DeFi Markets Update 2025-12-23

Monad Yields, JPMorgan MONY, JPYC on Morpho

Welcome to another DeFi Markets Update—your no-nonsense briefing on the cryptobanking plumbing and market pulse.

Merry Christmas and see you all after the fold in 2026.

Monad Yields Update

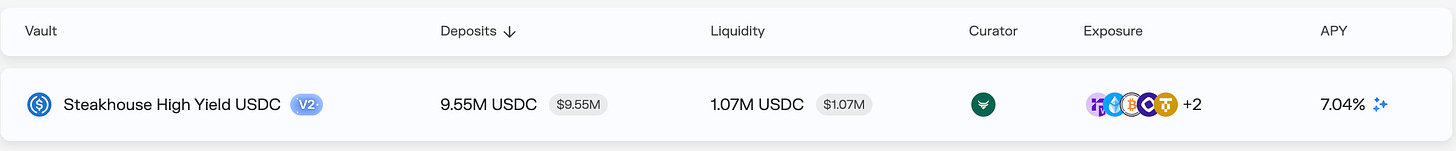

The Steakhouse High Yield USDC vault on Monad, is currently showing incentive-driven yield - total of 7% APY.

Around 2–3% APY comes from native yield, with the remainder driven by incentives. These incentives are not guaranteed, but they have remained relatively steady over the past few weeks (average of 5.7% APY), and appear attractive as liquidity on Monad remains anchored around AUSD-led deposits, offering a window to earn elevated returns while they are in place.

J.P. Morgan Launches a Tokenised Money Market Fund on Ethereum

It’s been a week since J.P. Morgan Asset Management has launched My OnChain Net Yield Fund (MONY), a private, tokenised money market fund on Ethereum via Kinexys Digital Assets, J.P. Morgan’s tokenisation platform. The fund invests in U.S. Treasury securities and Treasury-collateralised repurchase agreements, with daily yield and on-chain fund issuance and redemption via Morgan Money using cash or USDC.

The fund was seeded with $100m of J.P. Morgan’s own capital before opening to external investors, and is positioned around treasury exposure (Etherscan). This exposure aligns with current DeFi demand, where tokenised U.S. Treasury Debt represents the largest RWA category by value, showing the strongest PMF among tokenised RWAs.

Tokenised cash products like MONY create a good opportunity when on-chain lending market yields are low and leverage opportunities are limited, as they provide a yield source that is driven by TradFi rates. This keeps the yield more reliable and less tied to incentives or DeFi market cycles.

MONY moves a traditional cash product on-chain, with investors holding a fund token while settlement, ownership records, and yield reinvestment run through Ethereum. This creates a clear on-chain reference for low-risk TradFi yield that DeFi money markets and strategy vaults can use as a benchmark for yield, risk, and capital efficiency.

JPYC Set to Expand Currency Choice in DeFi Lending

At the Vault Summit, Morpho announced upcoming support for JPYC, a regulated Japanese yen stablecoin. This adds JPY-denominated liquidity on-chain, expanding currency choice in lending markets.

Will this open a yen carry trade opportunity? It works by borrowing JPY, with low interest rates, and investing in higher-yielding assets elsewhere, most often in USD denominated markets, capturing the interest rate spread on top of the directional exposure. Even with the recent interest rates increases from the Bank of Japan, the yen rates are still structurally lower than the U.S. dollar rates, keeping the trade viable, albeit less attractive than in previous years.

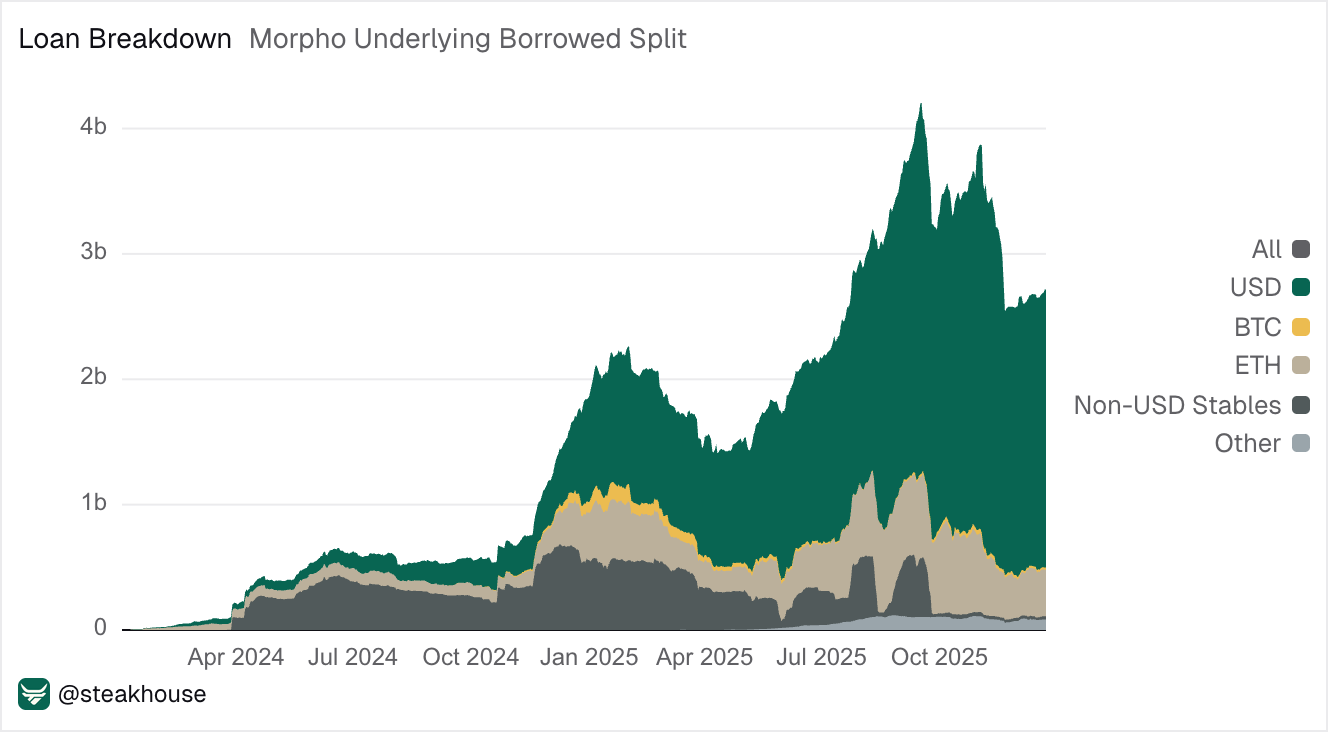

By bringing regulated yen liquidity on-chain, JPYC enables JPY-funded strategies to emerge in DeFi. Today, borrowing activity remains overwhelmingly USD-denominated, with USDC and USDT accounting for the majority of usage.

JPY on-chain creates scope for cross-currency positioning and spreads as additional currencies come on-chain. Steakhouse plans to deploy a JPYC-based vault on Morpho by the end of the year.