DeFi Market Updates 2025-12-10

Kraken’s xStocks Deal, Incentive-Driven vs Organic Liquidity, Yield Spread Arbitrage

Kraken’s xStocks Deal Signals Growing Confidence in DeFi

Kraken has fully acquired Backed Finance, the team behind xStocks, bringing tokenised equities under one of the largest regulated exchanges. This strengthens credibility for on-chain RWAs and expands access to tokenised traditional assets, a positive signal for the gradual move of traditional markets into DeFi.

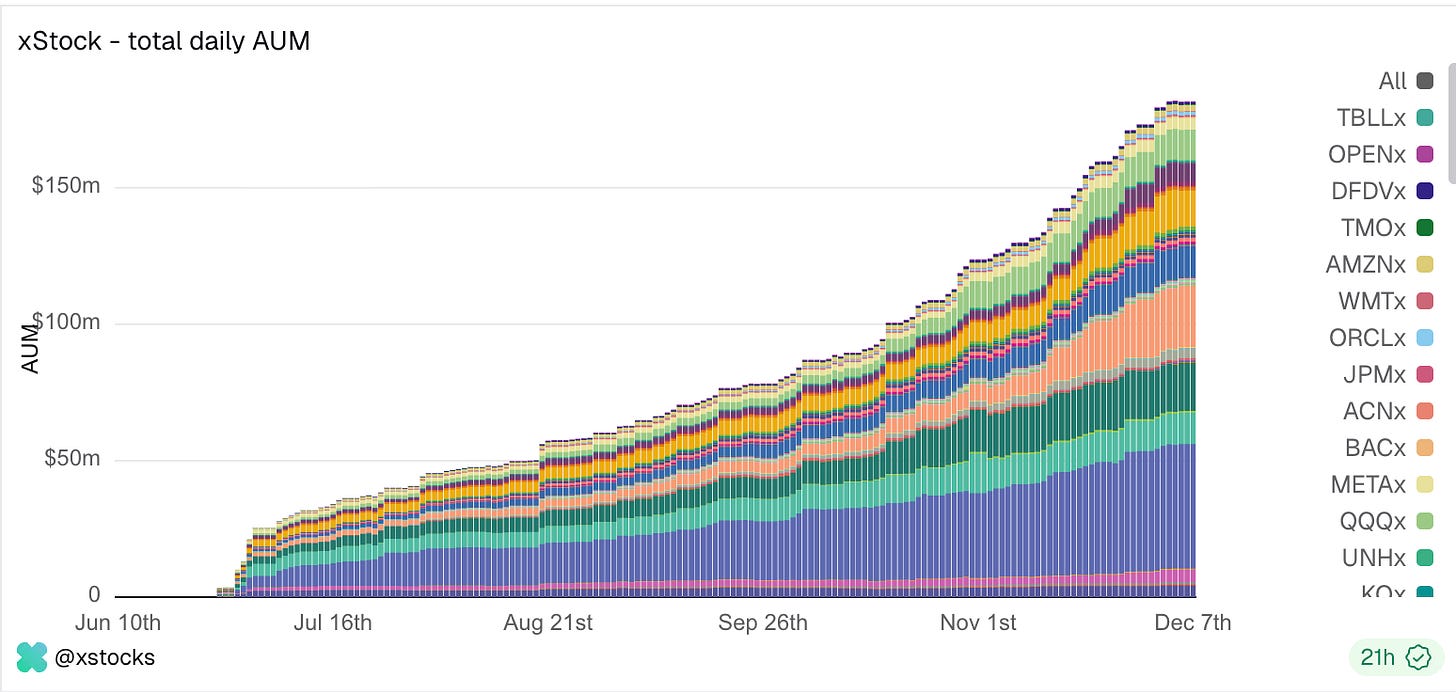

xStocks’ AUM has climbed to above $180M, supported by 45k+ on-chain holders. The steady increase suggests users are holding these assets longer-term, reflecting growing interest in tokenised equities.

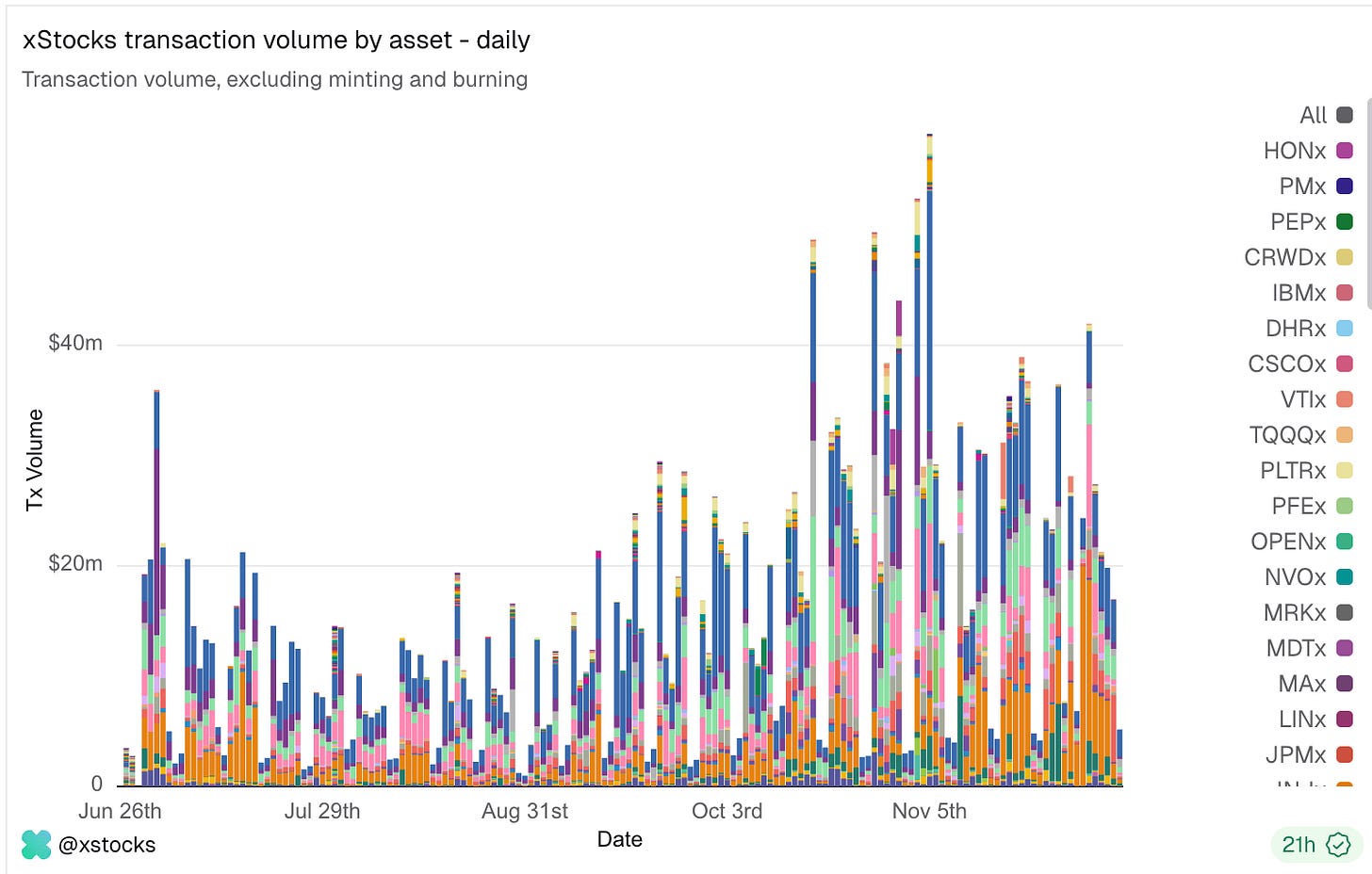

On-chain trading volumes remain consistent with a slight improvement over time, and together with the steadily rising AUM base, point to stable engagement and early signs that RWAs may continue to gain traction.

Having a major exchange invest directly into tokenised equities helps legitimise on-chain market infrastructure and signals growing institutional interest in bringing traditional assets onto DeFi rails. We’re seeing the same trend across the industry too: protocols like Midas and ONDO are already bringing RWAs on-chain, and Kraken’s move reinforces that this shift is becoming more mainstream.

Assessing Incentive-Driven vs Organic Liquidity

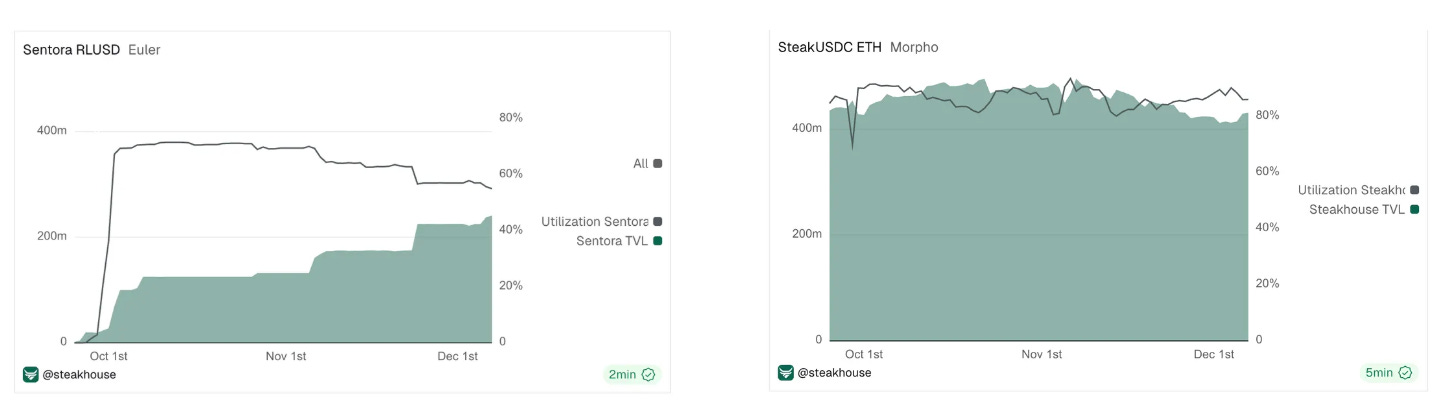

Current market activity provides a useful case study to highlight the contrast between incentive-driven liquidity and organic demand. For example, Sentora curated vaults on Euler have grown significantly since 10/10 and now sit at roughly $650m in curated deposits (even as other curators like MEV and Re7 have seen their TVL decrease following the xUSD fiasco we highlighted in our 2025-11-24 issue).

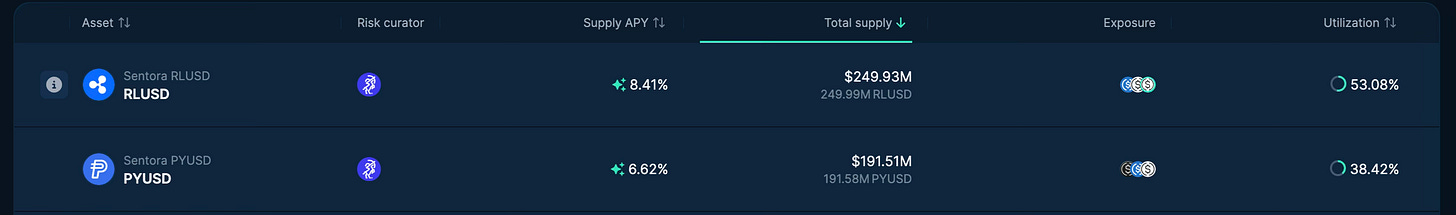

The most prominent Sentora markets being RLUSD and PYUSD, currently offer attractive rates for lenders, with organic APYs around 1–3%, boosted at the vault level by an additional 5–7% in incentives.

This is a strong yield opportunity, but also a clear example of incentive-driven usage. Supply has grown quickly while borrow demand lags, with utilisation in the 35–55% range, leaving much of the capital idle and earning mainly incentives. In such conditions liquidity tends to be short-term; once incentives ease, yields normalise and TVL can exit quickly.

In contrast, the Steakhouse USDC vault reflects real borrow demand, with consistent TVL and utilisation sitting around 90% on Morpho. This means deposited USDC consistently finds borrowers while still giving users access to liquidity. As a result, you can earn around 4% APY with the confidence that the demand behind it is organic, creating a more sustainable long-term yield.

Cross-Chain Yield Spread Arbitrage on USDC

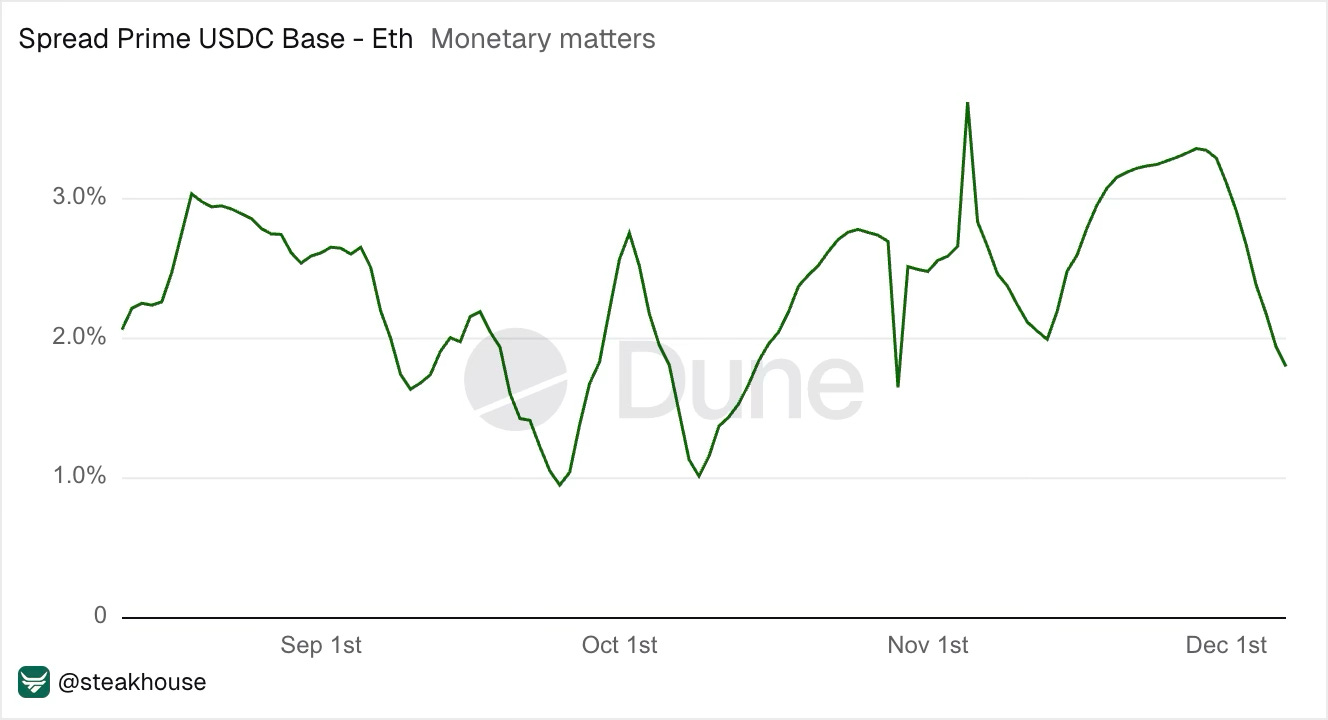

An arbitrage opportunity remains between the two Steakhouse USDC vaults. Steakhouse Prime USDC on Base is currently yielding around 5.7%, while SteakUSDC on Ethereum sits closer to 3.8%, leaving a current spread of roughly 1.9%.

Both vaults share similar collateral exposure (mainly: cbBTC, wBTC, wstETH), so the yield gap reflects market dynamics rather than risk differences.

Base benefits from strong Coinbase-driven borrowing demand, where users leverage crypto collateral to access USDC liquidity. This keeps utilisation and APYs higher around 5.7%. Borrowers on Ethereum have a different profile, and demand shows stronger price elasticity, acting as an indicator for risk appetite - that has been consumed since 10/10, and hence APY around 3.6%.

Strong contrast between incentive-driven vs organic liquidity mechanics. The 35-55% utilzation on Sentora vaults shows capital is mostly idle hunting yield, while Steakhouse USDC at ~90% util reflects genuine borrow demand. The cross-chain arb is intresting too, price elasticity on Ethereum vs Coinbase-driven demand on Base creates persistant spread despite similar colateral exposure.