of our mandates.

While the curator landscape remains highly volatile, we grew steadily, adopting a keystone position in the ecosystem as a “structural stabilizer” (per

This is the role that our institutional segment and our wide-ranging fintech integrations value when co-creating products for their users.

🏆 Steakhouse deployed 63 new vaults this year

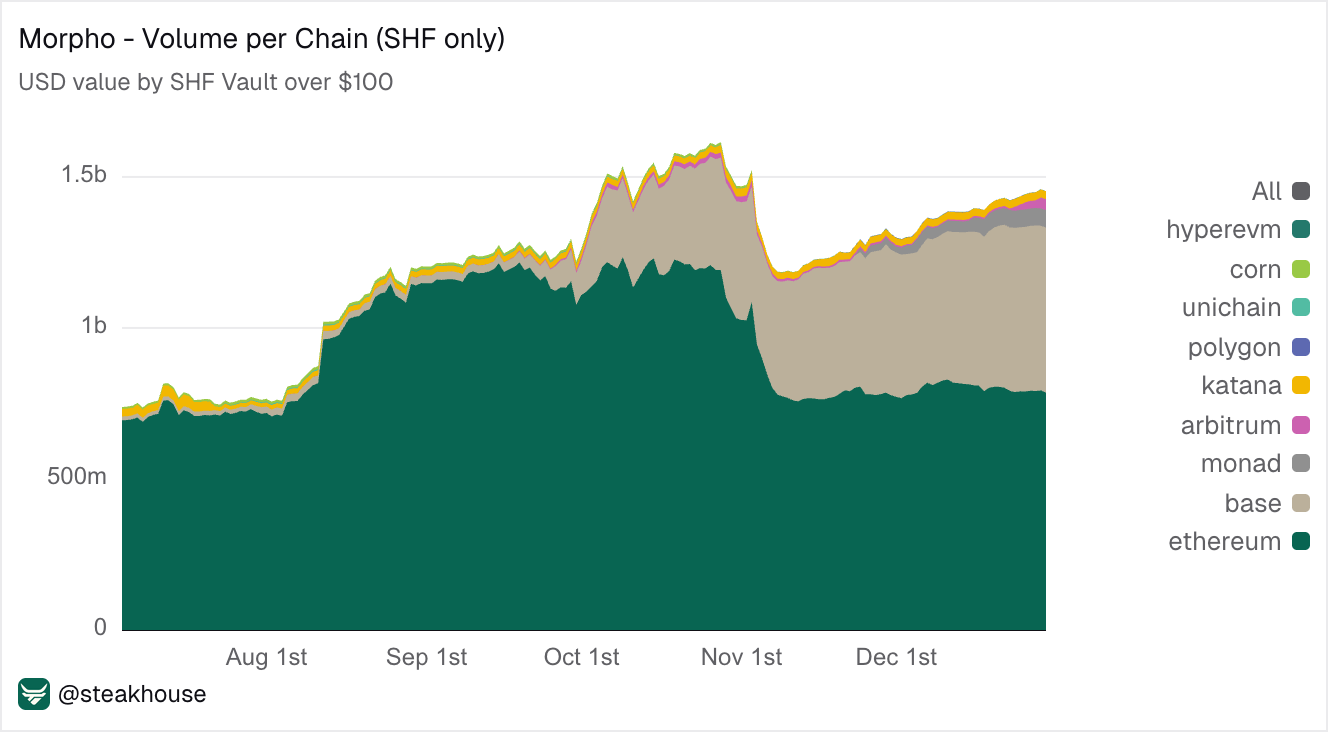

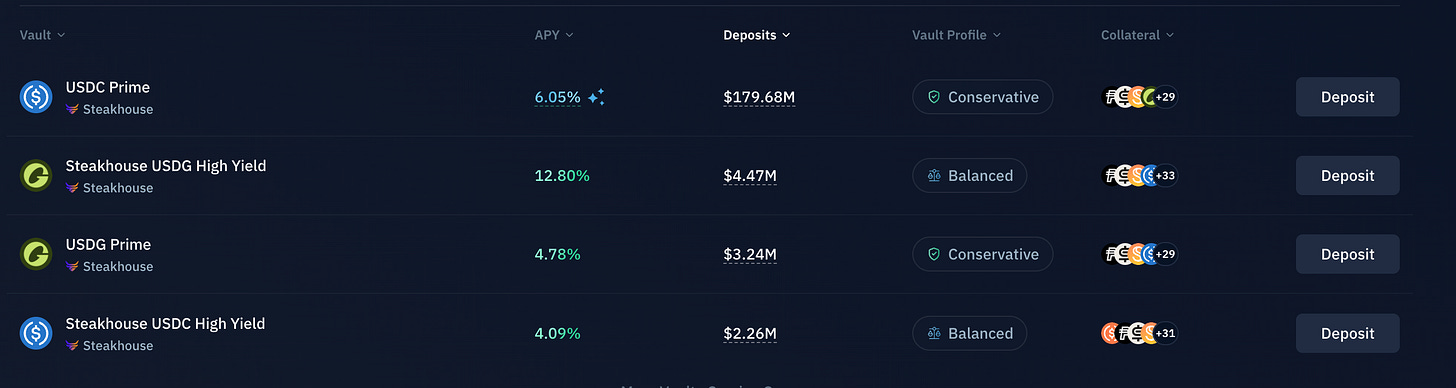

Our TVL is spread across multiple vaults driven by our Prime category as a best-in-class risk-adjusted vehicle for noncustodial exposure to the DeFi economy.

We generally structure our product segments into two product lines, Prime and High Yield (per base asset), under our Multi-Layer Risk Framework.

We don’t take excessive risks for short-term gains, and we strongly focus on minimizing our own footprint as a counterparty - strict noncustodiality, long-term timelocks, trustless @AragonProject guardians and limiting manual processes to the bare minimum.

🏆 Steakhouse powers Coinbase’s onchain USDC lending: $400m+ in deposits and 50k+ users

At Steakhouse we focus on B2B/B2B2C integrations, providing tailored vault infrastructure for fintechs looking to build non-custodial Earn products for their stablecoin users.

Coinbase integrates our Steakhouse USDC vault on Base directly into the retail exchange environment, abstracting the complexity of DeFi for tens of thousands of end-users with a seamless user experience.

Some of the industry’s most demanding institutional customers have partnered with us to build similar stablecoin experiences, including but not limited to Bitget, Lemon, Crypto.com, Farcaster, Safe, Chorus One, Trust Wallet, and others.

We work closely with diverse stablecoin issuers to embed DeFi into everyday consumer applications. We’ve only just begun.

2. Launch on Solana with Kamino

🏆 Leading the curation on Kamino for the majority of the year

Steakhouse launched on Kamino in May 2025 and now curates 4 vaults, expanding vault curation capabilities to Solana.

We brought our multi-layer risk framework to our Kamino vaults, ensuring consistent collateral standards, conservative market selection, and strong capital protection independently of the ecosystem.

Attractive yields and incentives drew users to Solana, propelling Steakhouse vaults into multiple nine figures and a strong foundation for further growth in 2026.

3. Pushing DeFi forward beyond vaults

🏆 We launched Grove (a Sky SubDAO)

Leveraging our history and expertise in asset-liability management, we launched Grove (@grovedotfinance), a Sky SubDAO, dedicated to advancing institutional credit infrastructure onchain. Since its launch Grove has allocated around $2 billion of capital into credit opportunities.

Grove brings together capital, risk frameworks, and protocol integrations to support scalable, resilient credit markets in DeFi. Read more: https://data.grove.finance/

🏆 We launched private credit in DeFi

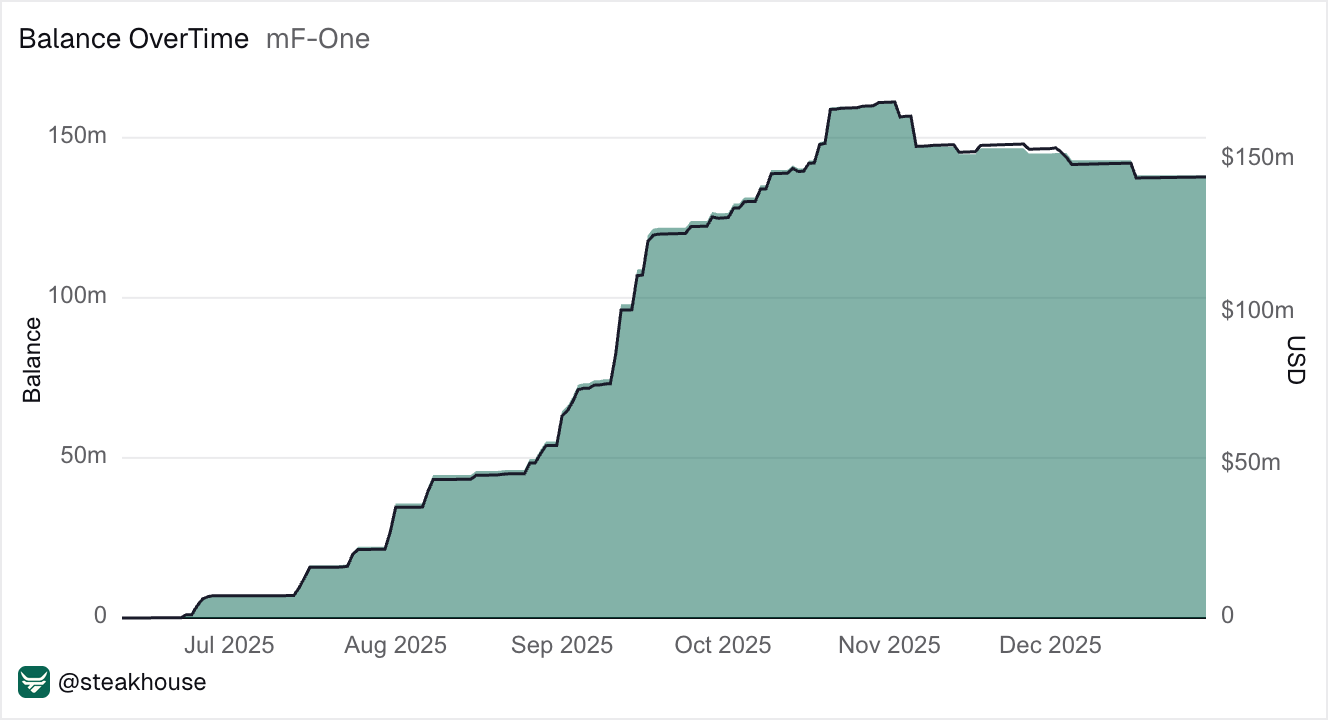

We onboarded Fasanara and Midas’ mF-ONE tokenized private credit fund with safeguards for DeFi lenders to bring it in line with other assets we curate within our risk framework.

The combination produced the first successful launch of a tokenized private credit instrument in DeFi, scaling to over $140m in onchain exposure.

As a novel asset class for DeFi, there are many new and unfamiliar risks which need both education efforts (Steakhouse Kitchen, Dune mf1 Dashboard, X mf1 post) and continuous improvement of tokenized structures to improve their suitability for use in DeFi.

🏆 We lead the transition to V2 vaults on Morpho

We deployed over 32 V2 vaults that are now live on Morpho, delivering a future-proof, trust-minimized framework for onchain asset management. Steakhouse curates the largest number and highest total value of V2 vaults on the protocol.

4. More of everything in 2026 👀

More Vaults, more Markets, more Stablecoins.

More V2 Markets, enabling fixed-rate lending and defined durations.

More products beyond repo to scale into duration and levered strategies (👀).

More currencies, moving beyond USD and EUR.

More accessibility to our products.

More on Solana, specifically @kamino.

More B2B and B2B2C integrations to be announced soon.

More educational content.

More DeFi Markets updates.

More steak.

Bottom Line: Stay tuned for More as we continue building the stablecoin economy.

Thank you for trusting Steakhouse Financial.