DeFi Markets Update 2026-02-10

The Box - Turbocharging Steakhouse vaults, Changes in Stablecoin Supply, EURC Opportunities on Base

Welcome to another DeFi Markets Update—your no-nonsense briefing on the cryptobanking plumbing and market pulse.

The Box - Turbocharging Steakhouse vaults

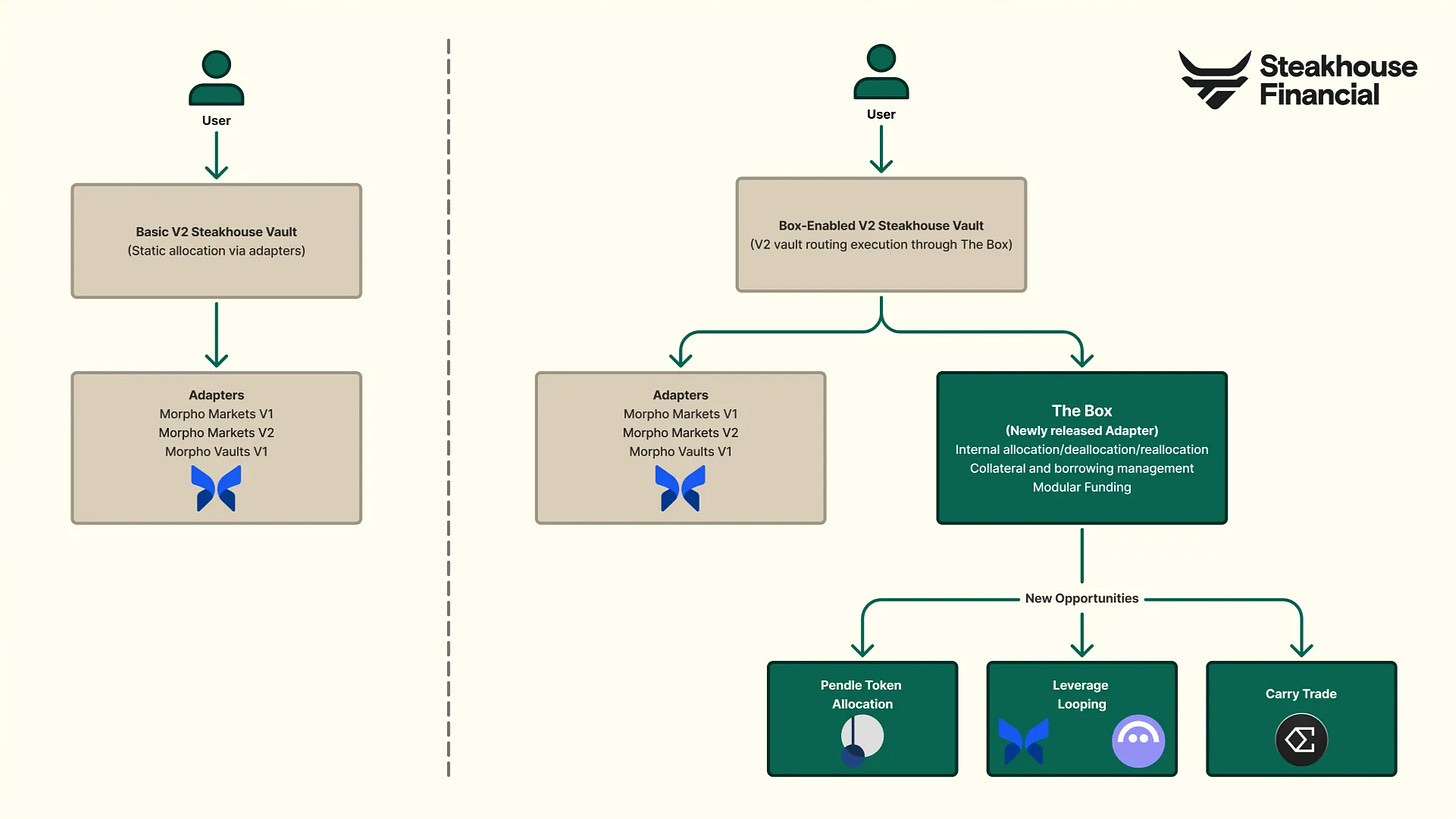

Steakhouse is introducing The Box, an extension for Morpho Vault V2, that expands vaults capabilities to support direct allocation and leverage, while maintaining a state of the art non-custodial model.

As more curators deploy V2 vaults on Morpho, Steakhouse remains the largest curator, managing 35 Morpho Vault V2 deployments across multiple chains.

The Box enables allocation/deallocation/reallocation of liquidity between underlying assets and whitelisted tokens, and supports pledging/depledging of assets as collateral and borrowing/repaying through funding modules.

It integrates Morpho Blue and Aave v3 as modular funding layers, with role-based controls including curator, allocators, guardian, and timelocked governance.

In practice, The Box enables Steakhouse vaults to execute more sophisticated strategies (launching next month) while maintaining the same core trust model → timelocks to manage investment whitelisting, Aragon guardian veto rights, and defined escape hatch.

Overview: Recent Changes in Stablecoin Supply

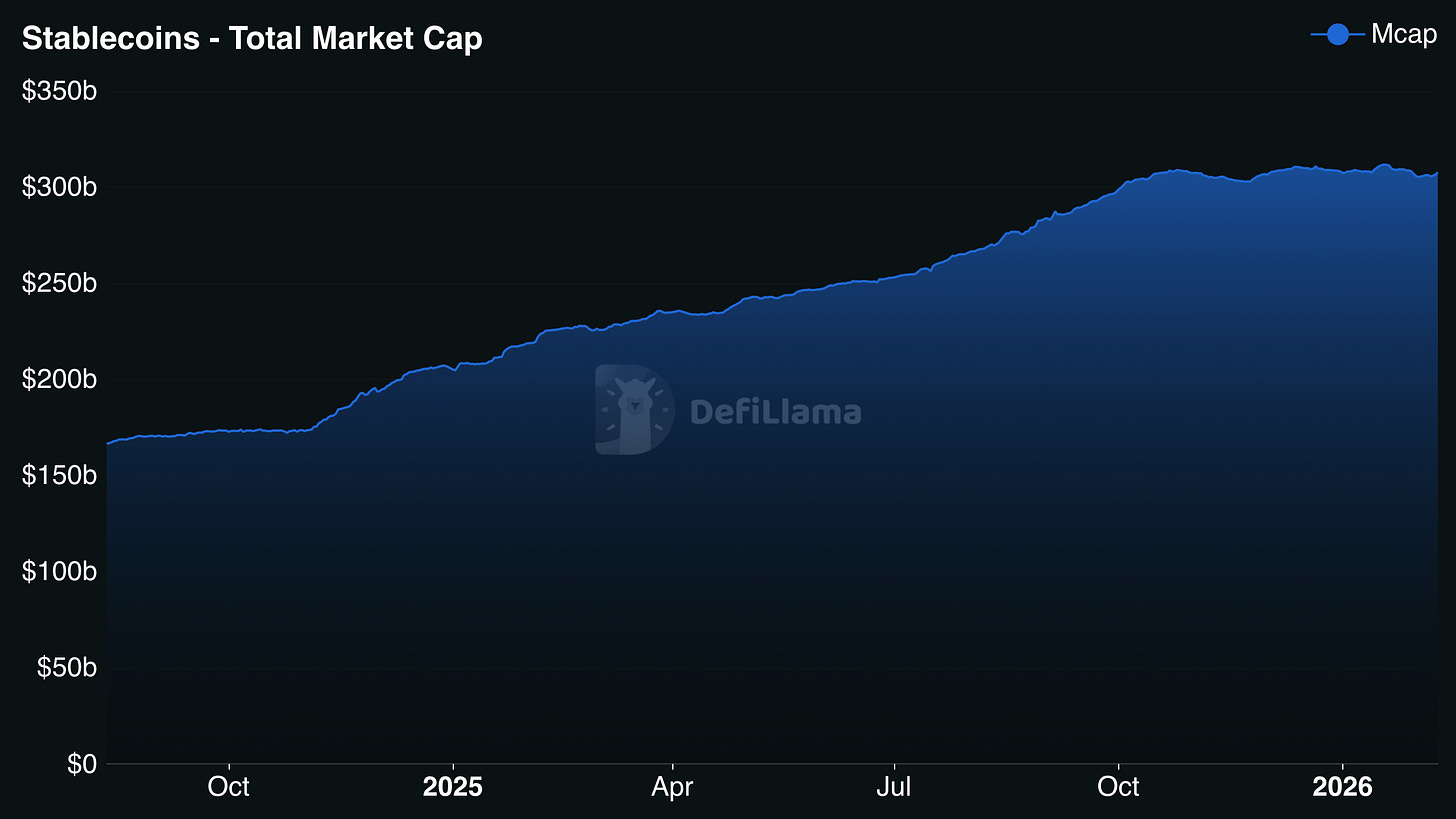

Both USDT and USDC recorded negative month-on-month supply growth at the end of January and into February so far. USDT declined by -1.2% MoM, bringing total supply to roughly $185bn, and USDC is down by -2.4% MoM (now $72.8bn).

The stablecoin environment continues to diversify on-chain. USD1 more than doubled over the past month (+53% MoM) to approximately $5.3B, while PYUSD grew 5.3% MoM to around $3.8B. Combined, these absorbed roughly $2.5B in new supply, closely matching the contraction observed in USDC.

The migration is largely driven by incentivised stablecoin markets across lending platforms. PYUSD and USD1 have seen aggressive incentive programmes across DeFi, pulling supply toward subsidised yields. On Kamino, the PYUSD vault curated by Sentora has grown to $333m since its September 2025 launch, but utilisation remains low at 44%.

While some could argue that capital is leaving DeFi, total stablecoin market capitalisation fell by just ~0.2% MoM and remains up year-to-date in 2026, suggesting capital has largely remained within the crypto ecosystem!

EURC Borrowing Opportunities on Base

EURC lending markets on Base are currently offering attractive low borrow rates across several collateral types.

Borrowing EURC against cbBTC, wstETH, WETH, and cbETH is available at rates between 0.86% to 0.94%, with LLTVs set at 86%.

Market depth remains solid, with all individual markets supporting circa €4M in available liquidity.