DeFi Markets Update 2026-01-14

USDC deposits on Base, Lending against USD rebuilds, V2 Vaults

Welcome to another DeFi Markets Update—your no-nonsense briefing on the cryptobanking plumbing and market pulse.

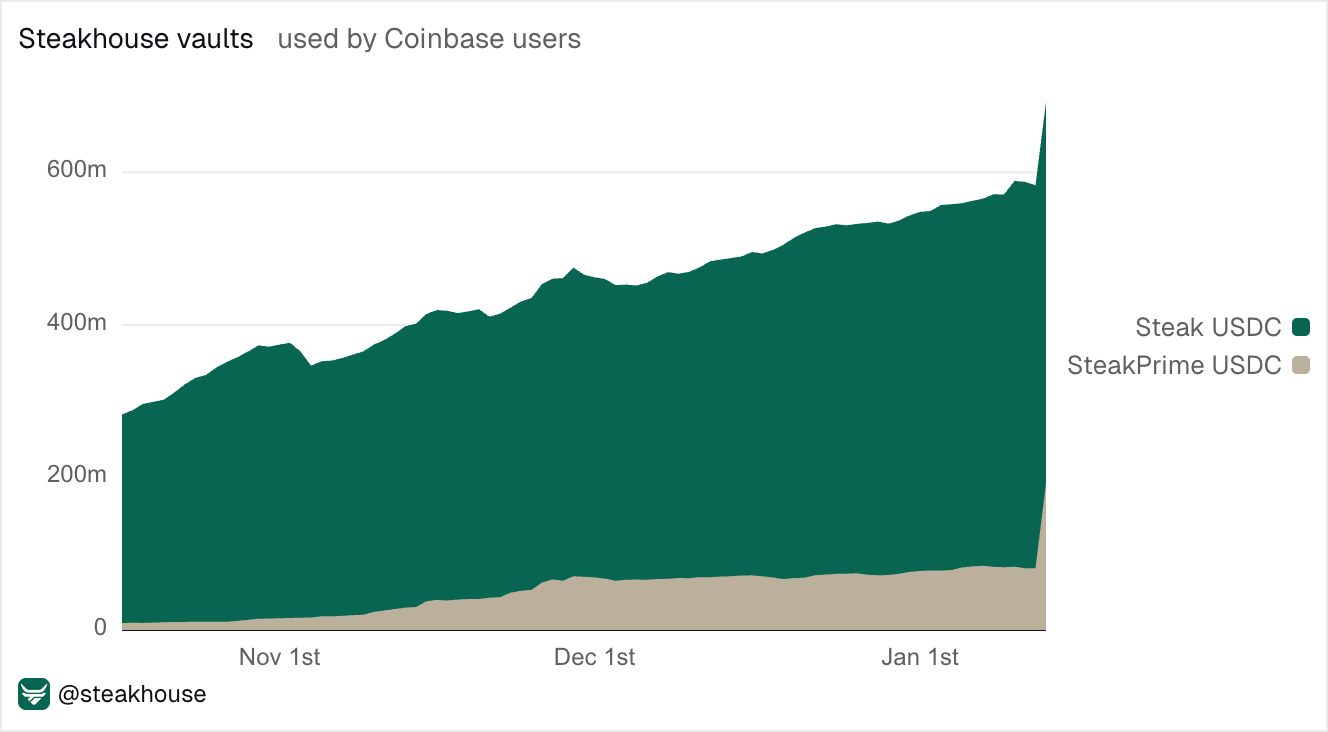

USDC deposits continue to grow on Base

Steakhouse USDC vault on Base crossed $500m in deposits this week, reflecting continued growth in Coinbase-routed USDC borrowing flows. Our second biggest USDC vault, Steakhouse Prime USDC, that has the same configuration and fee-free structure, has seen strong uptake over recent days.

Combined, our main Steakhouse USDC vaults now account for a significant share of USDC liquidity on Base - almost $700m.

Notably, Steakhouse Prime Instant is already operating as a V2 vault with the same underlying configuration, highlighting the gradual transition of Base USDC liquidity towards the V2 standard.

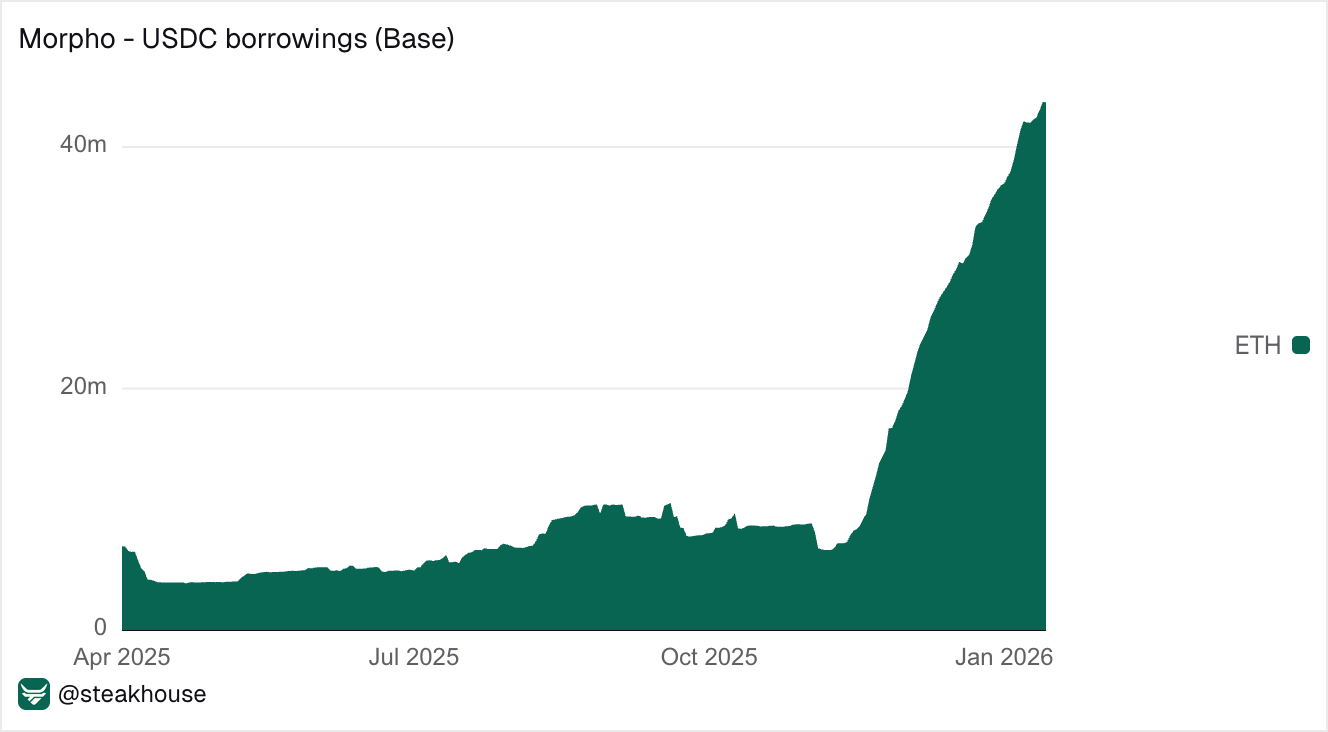

Coinbase recently enabled ETH as collateral to borrow USDC against, directly within its app powered by Morpho, following the same rollout path previously seen with cbBTC. Since launch, USDC borrowing against ETH on Base has increased over 5x, largely driven by this integration.

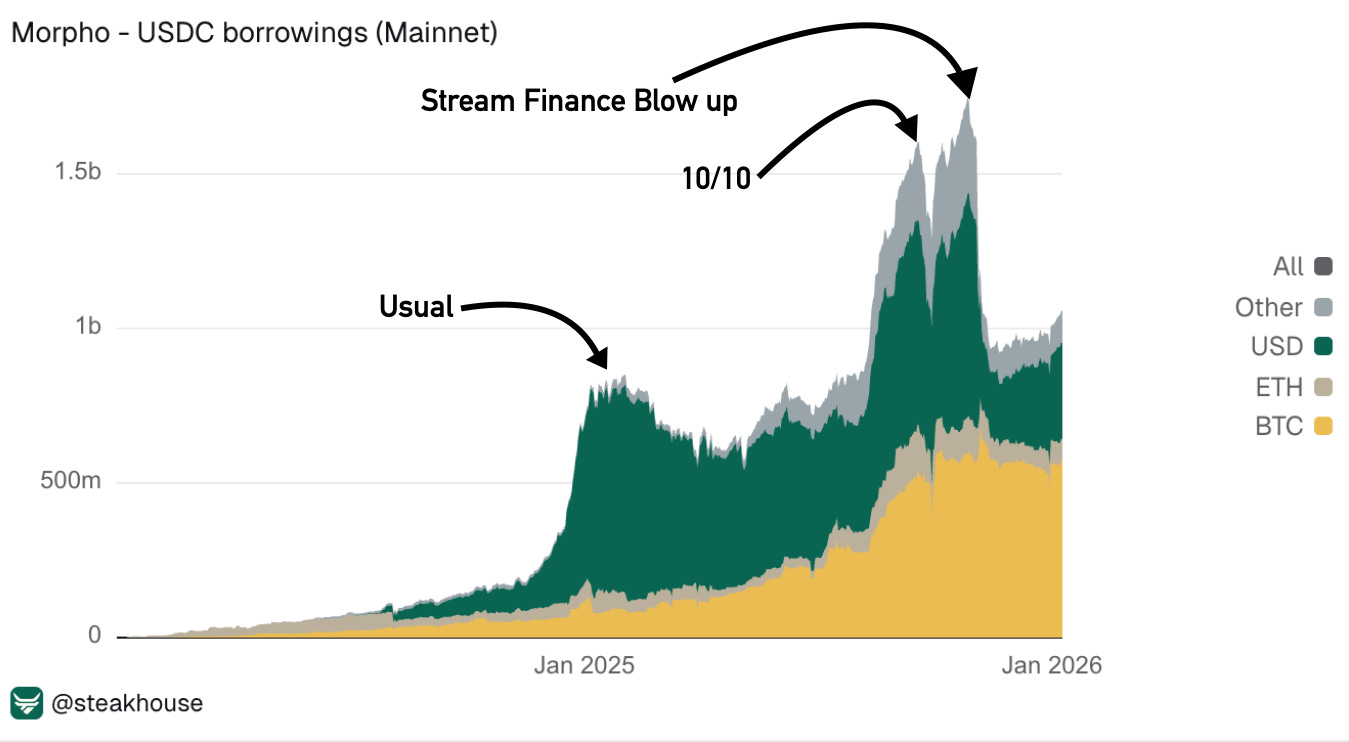

Healthier Lending as borrowing against USD slowly rebuilds

Borrowing against USD-denominated yield-generating collateral dropped sharply in November following the Stream Finance Blow up but has steadily rebuilt over the last three months.

On the other hand, borrowing against BTC plateaued since 10/10.

Monitoring this, one can see that Stream disciplined DeFi and served as a refresher on risk-taking and loss tolerance - leading to deleveraging across the board. Simple reminder: high yields and lack of underlying strategy knowledge exponentially increase risk.

The key question is whether rising borrow demand against USD denominated collateral since November 2025 reflects a return of risky, synthetic leverage, or a healthier mix of structurally safer collateral and real DeFi usage.

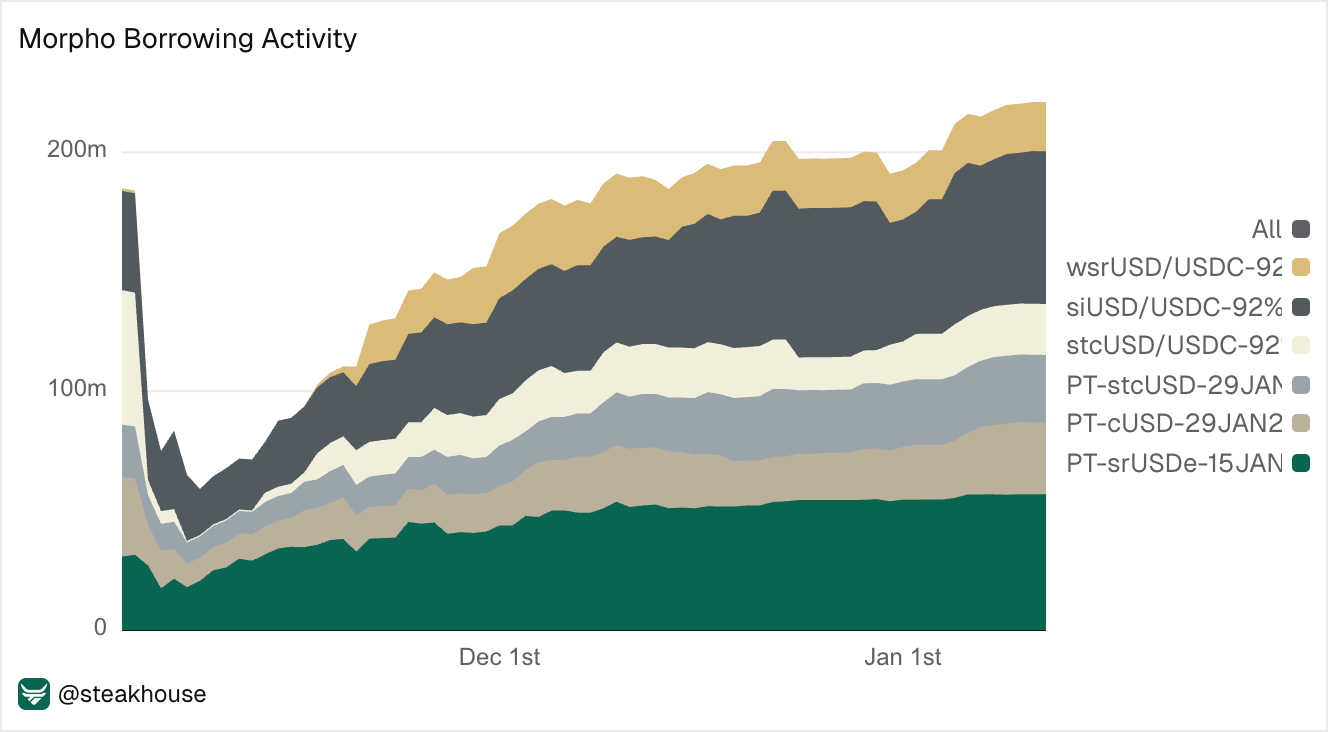

Recent borrow growth on Morpho points to the latter as borrowing has expanded across multiple USD-denominated markets like:

siUSD / USDC borrowing has grown by roughly $40m since November

PT-srUSDe-15JAN2026 / USDC has grown around $35m

PT-stcUSD-29JAN2026 / USDC has grown by roughly $20m

stcUSD / USDC has grown by $20m

PT-cUSD-29JAN2026 / USDC grown by $18m

wsrUSD / USDC grown by $20m

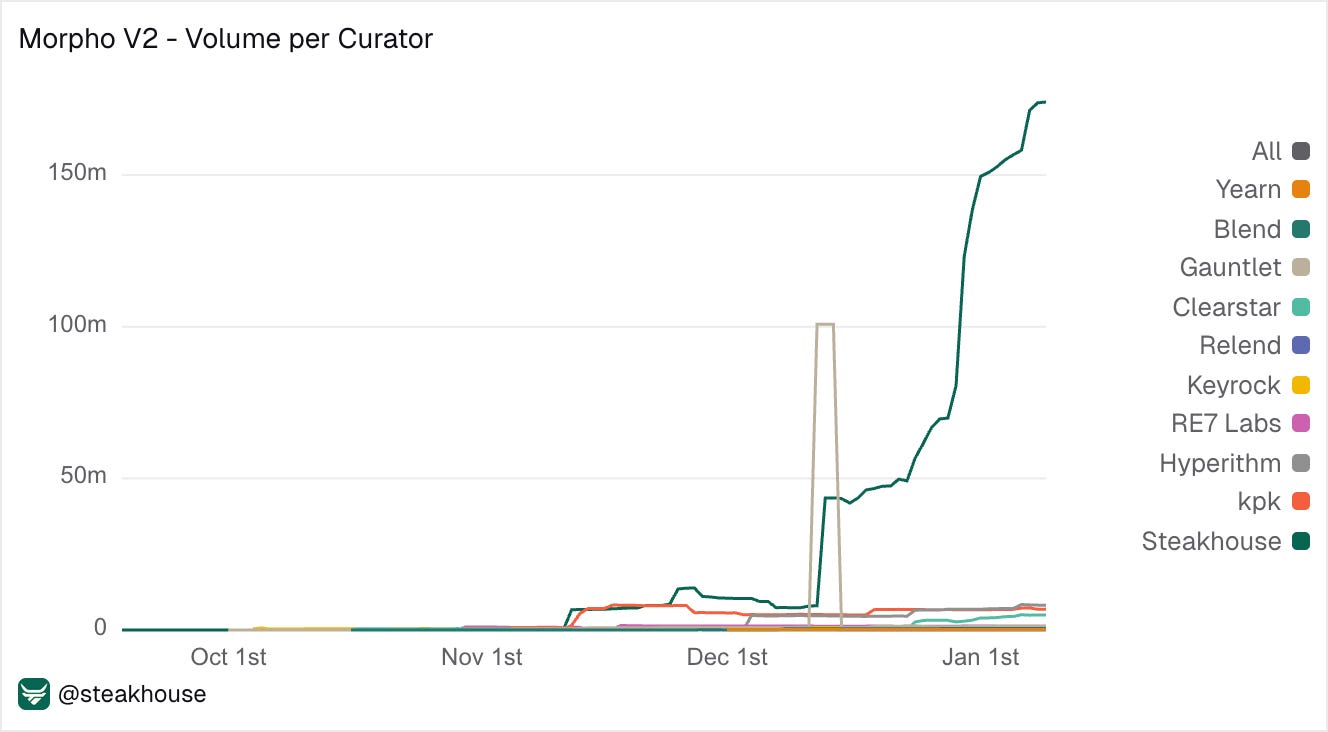

Deep Dive on V2 Vaults

Vaults V2 adoption is accelerating on Morpho, with an increasing number of V2 vaults deployed over the past few weeks.

Steakhouse already deployed more than 32 vaults with approximately $175m in total value locked.

Vaults V2 introduce a more generalized standard, allowing capital to be allocated not only to Morpho markets, but also other vaults and custom adapters.

Further, they allow risk to be managed more deliberately through relative and absolute thresholds and customizable governance.

As the V2 ecosystem matures, Steakhouse is preparing to leverage these expanded primitives more broadly, building on its existing non-custodial design principles and risk framework. More details on how this fits into our longer-term vault architecture will follow in the coming weeks.