DeFi Markets Update 2026-01-21

Base USDC Overtakes Mainnet, Katana Bonus, USD1 Yield Opportunity, Steakhouse vaults reach $2bn

Welcome to another DeFi Markets Update—your no-nonsense briefing on the cryptobanking plumbing and market pulse.

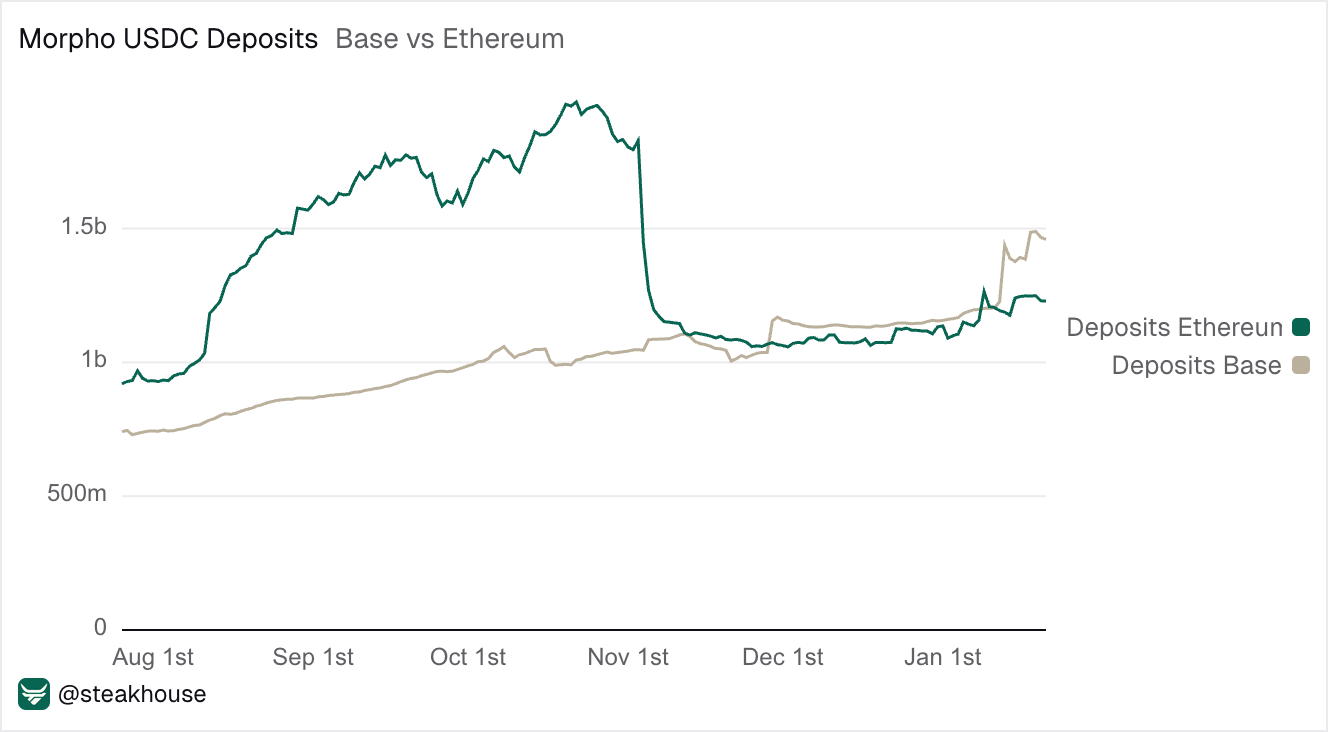

Morpho Base USDC Overtakes Ethereum Mainnet

This week USDC deposits on Base have overtaken Ethereum Mainnet, with Base at $1.4bn versus $1.2bn on Mainnet, marking a reversal of the historical liquidity hierarchy. This growth has most likely been driven by Coinbase’s onchain USDC lending integration powered by Steakhouse.

Katana Bonus on OKX Wallet

Katana rewards are now live on OKX Wallet, with 5M $KAT distributed to liquidity supplied via Morpho Earn vaults and also SushiSwap pools.

Incentives are heavy - the Steakhouse Prime USDC vault has currently 106% APY.

The campaign runs until Feb 19, with rewards accruing directly through OKX Wallet’s DeFi Earn interface on Katana.

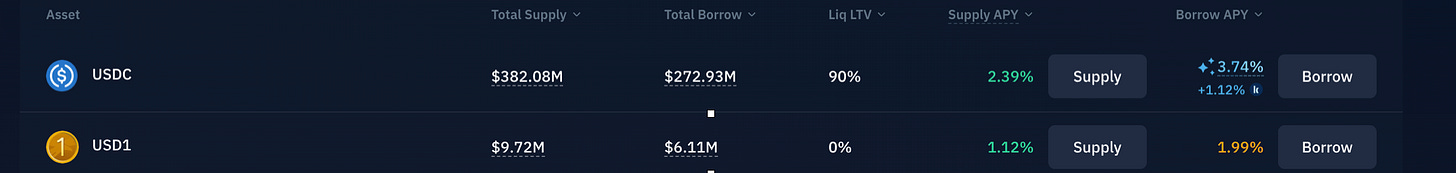

USD1 Launch Creates Yield Opportunity on Kamino

Steakhouse deployed a new USD1 High Yield Vault on Kamino, allocating towards Main market to route capital to the highest risk-adjusted USD1 yields on Solana.

USD1 is now live for lending and borrowing on Kamino, backed 1:1 by cash and U.S. government money market funds, with vault supplier incentives paid in $KMNO and $WLFI.

On Kamino, supplied USDC (earning 2.4% APY) can be used as collateral to borrow USD1 for 1.99% APY.

Which can then be redeployed into the Steakhouse USD1 High Yield vault on Kamino for 9% APY.

Steakhouse Morpho vaults reach $2bn

Steakhouse USDC vaults have grown by over 50% since the start of the year and account for the majority of inflows on Base.

As deposits on Base increased and our vaults grew, Steakhouse crossed $2bn in total assets curated on Morpho, becoming the first ever curator to reach this milestone!

For our regular readers, last week’s meaty issue recommended capital migrating towards V2 vaults. Morpho just launched V2 rewards.