DeFi Markets Update 2025-12-16

Yield Spreads, Private Credit, RWAs on Solana

Yield spreads compress across markets

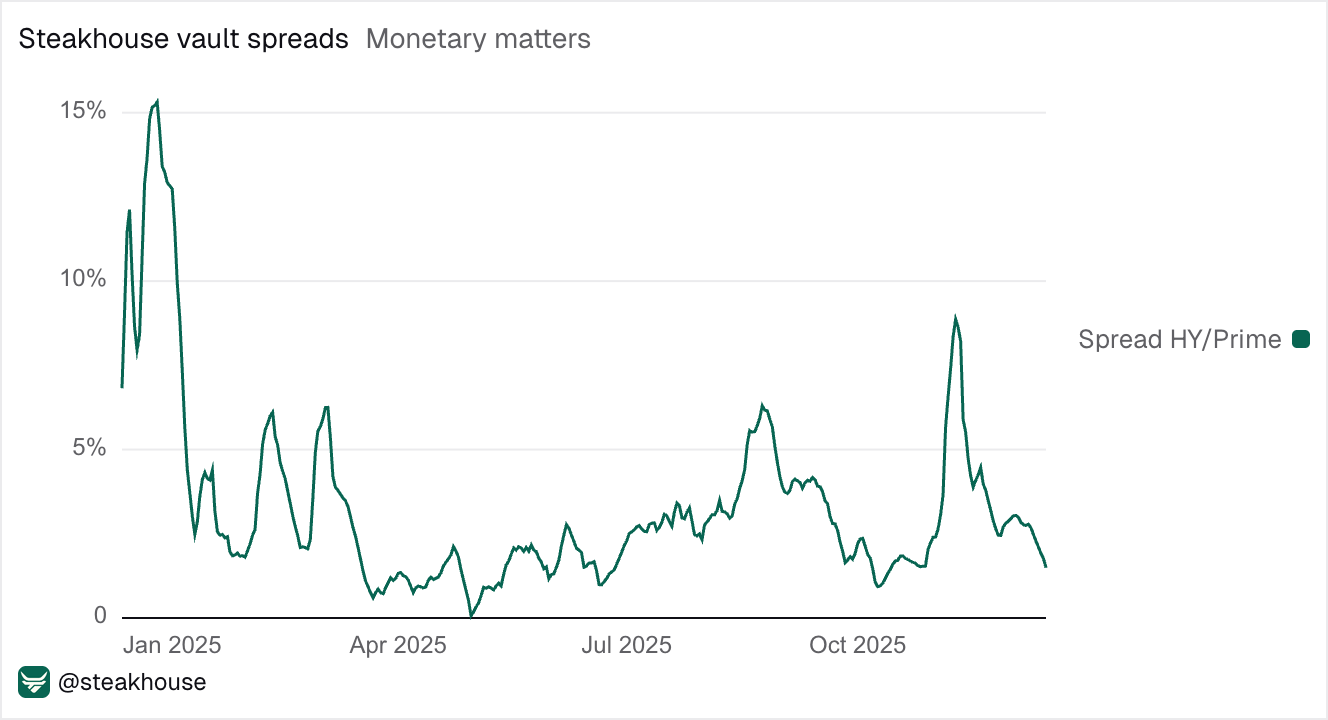

As market conditions stabilise, yield spreads on Morpho are compressing again. On Ethereum mainnet, USDC High Yield’s APY have moved lower to around 5%, narrowing the gap with the more conservative Prime vault, which is yielding roughly 3.5%. A similar dynamic is playing out across USDT denominated vaults.

Tight spreads reflect cautious leverage appetite following the Stream Finance (xUSD) unwind and a lack of compelling collateral opportunities (e.g. PT-based strategies), which limits the premium paid for higher-risk strategies.

Same trend is visible on Solana via Kamino. The USDC Prime vault is yielding 6.2%, of which 2.7% comes from KMNO Season 5 incentives, leaving roughly 3.5% organic yield, while the High Yield vault sits closer to 3.7% as it’s not incentivised.

Across both ecosystems, yields are converging despite very different risk profiles. In this setup, taking additional risk does not materially improve returns, which naturally favours more conservative positioning.

Private credit draws renewed attention

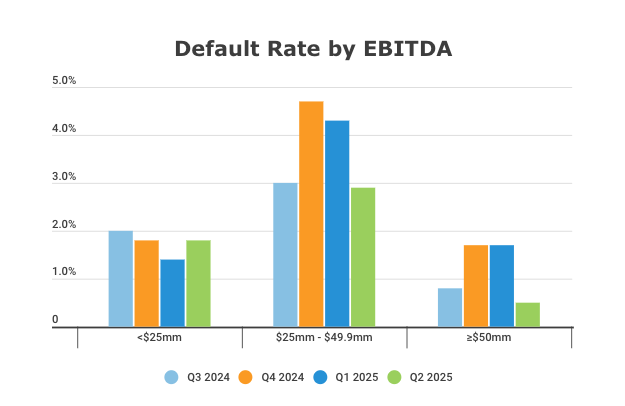

Private credit came back into focus this week as more data on defaults, valuations and recoveries became visible - as highlighted in our recent mF-ONE article. Default rates historically peak in stress periods, with current estimates placing us around that level at roughly 5%.

This highlights an important distinction: defaults are not the same as losses. Risk is better measured using expected loss = default rate × (1 − recovery rate), rather than looking at defaults alone. With lending recoveries remaining >80%, peak-cycle defaults have historically translated into realised losses closer to 1%; in asset-backed lending, collateral quality and structure matter more than volatility in reported default rates.

Source: European Investment Bank (EIB), historical default and recovery data for private and public lending (1994–2023). Figures shown are long-term averages.

From a risk-management perspective, we take the conservative approach to withstand even the most aggressive stress scenarios, including 5–6% peak default rates and full write-down assumptions. Parameters are therefore set such that even under a 6% drawdown, no bad debt is expected to emerge.

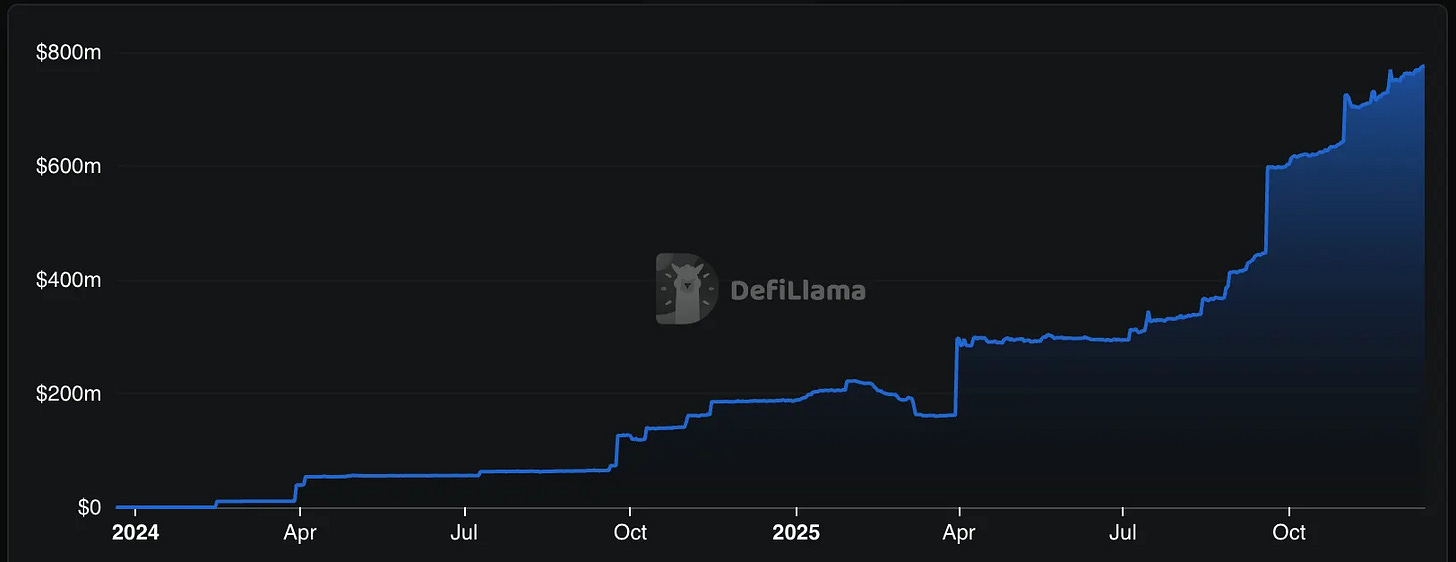

Private credit has expanded from a niche market of a few hundred billions to over $2 trillion globally, with some estimates above $3 trillion (an approximate 10×–15× increase over the past 20 years), and is expected to remain a growing part of global credit markets.

For readers looking to explore how this translates on-chain, see our mF-ONE article or further explore on the Fasanara site.

Source: Global Financial Stability Report, April 2024, Chapter 2

Growing RWA adoption on Solana

The RWA market continues to grow across DeFi, with tokenised assets increasingly moving beyond stablecoins into areas like private credit and yield-bearing products. While Ethereum has historically been the main hub, Solana is emerging as a second major ecosystem attracting a broader range of RWAs.

Real value, however, is only created when these assets gain practical utility, for example, when they can be used as collateral. On Solana, lending markets like Kamino are positioning themselves at the centre of this transition, enabling RWAs to integrate into DeFi credit and strategies.

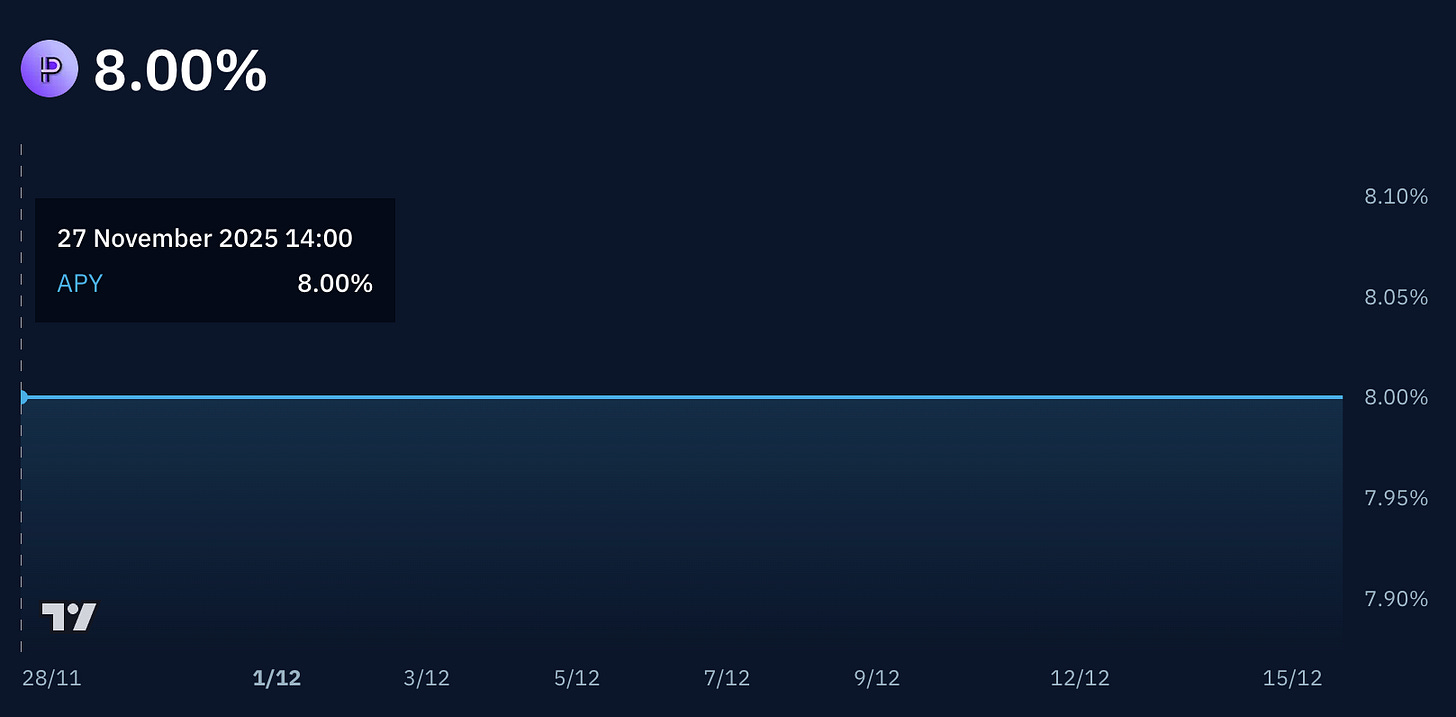

Kamino recently launched PRIME collateral, a home equity line of credit (HELOC) that allows homeowners to borrow, spend, and repay flexibly using their home as collateral. PRIME is currently steadily yielding fixed 8% APY since Nov 27, which may appeal to more conservative investors as it provides predictability in a usually floating environment, while a looped strategy can reach up to 24% APY.

New products are coming online that reflect a broader shift toward institutional-style on-chain credit. Fixed-rate loans, RWA-native markets, and custody-aware collateral structures are gaining traction. Together, this points to a more mature lending stack forming around RWAs on Solana, with expanding collateral options and real on-chain usage.

investments are an.!

Important part of financial