Lend your USDC on Coinbase

Building a better future financial system, available to Coinbase users through Morpho

Coinbase is introducing a new lending product developed in collaboration with Steakhouse Financial and Morpho that brings access to onchain money markets for millions of Coinbase users worldwide, through Morpho’s DeFi infrastructure.

To introduce lending on Coinbase, we wanted to make a short explainer post to help users understand the product, the risks they take and what we do on the curator side to mitigate those risks.

DeFi capital markets are volatile and dynamic but also present a lot of opportunities. When simple transactions can take place directly between users, operations can often be done faster, cheaper and more transparently.

In the road to Coinbase’s vision to building a better financial system, DeFi protocols such as Morpho play a key role. We are proud to partner with Coinbase and build on Morpho to deliver the next step in that direction through our curated vaults, available now to select Coinbase users, directly in-app. Read more about the product integration on the Coinbase blog.

Building together towards a better future financial system

Steakhouse’s mission is to build open and transparent finance. This mission works perfectly in sync with Coinbase’s vision of a world where users can have greater economic freedom by using accessible and secure financial tools with fewer middlemen.

Our lending vaults, built on immutable Morpho smart contracts on Base, are an example of how DeFi can help create products that connect borrowers and lenders directly. By integrating them into the core Coinbase app experience, the user flow is made easier and more accessible without having to onboard into DeFi directly. Coinbase can help its users navigate different options and interact with smart contracts without leaving the safety and friendliness of the core app user experience.

Coinbase and Morpho call this the ‘DeFi mullet’ - a fintech experience in the front, powered by immutable smart contracts in the back. We used this product stack to bring onchain repo markets to over $1.2bn in user deposits and, now, to bring USDC lending to Coinbase users around the world.

For more information on our approach to risk management, please visit our Information Hub at https://steakhouse.financial/docs.

What is a money market?

A money market matches people who have extra assets (lenders) to people who are looking for short-term liquidity (borrowers). Borrowers pay an interest rate to access liquidity for a time and lenders earn the interest rate in turn. The transaction is secured by the borrower posting collateral. If the value of the collateral declines, Morpho smart contracts seize and liquidate it to repay the loan and protect lenders.

Through the use of Morpho’s smart contract DeFi protocol, the match-making between a borrower and a lender can take place without a centralized counterparty. This can make it cheaper and more transparent for both parties relative to trusting a middleman.

The tradeoff to not having a trusted intermediary is that these loans are made on top of locked collateral. If the borrower fails to repay their loan, the collateral that they locked up in Morpho gets auctioned and liquidated automatically to ensure that the lender is repaid.

Coinbase users are already able to access the borrow side of this market through their crypto-backed loans platform with cbBTC. Under the hood, Morpho users on Base lend USDC to borrowers with cbBTC collateral and interest is accrued in real-time.

With Coinbase’s lending product, Coinbase users can now take advantage of the other side of the equation. Users with excess cash as USDC can deposit it in Morpho through our curated vaults, starting with Prime and soon expanding to a wider range of options. Those assets are then lent out to borrowers with a diverse range of collateral, earning a yield for lenders.

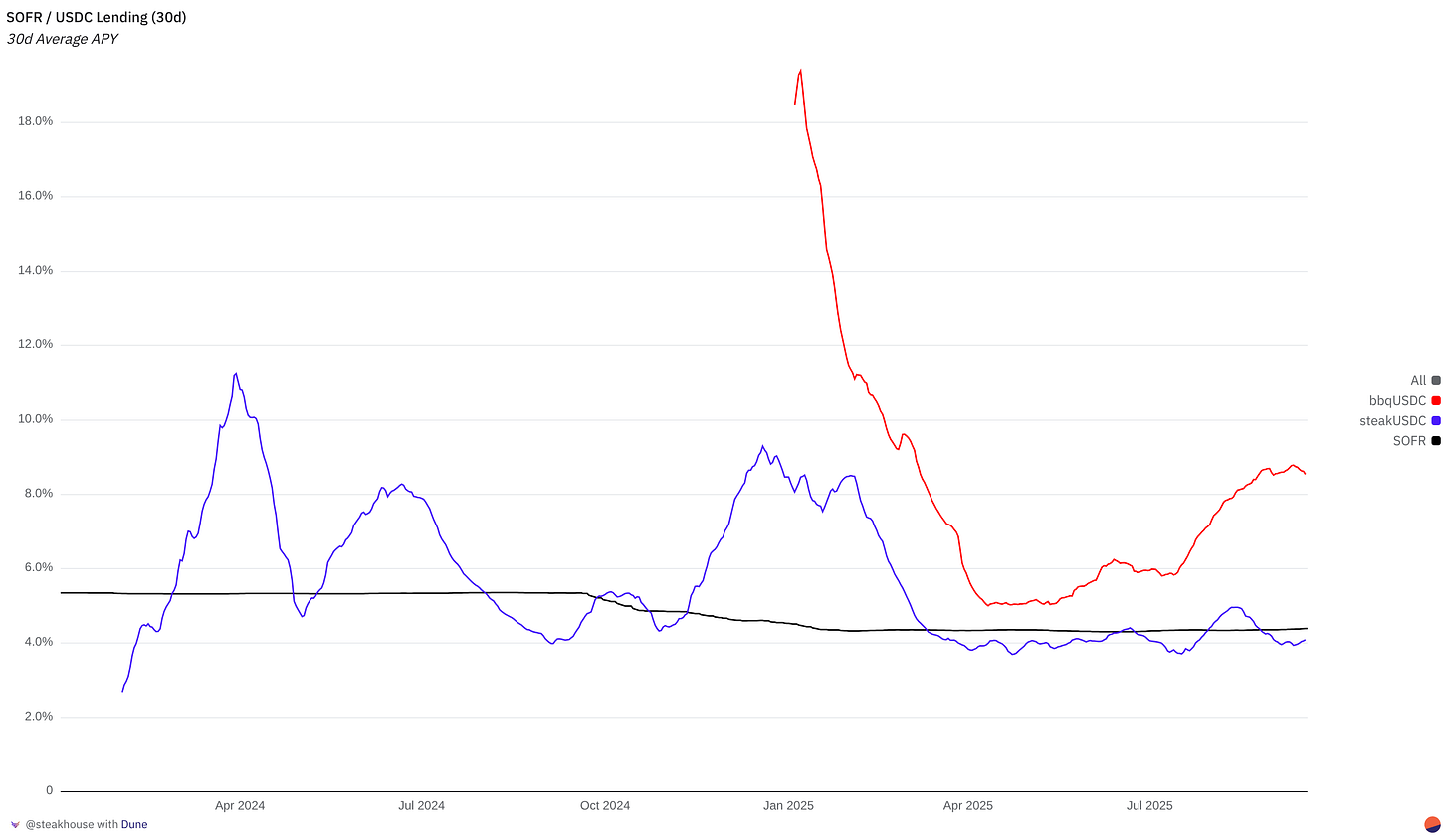

The benefit to doing this is that DeFi rates can be quite attractive relative to the risk-free rate. Loans are always overcollateralized and provided the asset lent against is liquid, the risk of a loss can be mitigated even in periods of heightened market volatility. For BTC and ETH in particular, these rates can be quite attractive relative to the risk.

What is the role of a curator for a DeFi money market?

The role of a curator in Morpho is similar to that of a match-maker. We don’t take custody of any user funds. We run proprietary quantitative algorithms that optimize the use of lender assets by matching them to borrowers in the best way. This means that by using one of our vaults, you can lend to more than one type of borrower, depending on their collateral asset. We are in charge of proposing new assets, after carefully evaluating them through our Risk Framework.

On the Morpho platform, we are the largest such curator with over $1.2bn in lender deposits at time of writing, and the largest stablecoin curator by over 3x relative to smaller players. Users value our systematic approach to risk management and our consideration of liquidity as one of the most important features for vault users.

What this does is allow lenders to select their level of risk and return in a more fine-grained manner. Prime vaults lend only to collateral assets that we would consider to be very high quality. This means that both the collateral tokens themselves present minimal risks of insolvency and secondary markets are liquid enough to support quick liquidations in case of need. These assets include tokens such as cbBTC, wstETH and cbETH.

If the Federal Funds rate decreases enough in the future, we might also include high-quality tokenized treasury bills, to ensure that the rates offered to lenders are always competitive. High Yield vaults take on more risk of illiquidity and slightly more collateral risk in return for higher lending rates. This vault is much more dynamic and changes much more rapidly than our Prime vault, as we introduce and remove collateral assets all the time. We are very considerate about collateral selection and we prefer to forego users earning higher rates if there is a substantial risk that they might lose their deposits through bad debt events (i.e. that borrowers do not repay their loans, such as if there is insolvency in the collateral token).

What risks are present in lending to DeFi users?

The main and ever-present risk is ‘bad debt’. This would happen when a borrower takes out a loan but they no longer have the incentive to repay the loan and the position cannot be liquidated profitably. In this case, the effective amount of user deposits available would decrease, so if you deposited $100 just before a bad debt event, you risk seeing your deposit decrease. To date, none of our Morpho vaults have accrued bad debt.

We mitigate this through curating collateral assets and their corresponding borrow markets very carefully. Our quantitative modeling measures the range of possible outcomes, including secondary liquidity modeling, and our underwriting vets collateral assets for any threats to solvency.

The other major risk is illiquidity. Typically, the market targets having 90% of available liquidity borrowed at any given time, achieved by changing the interest rate dynamically. If more than 90% of liquidity is borrowed, the interest rate increases faster to incentivize borrowers to repay. Conversely, if less than 90% is borrowed, the interest rate decreases to incentivize more borrowers to take out loans.

This means that at equilibrium, there is always about 10% of the market that is available to withdraw at any given time. The vast majority of users will represent a lot less than 10% of an individual market and never realistically be constrained by this should they want to withdraw their deposits. However, if market conditions change, there could be situations where the liquidity is fully removed. The mitigant is that increasing borrow rates make it more likely for collateral positions to be liquidated and repaid, bringing liquidity back to the market. We also aim to mitigate this through our proprietary quantitative algorithms that aim to ensure all the markets our vaults allocate to maintain appropriate levels of liquidity at any given time though there may be occasions when some wait time may be unavoidable, such as periods of heightened volatility.

Prime vaults will be much less exposed to these risks, by being allocated primarily to BTC and ETH related assets of high quality and deep liquidity.

High Yield vaults will face slightly higher insolvency risk, mitigated by our collateral curation framework and risk management, and slightly higher liquidity risk, as the borrow rate environment is far more volatile.

How often are interest payments made to the lenders? Weekly like USDC or less frequently?