DeFi Markets Update 2025-12-30

Bitget Onchain live, AUSD Borrow Rates, BTCÐ as regulated Collateral

Welcome to the last DeFi Markets Update in 2025—your no-nonsense briefing on cryptobanking plumbing and market pulse.

Bitget Onchain live via Morpho

Bitget’s Onchain Earn on Arbitrum deployed USDC and USDT into embedded Morpho Vaults, with Steakhouse acting as the exclusive Curator.

Since launch, the vaults have scaled quickly, with USDC High Yield reaching $32m and the USDT one around $30m, reflecting strong early demand.

Users deposit USDC or USDT through Bitget, with funds deployed onchain into Morpho on Arbitrum where interest accrues in real time. Positions remain fully liquid with no lock-ups, while Bitget abstracts away wallet management and gas execution at the application level, allowing users to access onchain yield through a familiar centralised interface.

The USDC High Yield vault is currently supported by incentives and is earning around 4.4% APY.

Cross-Chain Differences in AUSD Borrow Rates

AUSD borrowing rates on Morpho differ across chains when comparing the same pairs. On Monad, both WETH/AUSD and WBTC/AUSD pairs are currently incentivised and have negative borrow rate (note that instantaneous rates are between 1-1.5%).

On Ethereum mainnet, the same WETH–AUSD and WBTC–AUSD pairs borrow between 2-3%, resulting in a rate spread for otherwise comparable collateral profiles.

These lower, incentive-driven borrowing costs enable efficient leveraged exposure, where users can borrow AUSD at relatively low carry and deploy capital into higher-yielding opportunities. One key use case is wsrUSD looping, which accounts for a significant share of AUSD borrowing activity on both Monad and Ethereum.

BTC and ETH Move Toward Regulated Collateral Frameworks

This month, the Commodity Futures Trading Commission (CFTC) announced the launch of a Digital Assets Pilot Program allowing digital asset, including BTC, ETH and USDC, to be used as margin collateral in regulated derivatives markets.

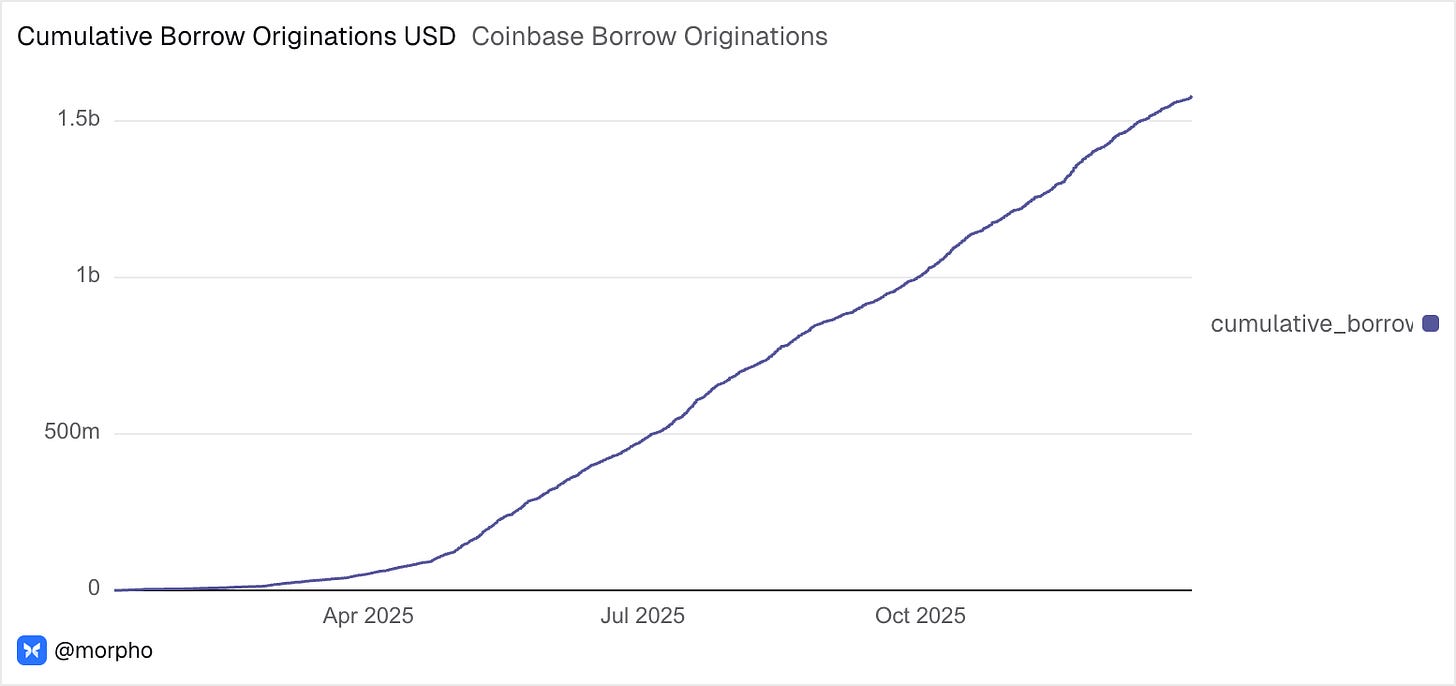

Coinbase, with their borrow product, also allows U.S. users to borrow against their BTC and ETH, and has surpassed $1.5 billion in cumulative borrow originations, highlighting increasing demand for crypto-backed credit within regulated U.S. platforms/regulated intermediaries.

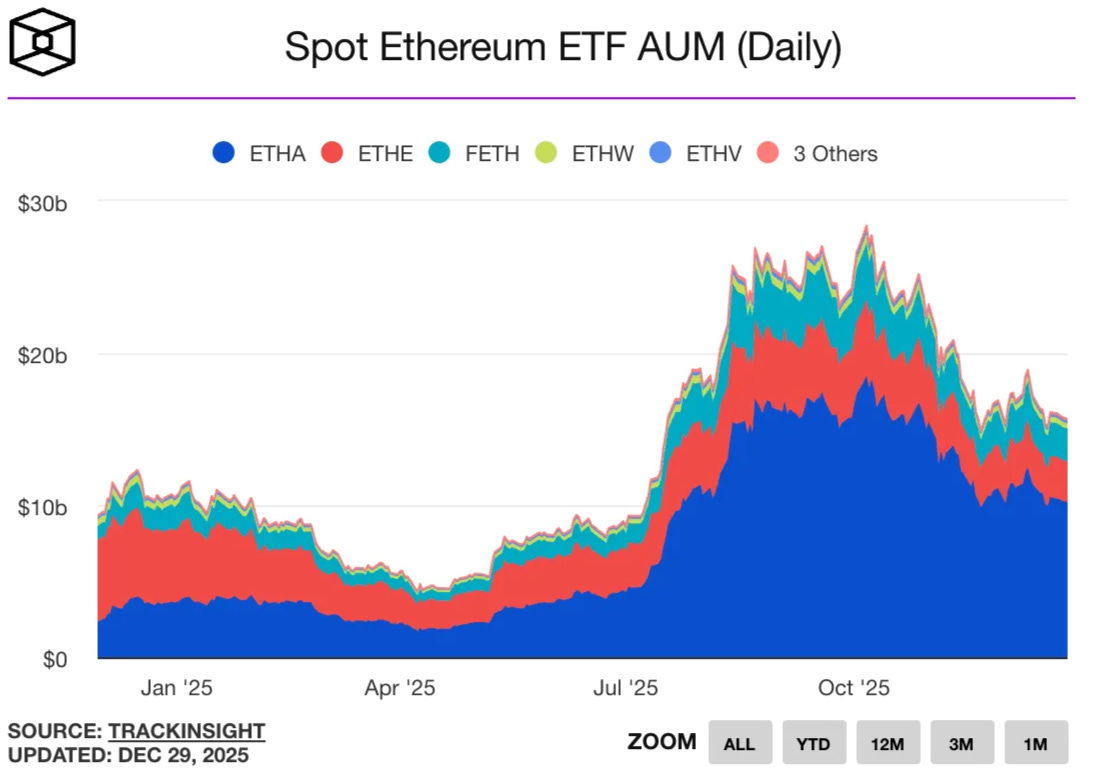

Furthermore, ETFs have lowered barriers to regulated institutional access. Rising AUM in spot ETH ETFs reflects growing exposure via regulated, custodied vehicles, which may make it operationally easier for institutions to hold ETH exposure within existing custody and risk processes.

At the legislative level, the GENIUS Act, enacted in July 2025, established a federal framework for stablecoins, supporting their use within regulated payments, settlement, and credit infrastructure.

The proposed CLARITY Act, currently advancing through the U.S. Senate, seeks to define crypto market structure and distinguish intermediated services from decentralised protocols, which could further support institutional participation if enacted.