DeFi Markets Update 2026-01-28

EURCV Launch, Base Activity, Macro risks, Quantum Threats

Welcome to another DeFi Markets Update—your no-nonsense briefing on the cryptobanking plumbing and market pulse.

EURCV launching in DeFi with Steakhouse

Steakhouse has launched the Steakhouse Prime EURCV vault on Morpho, which is currently heavily incentivised with MORPHO rewards, reaching 6.8% APY.

Additional incentive campaigns are expected to roll out shortly, further supporting vault adoption and liquidity growth.

Users can now borrow EURCV against major assets such as cbBTC and wstETH, as well as against EUTBL, a tokenised euro money market fund managed by Spiko.

Borrow rates are expected to remain relatively low in the forseeable future, with comparable euro-denominated markets such as EUTBL/EURCV and cbBTC/EURCV being currently around 0.4%.

EURCV liquidity is facilitated through an actively managed Uniswap V3 pool, designed to maintain low slippage, even for larger trades of around $100k.

Base Activity Continues to Accelerate

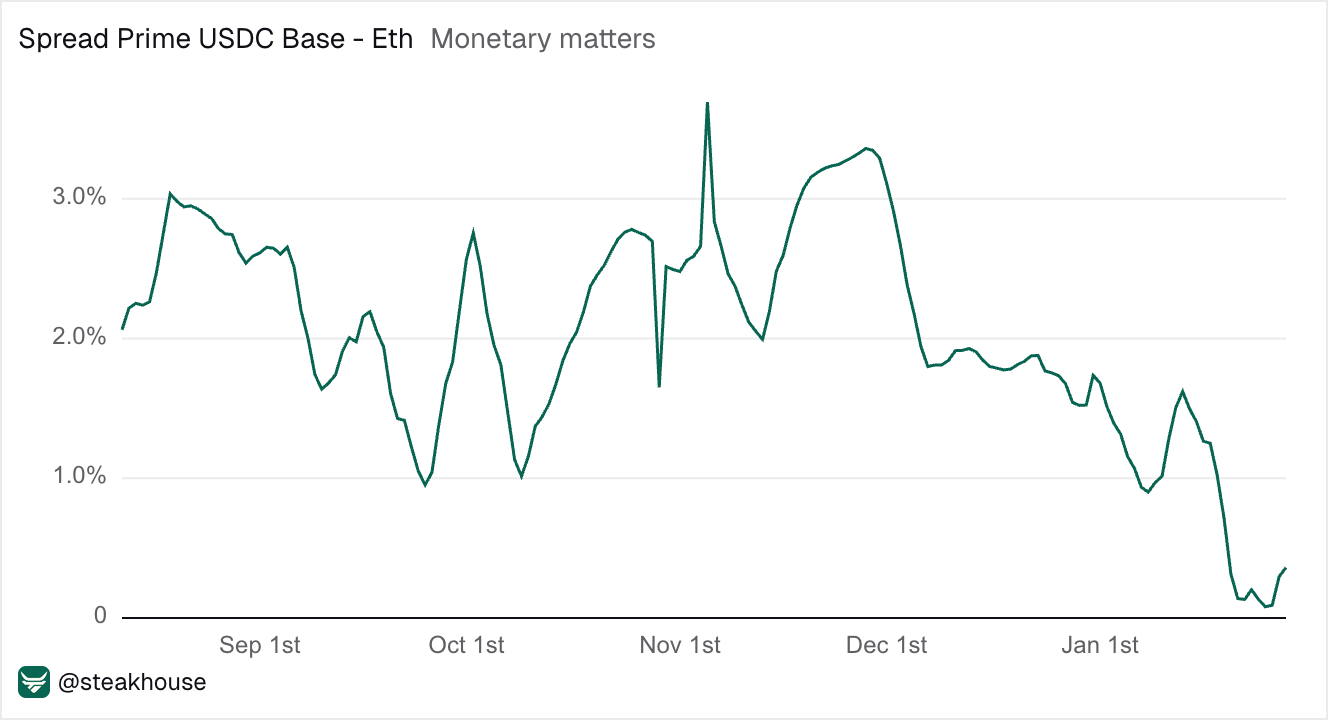

Lending rates on Base largely converged with Ethereum as new capital flowed in and compressed the spread. The USDC rate premium that used to be above 2-3% has now narrowed to 50bps.

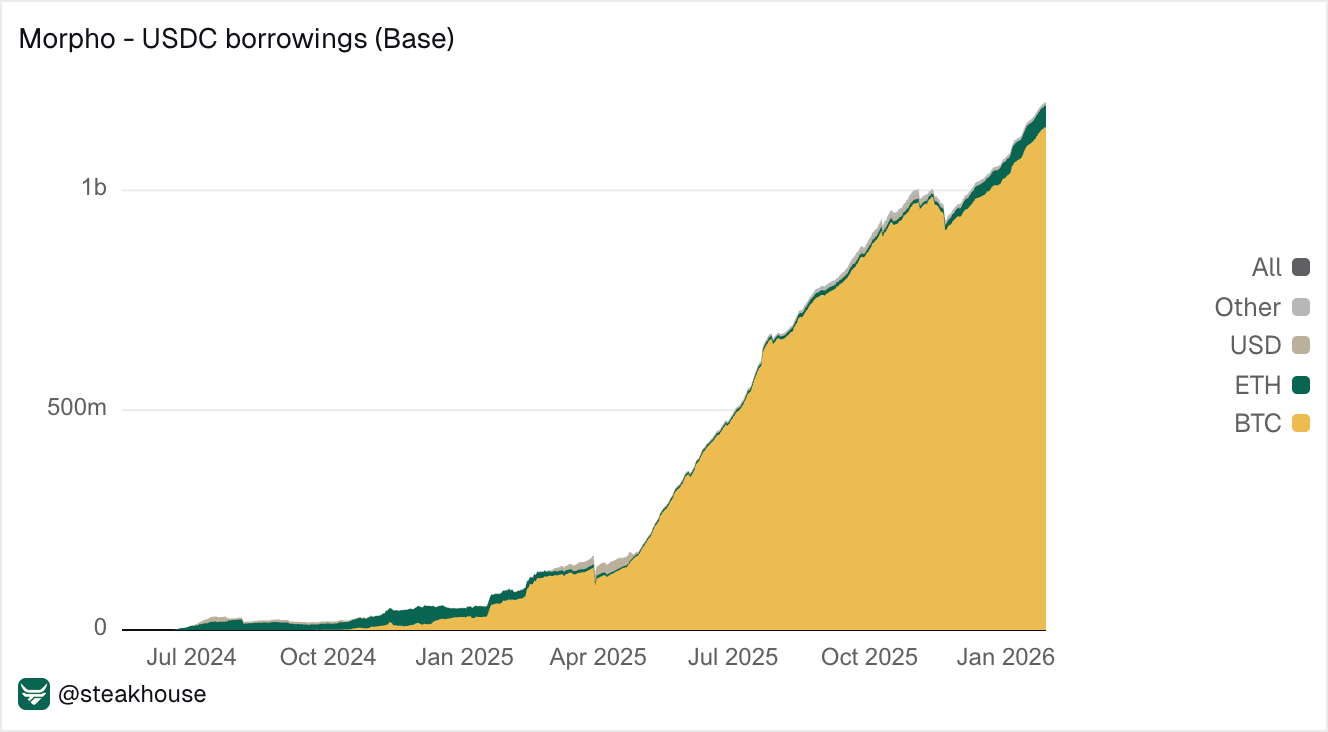

Base lending has grown consistently throughout 2025, expanding by roughly 25x, with Bitcoin-backed borrowing driving the majority of growth.

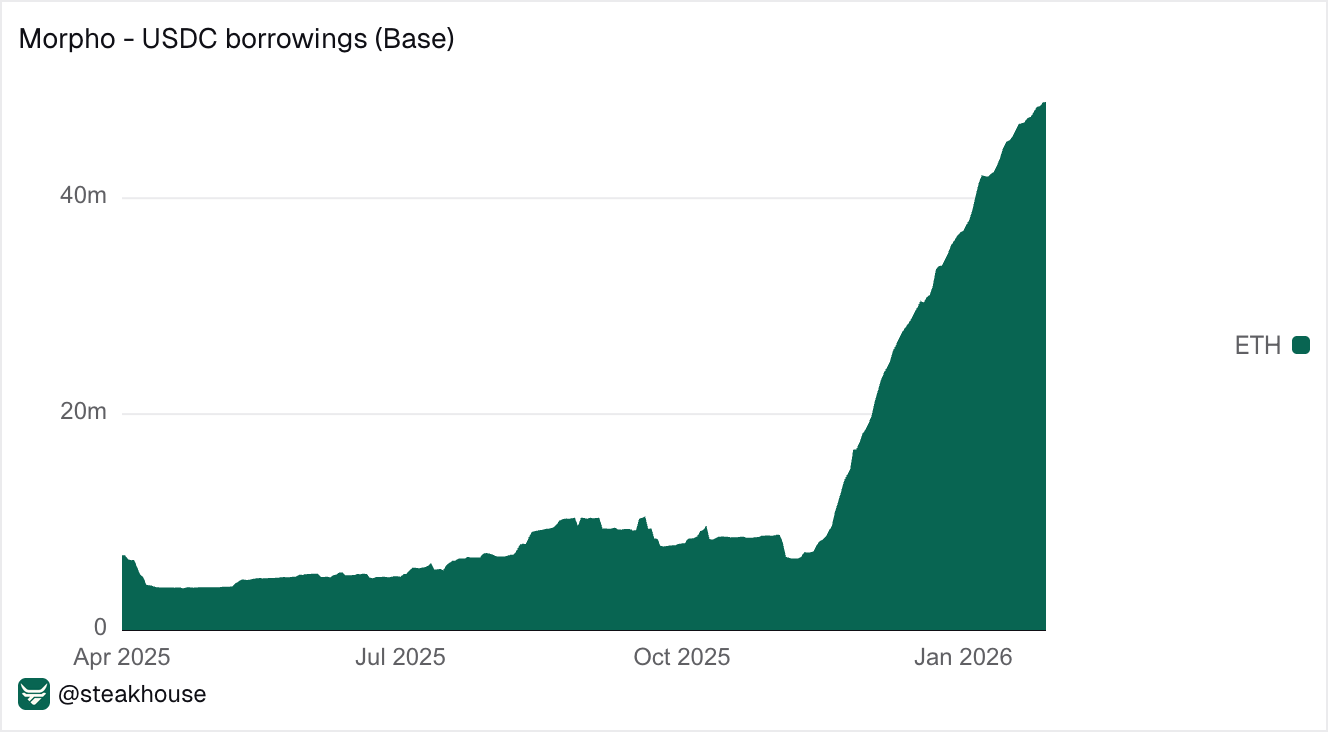

Since ETH was added to the Coinbase Borrow program, USDC borrowing against ETH on Base has increased over 6x, largely driven by this integration.

Recent price action amid elevated macro risk

Since 18 Jan, BTC fell from around $95k to $88k, while ETH dropped from roughly $3.4k to $2.9k, reversing the early-January hype.

In contrast, while BTC fell, tokenised Tether Gold XAUt moved higher, as both gold and silver reached new all-time highs this January.

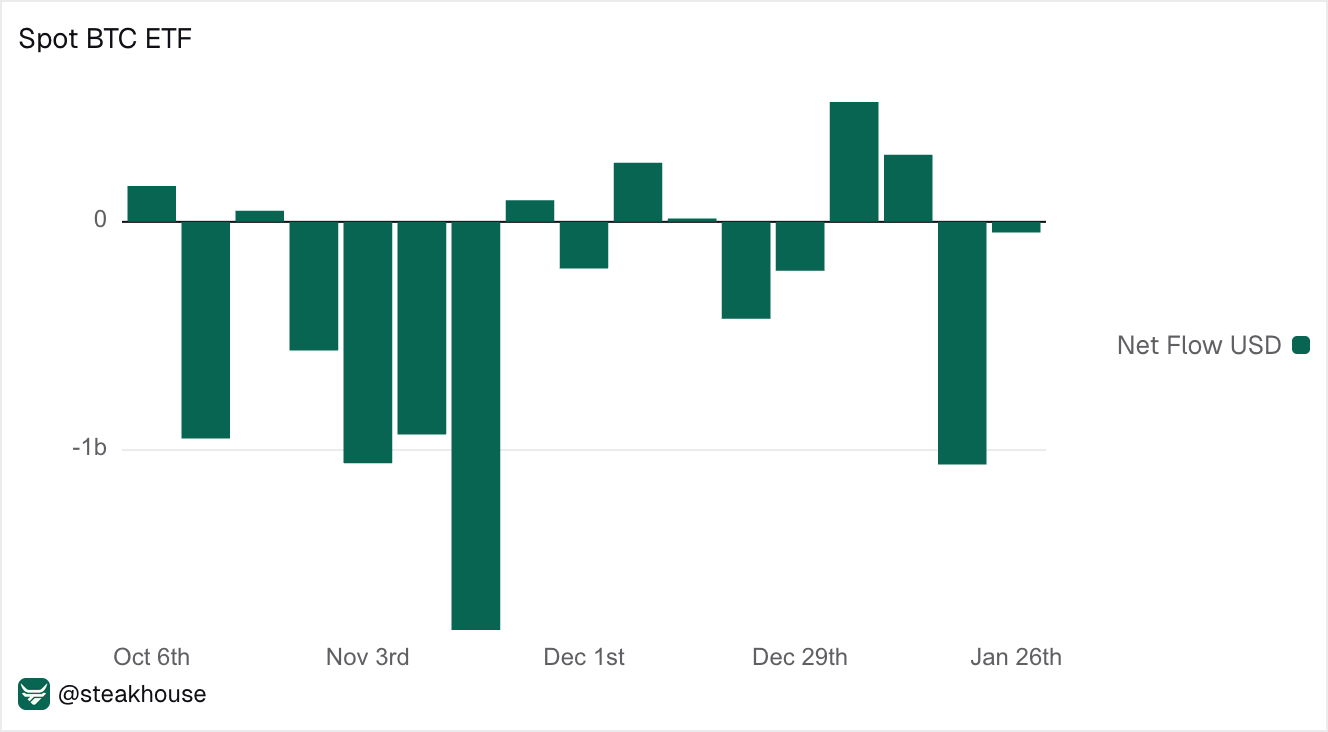

Spot BTC ETFs saw net outflows of over $1bn on January 19 as institutions reduced exposure amid rising macro and geopolitical risk, including growing Government shutdown concerns.

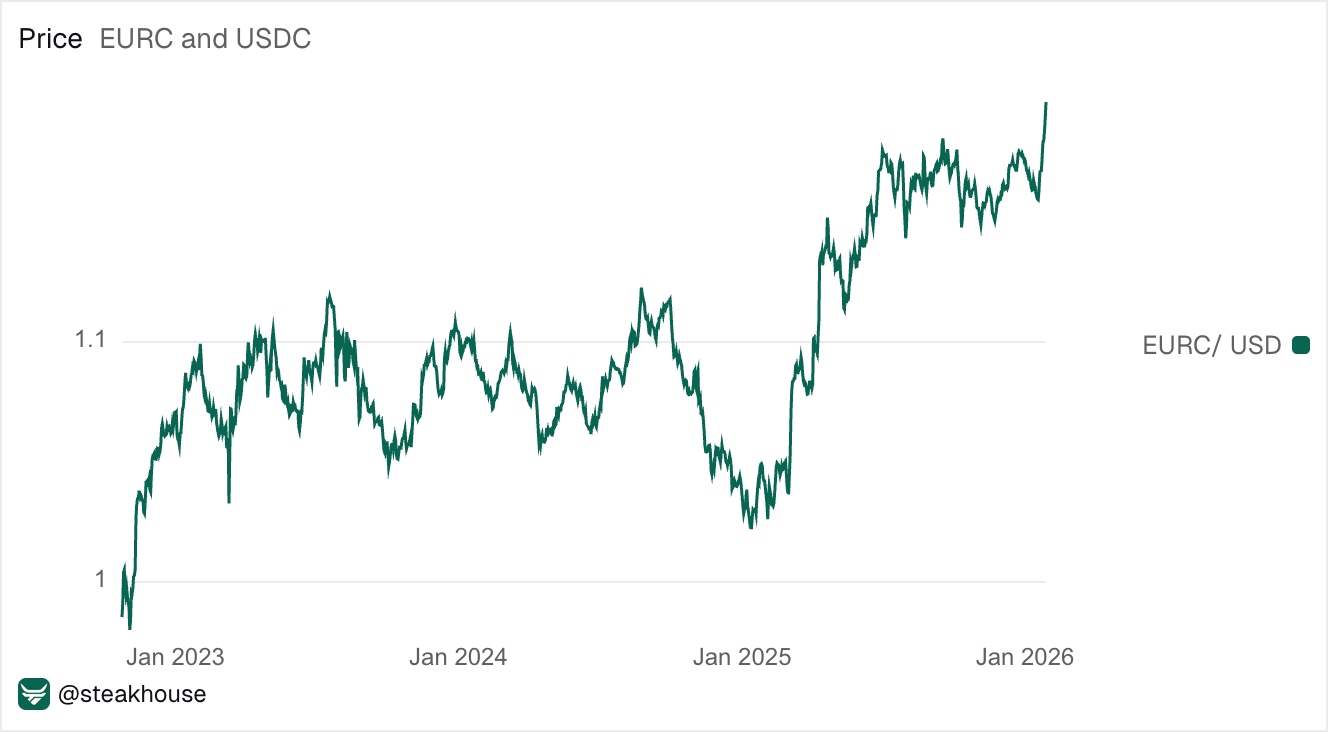

The move into commodities has coincided with the US Dollar Index (DXY) falling to a four-year low, signalling changing macro positioning.

Overall, markets remain tied to Trump-driven geopolitics and policy risk. Here’s a short summary of recent events:

Jan 3 – US military intervenes in Venezuela, captures President Maduro

Jan 7–15 – ICE enforcement surge in US cities

Jan 8–26 – Rising tensions with Iran: U.S. cancels planned diplomacy, issues stern warnings amid widespread protests in Iran, and significantly deploys the USS Abraham Lincoln and other forces to the Middle East to counter Tehran

Jan 20–21 (Davos/WEF) – At World Economic Forum, Trump pushes a Greenland/Arctic “framework” deal and formally steps back from earlier EU tariff threats tied to Greenland

What to expect next:

Jan 27–28 – Federal Reserve meeting & rate decision

Jan 29 (postponed from Jan 27 due to a winter storm) – U.S. Crypto Market Structure Bill markup

Quantum threat to network security

Beyond macro pressures, quantum computing is increasingly viewed as a long-term structural risk for crypto, as sufficiently powerful quantum systems could theoretically break the elliptic-curve cryptography that currently secures Bitcoin and Ethereum wallet signatures, with implications for long-term network security and asset trust.

Ethereum has embedded post-quantum security into its official long-term roadmap under its “future-proofing” efforts, aiming to gradually transition toward quantum-resistant cryptography over the coming years to ensure funds and the protocol remain secure for decades.

To accelerate this shift, the Ethereum Foundation has launched a $2m Post-Quantum initiative, forming a dedicated PQ team and rolling out multi-client testing environments to develop and trial quantum-resistant signature schemes.

Bitcoin has yet to outline a concrete post-quantum security roadmap, leaving mitigation to potential future network changes once risks become imminent. The growing divergence in preparedness could influence relative sentiment between ETH and BTC as markets begin pricing long-term network resilience.