DeFi Markets Update 2026-01-06

Low-Cost Borrow on Morpho, Year-end Leverage Unwinds, Credible Neutrality

Welcome to another DeFi Markets Update—your no-nonsense briefing on the cryptobanking plumbing and market pulse.

Low-Cost Borrowing Across Morpho Markets

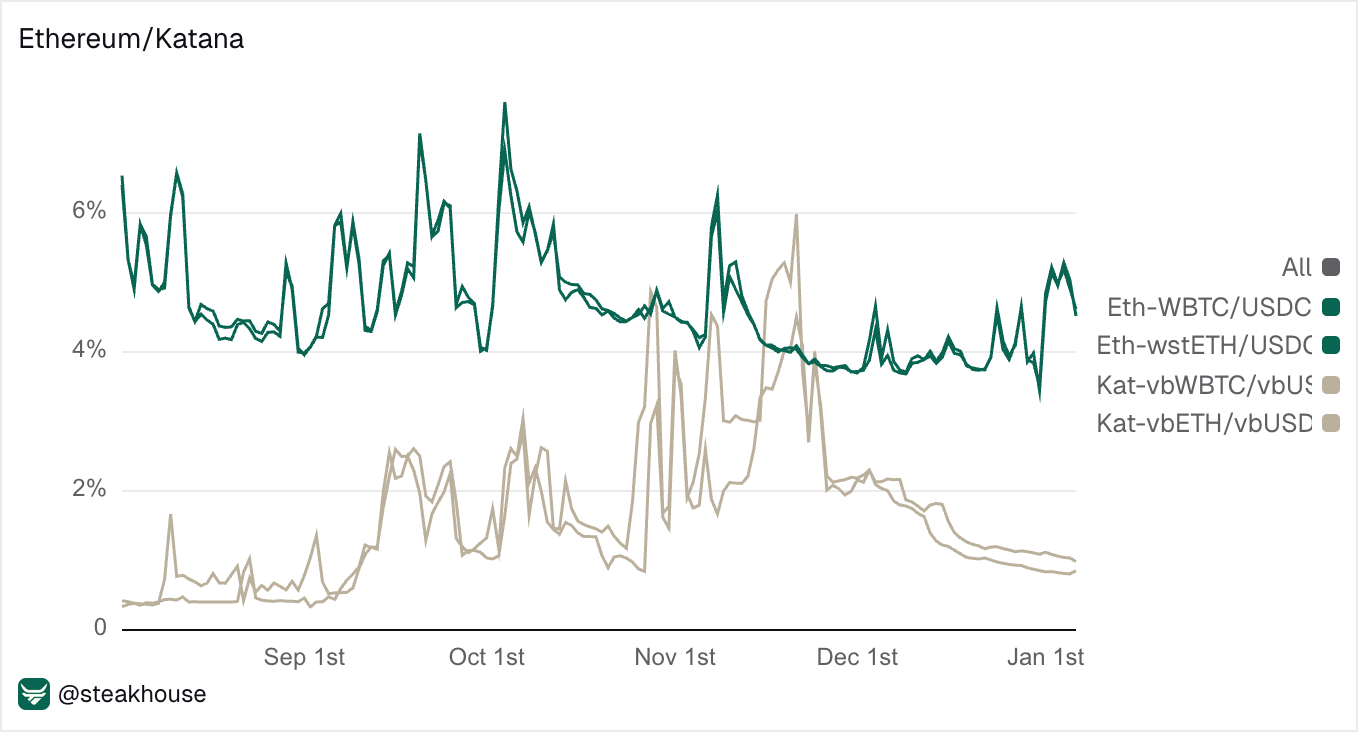

USDC borrowing against ETH and BTC on Morpho differs across chains, with higher borrow rates on Ethereum Mainnet and a steady decline in rates on Katana over recent months.

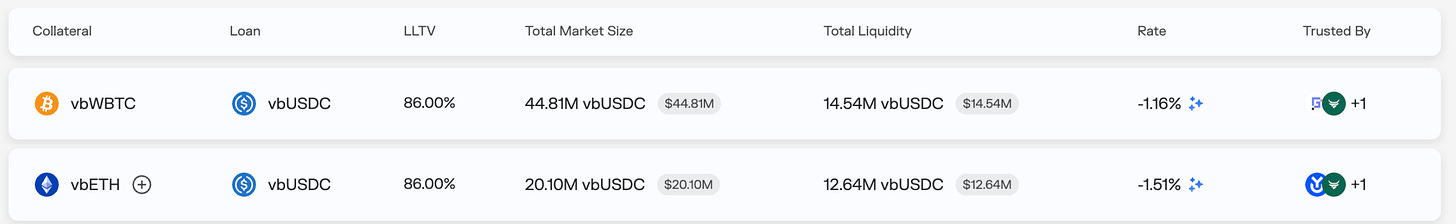

On Katana, borrow markets remain actively incentivised, with rewards paid in KAT (currently not tradable, leaving room for speculation around its eventual launch price👀). Borrow rates for vbETH and vbWBTC are therefore around -1.5% and -1.15% respectively.

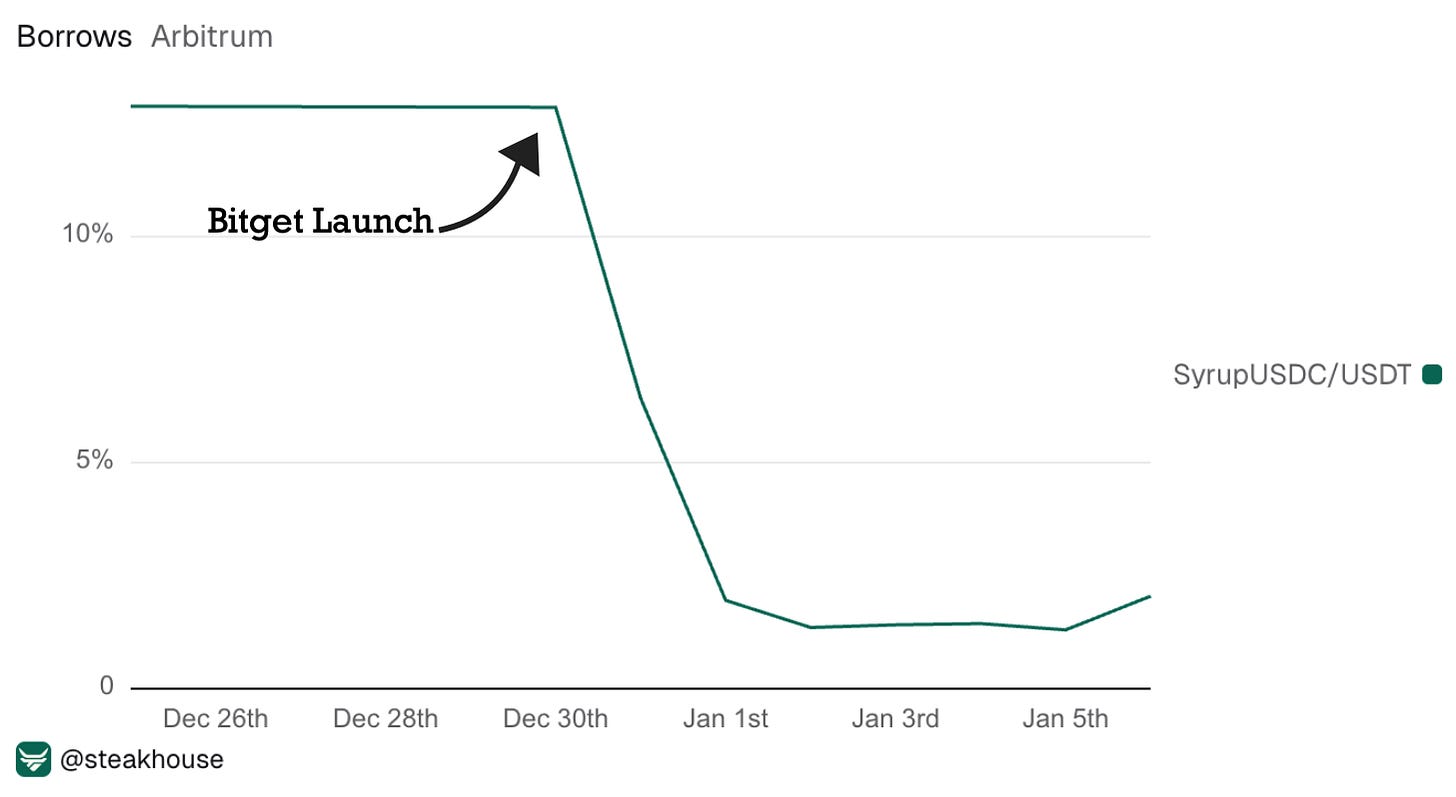

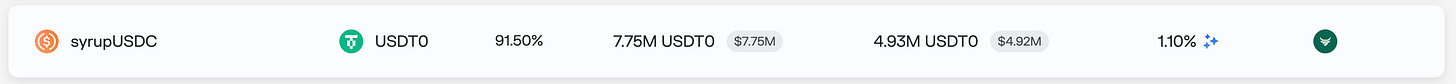

Additionally, on Arbitrum, the SyrupUSDC/USDT borrow market has benefitted from strong liquidity inflows after Bitget’s late-December On-Chain Earn launch, aligning with a noticeable drop in USDT borrow rates.

As a result, the SyrupUSDC/USDT market currently has a borrow rate at around 1.1%, compared with roughly 4% on Mainnet for the same pair.

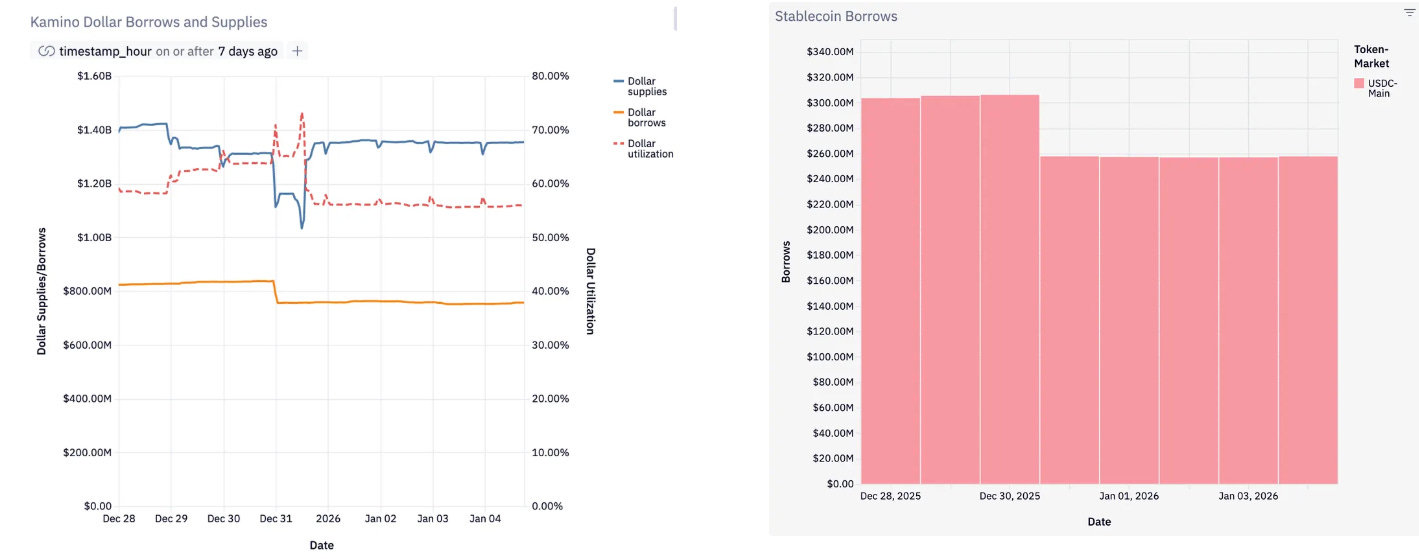

Year-End Leverage Unwinds on Kamino

The reset of the tax calendar encourages investors to realise gains and losses accumulated over the year. This typically leads to portfolio rebalancing and leverage reduction into December, resulting in weaker demand for DeFi leverage ahead of the calendar reset.

This dynamic was reflected in the USDC Prime vault on Kamino, where supply APY decreased sharply on 31 December, falling from 6.5% to below 4% within few hours before the EOY.

This decline was caused by a sharp contraction in open borrows, with roughly $75m unwound and utilisation falling by around 13%.

Year-end APY dislocations tend to be driven by year-end portfolio optimisation rather than changes in underlying fundamentals, with leverage unwound into the calendar reset and typically rebuilt in early January. Whether fiscally motivated or part of broader market positioning, the resulting rate compression is one to watch for borrowers seeking cheaper debt during these transitional periods.

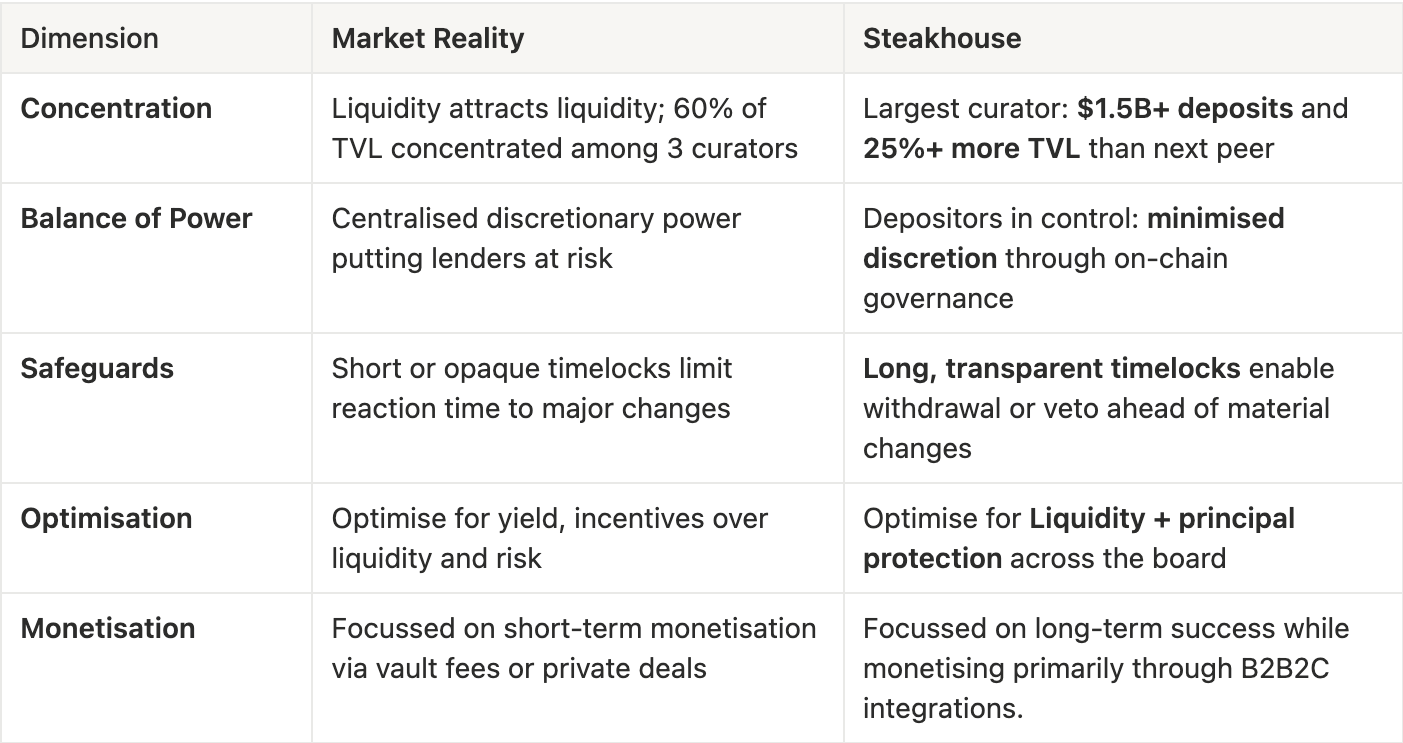

Credible Neutrality in DeFi Infrastructure

In his recent post Balance of Power, Vitalik argues that durable financial infrastructure must constrain power by design, particularly where profit incentives can diverge from user interests. He calls for explicit decentralisation models that distribute control through rules, governance, and credible exit mechanisms as systems scale.

At Steakhouse, these ideas are implemented on the application layer. Vaults are built as open, strictly non-custodial financial products with decentralised governance, where parameters are enforced through onchain rules - this structure closely aligns with the low-risk DeFi framework outlined by Vitalik.

Governance is enforced through AragonDAO, where vault depositors directly control material changes. Any proposal made by Steakhouse as guardian can be vetoed if at least 1/n of depositors participate and vote to revoke it, with timelocks ensuring sufficient time for users to react. This structure places governance authority with vault users, while Steakhouse operates strictly as a curator within DAO-defined boundaries.