Automating Asset and Liability Matching

Steakhouse proposed a framework approach to addressing liquidity imbalances in the MakerDAO stablecoin including a dampened redemption curve and time-locked savings vaults

Problem

Dai maturity can be estimated behaviorally but is essentially unknown. There is a non-zero chance of a bank-run scenario for redemptions that could threaten the stability of the system if illiquid or slow to liquidate collateral cannot be redeemed on time. Furthermore, if assets are not adequately invested in line with liability profiles, the ability for the protocol to accrue a surplus is reduced, which reduces the buffer to adequately control for potential risks.

Solutions Proposed

The ideal resolution is an automated system with minimal human intervention. It could be something like the ALM controller proposed by @hexonaut. It should be able to create a continuous feedback loop of locking in explicit behavioral parameters for circulating Dai on-chain and match them with an asset

Reduce the incentive to run on the assets

One alternative is to introduce a redemption curve on PSM vaults to disincentivize speed of redemptions, as a control mechanism to force users to wait to redeem.

The intuition is that this would force a haircut on redemptions, which is undesireable. However, the lack of such a mechanism effectively rewards first-movers to redemptions, who would be made entirely whole, at the expense of last-mover users.

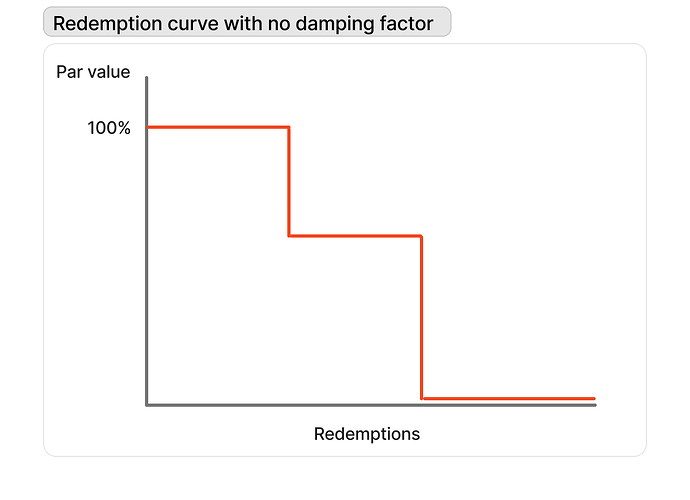

The problem is that a hypothetical curve for redemptions effectively already exists. One example of redemption value relative to par value could theoretically look like the below, as it hits illiquidity walls for RWA collateral or liquidation bugs for decentralized collateral.

To remedy the situation where some users rush the exit at the expense of others, some amount of redemption damping would be desirable if it were elastic in time. In other words, if the redemption value hinged on speed of redemptions and returned quickly if the speed of redemptions slowed. This would effectively disincentivize panic and would allow the pricing time preference for instant redemptions. This is worse than being able to redeem for par value, but better than no damping because it levels the playing field for all Dai holders essentially.

The Gyroscope team suggest the following desireable characteristics for an effective redemption curve (ref):

Collateralization ≥ lower bound

Redemption price ≥ lower bound

Redemption price under normal conditions = par

Continuous, not steep

No incentive to subdivide redemptions

Their proposal is a linear redemption curve where the parameters for the Upper and Lower bounds are computed dynamically.

Allow the emergence of time-demand for Dai

The other side of the equation is creating a system to allow Dai holders to auction off some liquidity into the system in return for a higher share of the DSR.

A monolithic DSR treats all Dai use as the same. But Dai holders behave differently and have different preferences. These preferences could help improve the robustness of the protocol by allowing users to opt-in to reducing the liquidity gap. Offering a 7-day lockup is one step in the right direction to creating this, but we could be more ambitious.

With minting capabilities, staked Dai could use the DSR with minimal changes to provide a market in variable-length lockups. The issuance of these lockups could be permissionless, triggered by bots when they detect a significant divergence between an ideal asset-liability profile and actual. The share of the vault value corresponding to each level of lockup would just require principal tokens to be issued at varying discounts to their redemption value depending on the rate and on the lockup length.

In the final stage, the primary market for these tokens could follow an automated Dutch auction process to discover the efficient rate. Transferability would provide continuous market feedback on the term structure of locked up Dai. Comparable markets such as the US treasury yield curve may offer a useful starting point for pricing, if demand for the maturity locked Dai is thin at first.

As long as the weighted return on assets is greater than the weighted cost of the DSR for each maturity, the protocol should be able to manage its liquidity exposure better, which should result in a greater ability to allocate assets efficiently. This should result in a faster growing surplus buffer that could help mitigate tail risks and provide greater stability for the protocol and for Dai holders.

Takeaways

The MCD protocol can integrate behavioral feedback from vault use and Dai use to develop solutions that increase its robustness and resilience in a balanced and automated way. This approach is generalizable to either existing MCD or segregated subDAO balance sheets.

Maker benefits from Dai holders who are willing to provide Dai to the protocol essentially for free. That said, the liquidity profile of this Dai (beyond bricked Dai) is essentially unknown. Increases in the DSR through term-locked vaults would therefore be more about reducing the impact of tail liquidity events than about aiming to grow the supply of Dai by attracting new holders.

To the extent token holders would want to explore mitigating the impact of potential liquidity events, and increase the certainty with which they shape their ALM decisions through on-chain votes, the above options provide one combination of alternatives.

Redemption curves are one way of increasing this resilience on the asset side of the balance sheet. Providing a way to modulate the maturity of circulating Dai on the liability side is another, additional, alternative. Both could be integrated into an ALM feedback controller to set a moving target to incentivize the market to push the protocol closer towards a sustainable equilibrium.